Answered step by step

Verified Expert Solution

Question

1 Approved Answer

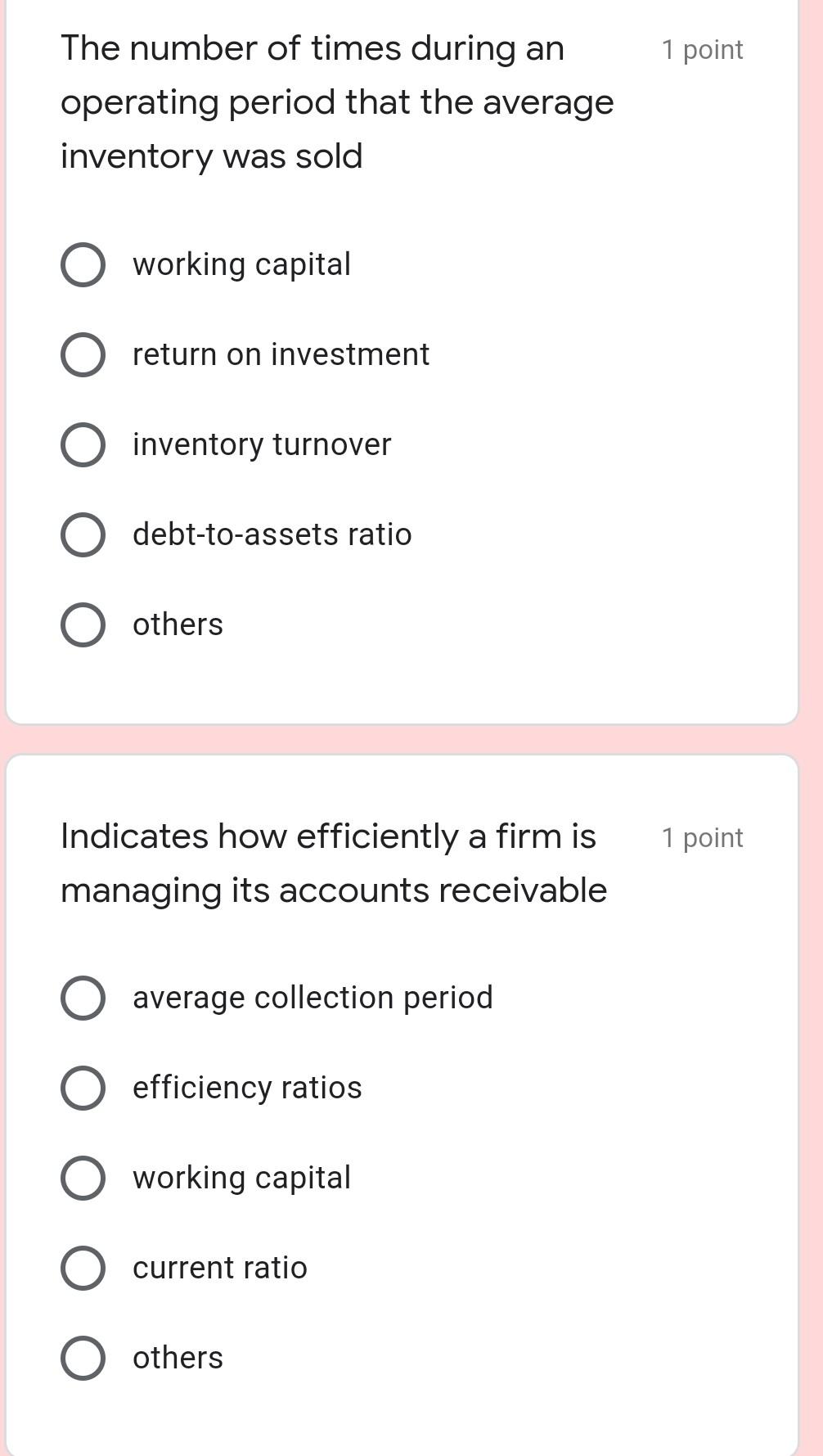

multiple choice questions 1 point The number of times during an operating period that the average inventory was sold O working capital return on investment

multiple choice questions

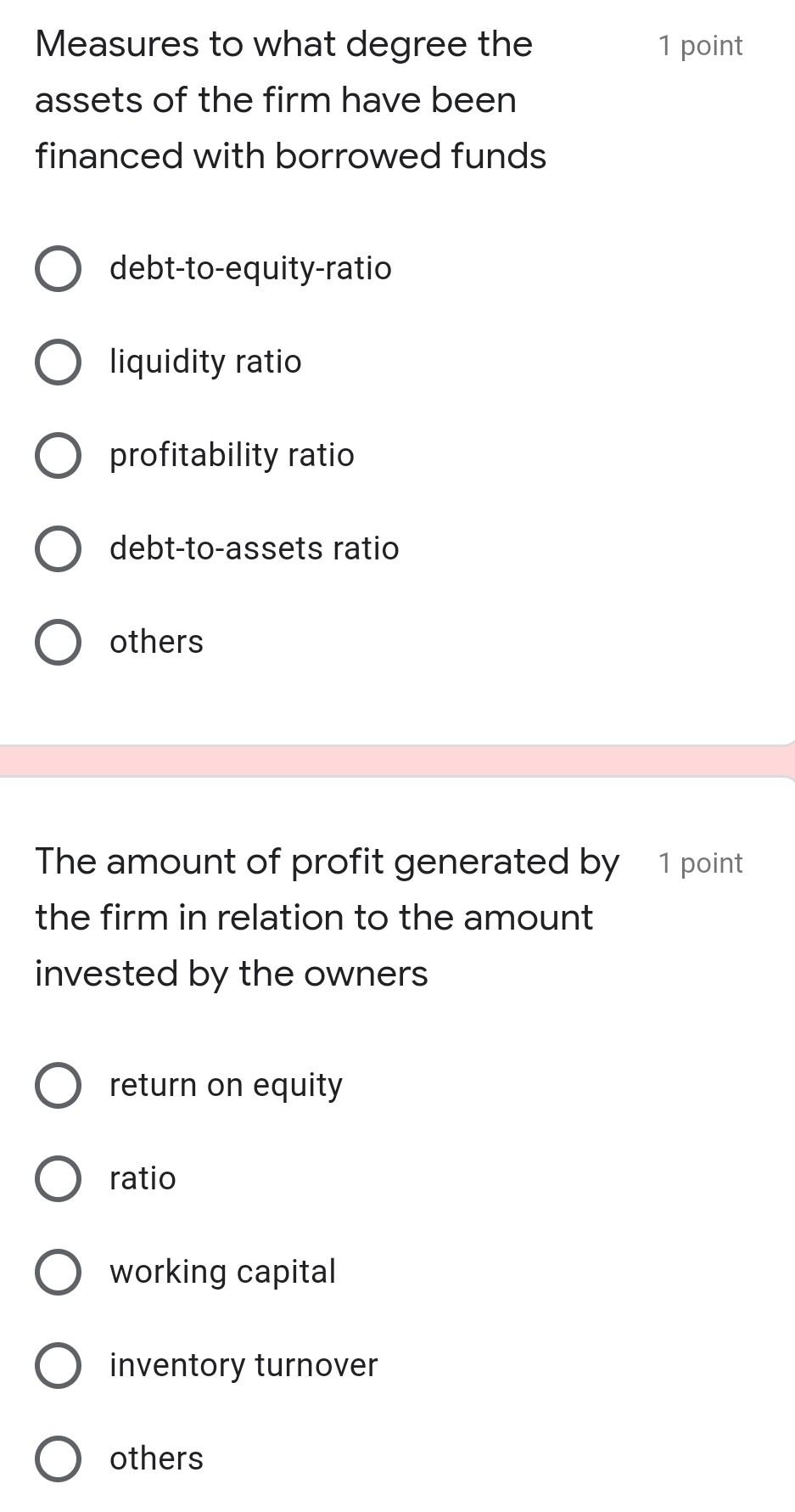

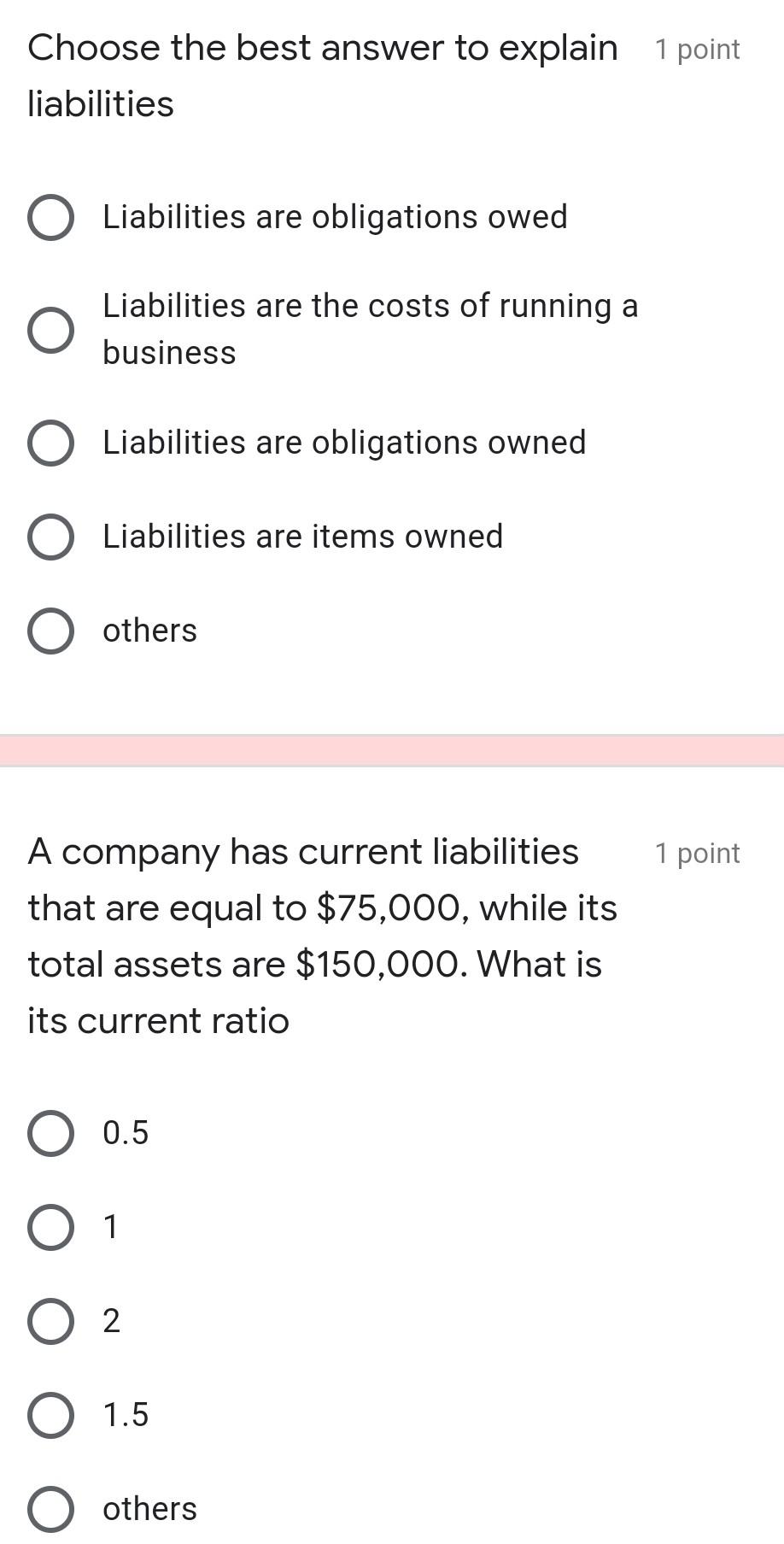

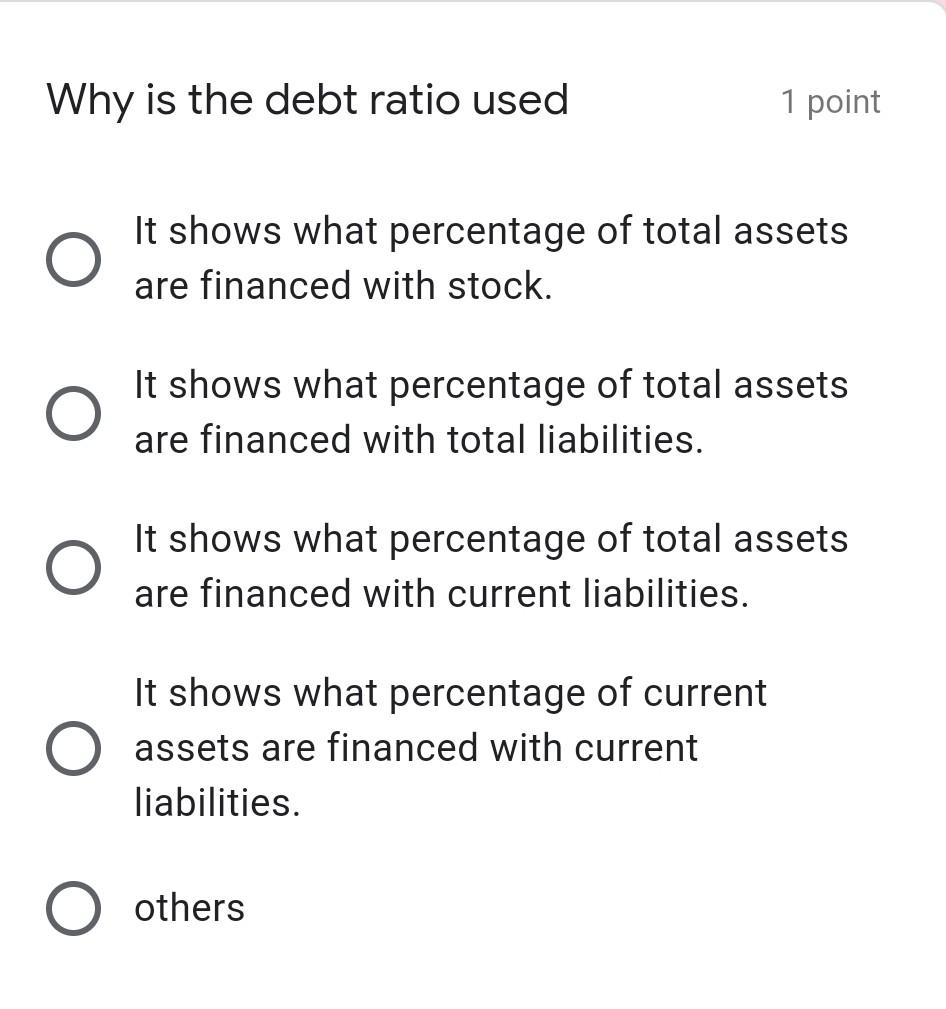

1 point The number of times during an operating period that the average inventory was sold O working capital return on investment inventory turnover debt-to-assets ratio others 1 point Indicates how efficiently a firm is managing its accounts receivable O average collection period O efficiency ratios O working capital current ratio others 1 point Measures to what degree the assets of the firm have been financed with borrowed funds debt-to-equity-ratio O liquidity ratio O profitability ratio debt-to-assets ratio others The amount of profit generated by 1 point the firm in relation to the amount invested by the owners O return on equity ratio O working capital inventory turnover others Choose the best answer to explain 1 point liabilities Liabilities are obligations owed Liabilities are the costs of running a business Liabilities are obligations owned Liabilities are items owned others 1 point A company has current liabilities that are equal to $75,000, while its total assets are $150,000. What is its current ratio 0.5 1 2 O 1.5 others Why is the debt ratio used 1 point It shows what percentage of total assets are financed with stock. It shows what percentage of total assets are financed with total liabilities. It shows what percentage of total assets are financed with current liabilities. It shows what percentage of current assets are financed with current liabilities. othersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started