Multiple choice questions

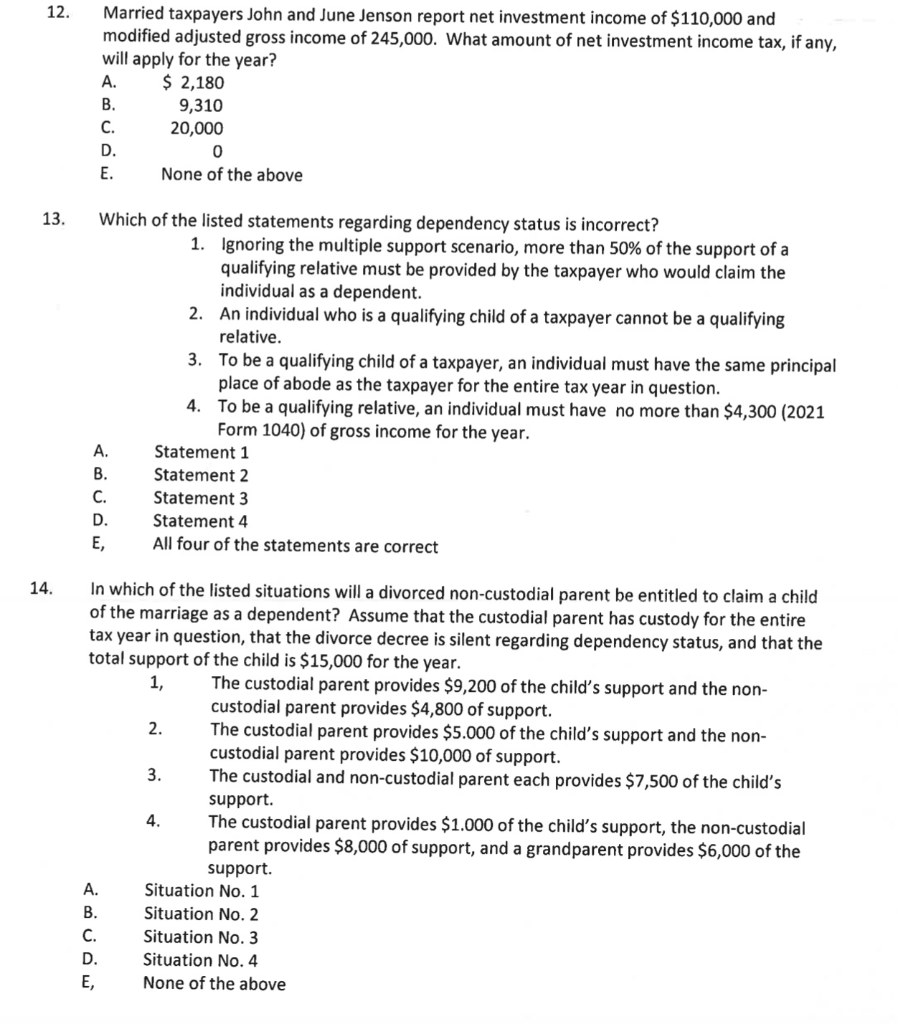

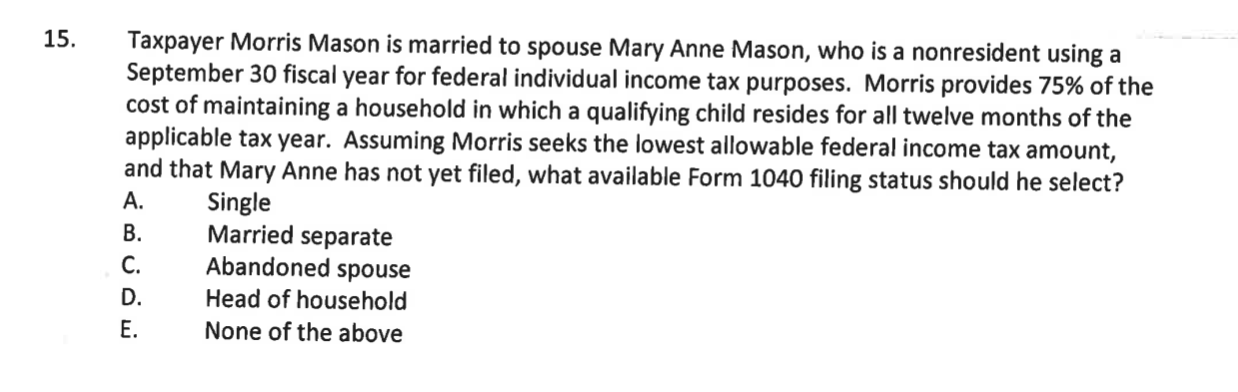

11. Ivan Irving, age 67, reports $1,000 of taxable interest income, a $25,000 taxable pension, and $9,000 of Social Security benefits. Ivan provides $22,000 of his own support. The remainder of Ivan's support is provided by his four children -- John Irving, $ 6,000; Katherine Wilson, $9,000; Lawrence Irving, $1,000; and Mathew Irving, $2,000. Who, if anyone, is eligible to claim Frank Farley? A. John B. Katherine C. Lawrence D. Mathew E. None of the above 12. Married taxpayers John and June Jenson report net investment income of $110,000 and modified adjusted gross income of 245,000. What amount of net investment income tax, if any, will apply for the year? A. $ 2,180 B. 9,310 C. 20,000 D. 0 E. None of the above 13. Which of the listed statements regarding dependency status is incorrect? 1. Ignoring the multiple support scenario, more than 50% of the support of a qualifying relative must be provided by the taxpayer who would claim the individual as a dependent. 2. An individual who is a qualifying child of a taxpayer cannot be a qualifying relative. 3. To be a qualifying child of a taxpayer, an individual must have the same principal place of abode as the taxpayer for the entire tax year in question. 4. To be a qualifying relative, an individual must have no more than $4,300 (2021 Form 1040) of gross income for the year. Statement 1 B. Statement 2 C. Statement 3 D. Statement 4 E, All four of the statements are correct 14. In which of the listed situations will a divorced non-custodial parent be entitled to claim a child of the marriage as a dependent? Assume that the custodial parent has custody for the entire tax year in question, that the divorce decree is silent regarding dependency status, and that the total support of the child is $15,000 for the year. 1, The custodial parent provides $9,200 of the child's support and the non- custodial parent provides $4,800 of support. 2. The custodial parent provides $5.000 of the child's support and the non- custodial parent provides $10,000 of support. 3. The custodial and non-custodial parent each provides $7,500 of the child's support. 4. The custodial parent provides $1.000 of the child's support, the non-custodial parent provides $8,000 of support, and a grandparent provides $6,000 of the support. A. Situation No. 1 B. Situation No. 2 Situation No. 3 D. Situation No. 4 E None of the above 15. Taxpayer Morris Mason is married to spouse Mary Anne Mason, who is a nonresident using a September 30 fiscal year for federal individual income tax purposes. Morris provides 75% of the cost of maintaining a household in which a qualifying child resides for all twelve months of the applicable tax year. Assuming Morris seeks the lowest allowable federal income tax amount, and that Mary Anne has not yet filed, what available Form 1040 filing status should he select? A. Single B. Married separate C. Abandoned spouse D. Head of household E. None of the above