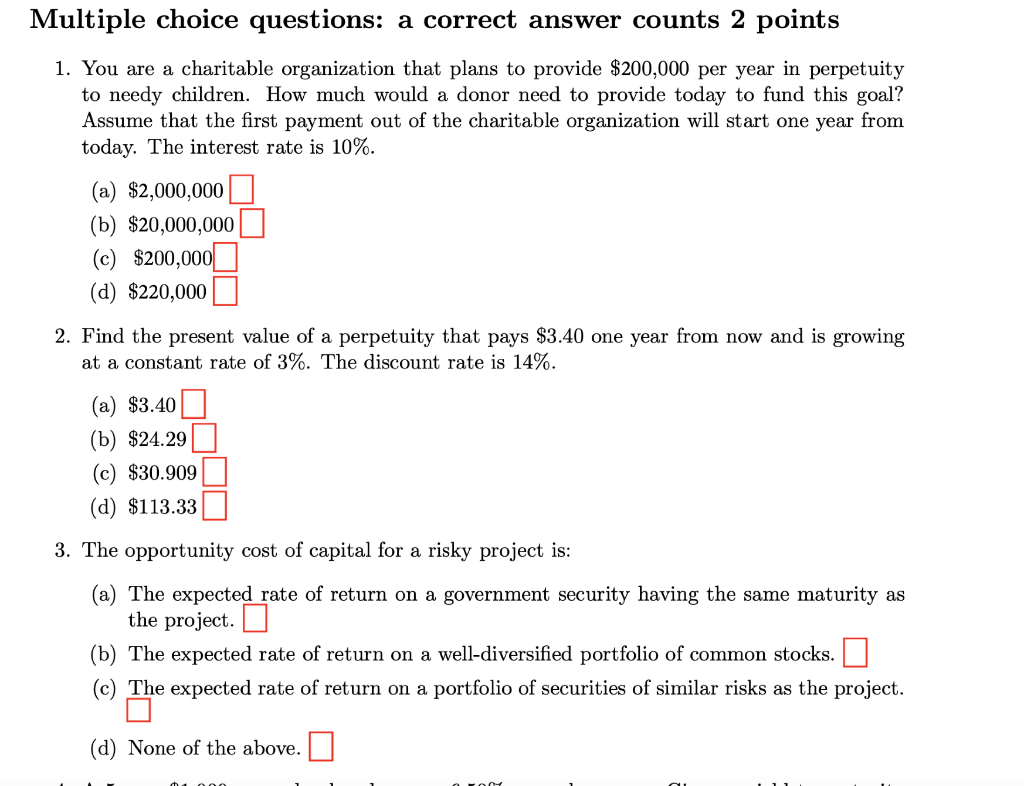

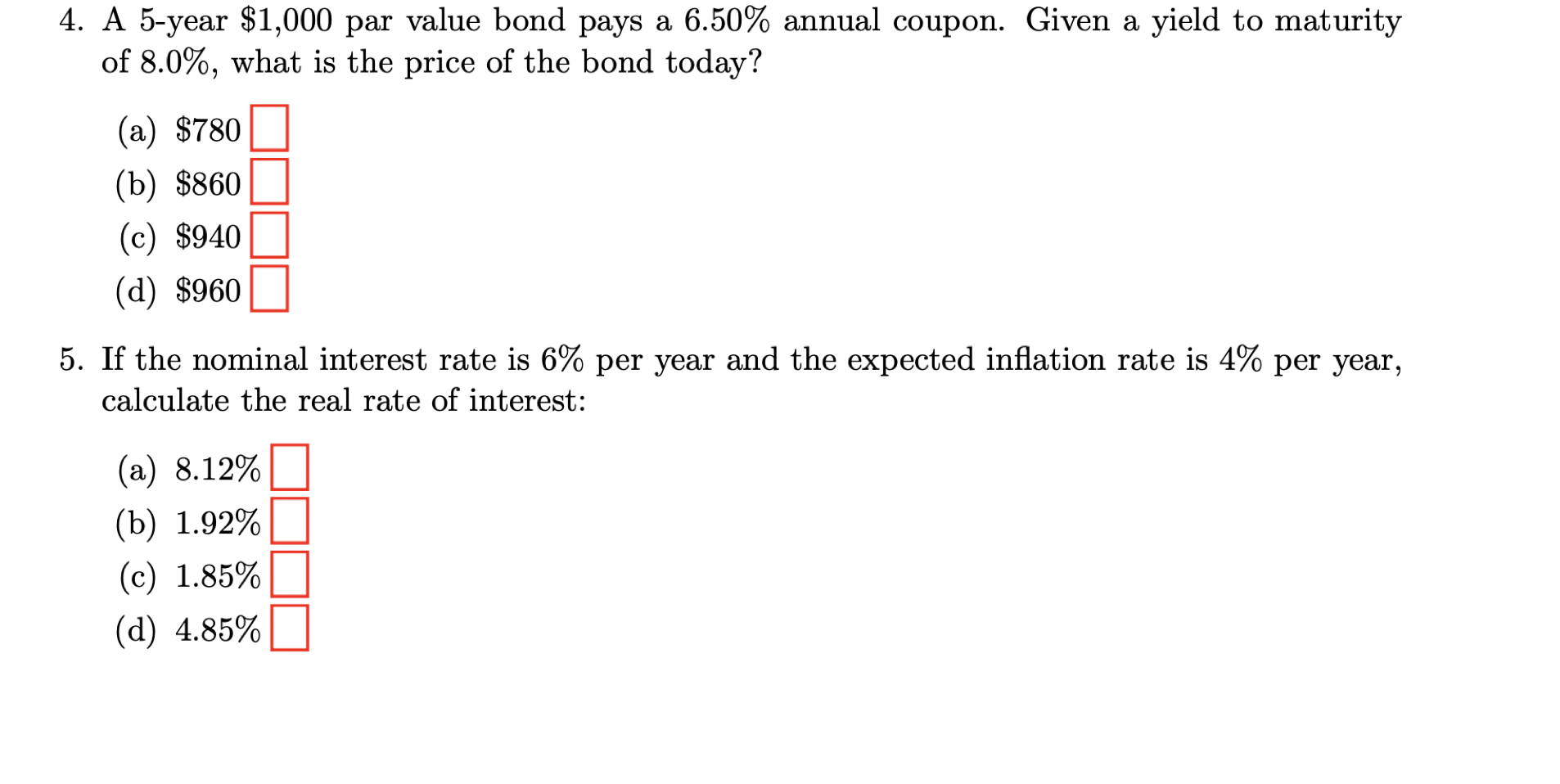

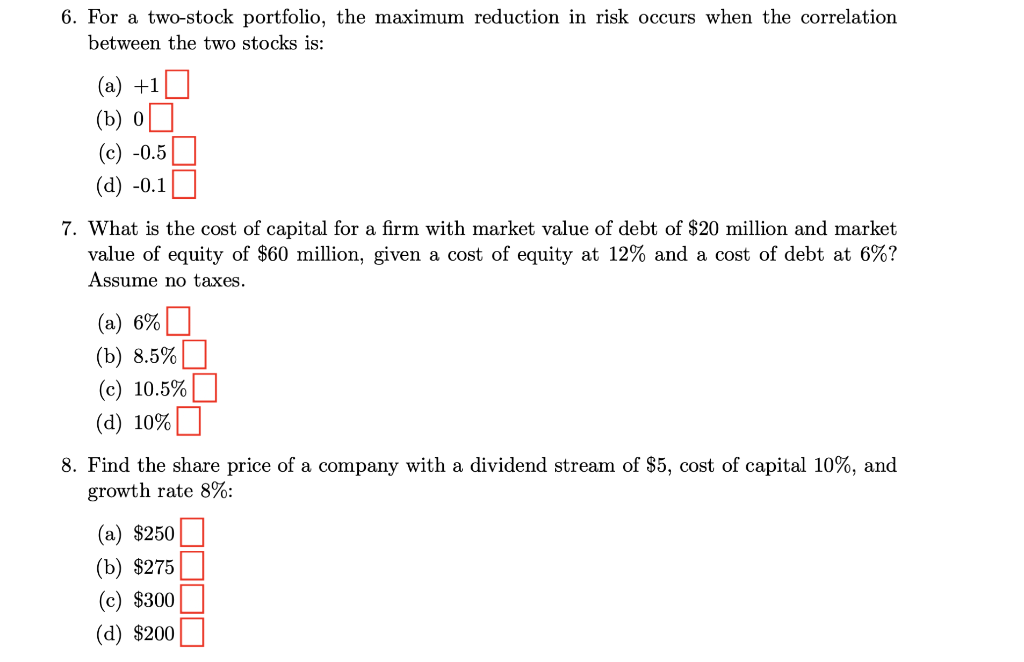

Multiple choice questions: a correct answer counts 2 points 1. You are a charitable organization that plans to provide $200,000 per year in perpetuity to needy children. How much would a donor need to provide today to fund this goal? Assume that the first payment out of the charitable organization will start one year from today. The interest rate is 10%. (a) $2,000,000 (b) $20,000,000 (c) $200,000 (d) $220,000 2. Find the present value of a perpetuity that pays $3.40 one year from now and is growing at a constant rate of 3%. The discount rate is 14%. (a) $3.40 (b) $24.29 (c) $30.909 (d) $113.33 3. The opportunity cost of capital for a risky project is: (a) The expected rate of return on a government security having the same maturity as the project. (b) The expected rate of return on a well-diversified portfolio of common stocks. (c) The expected rate of return on a portfolio of securities of similar risks as the project. (d) None of the above. 4. A 5-year $1,000 par value bond pays a 6.50% annual coupon. Given a yield to maturity of 8.0%, what is the price of the bond today? (a) $780 (b) $860 (c) $940 (d) $960 5. If the nominal interest rate is 6% per year and the expected inflation rate is 4% per year, calculate the real rate of interest: (a) 8.12% (b) 1.92% (c) 1.85% (d) 4.85% 6. For a two-stock portfolio, the maximum reduction in risk occurs when the correlation between the two stocks is: (a) +1 (b) 0 (c) 0.5 (d) 0.1 7. What is the cost of capital for a firm with market value of debt of $20 million and market value of equity of $60 million, given a cost of equity at 12% and a cost of debt at 6% ? Assume no taxes. (a) 6% (b) 8.5% (c) 10.5% (d) 10% 8. Find the share price of a company with a dividend stream of $5, cost of capital 10%, and growth rate 8% : (a) $250 (b) $275 (c) $300 (d) $200 9. The IRR (internal rate of return) is defined as: (a) The difference between the cost for capital and the present value of the cash flows. (b) The discount rate used in the NPV method. (c) The discount rate used in the discounted payback period method. (d) The discount rate that makes the NPV equal to zero. 10. Which portfolio has the most risk? (a) A portfolio of treasury bills. (b) Portfolio of common stocks of small firms. (c) A portfolio of long-term United States Government Bonds. (d) Standard and Poor's composite index