Multiple choice questions

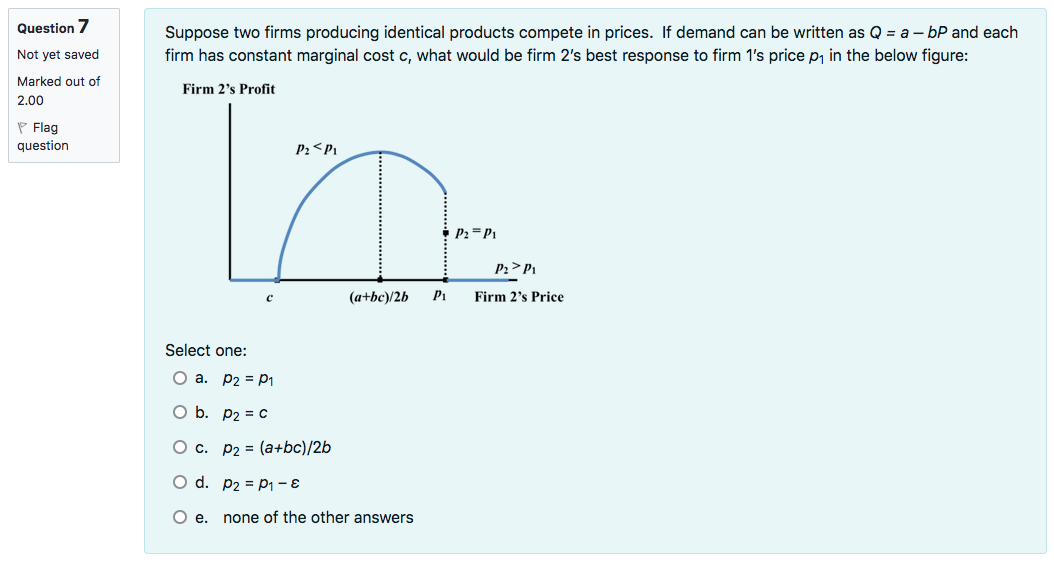

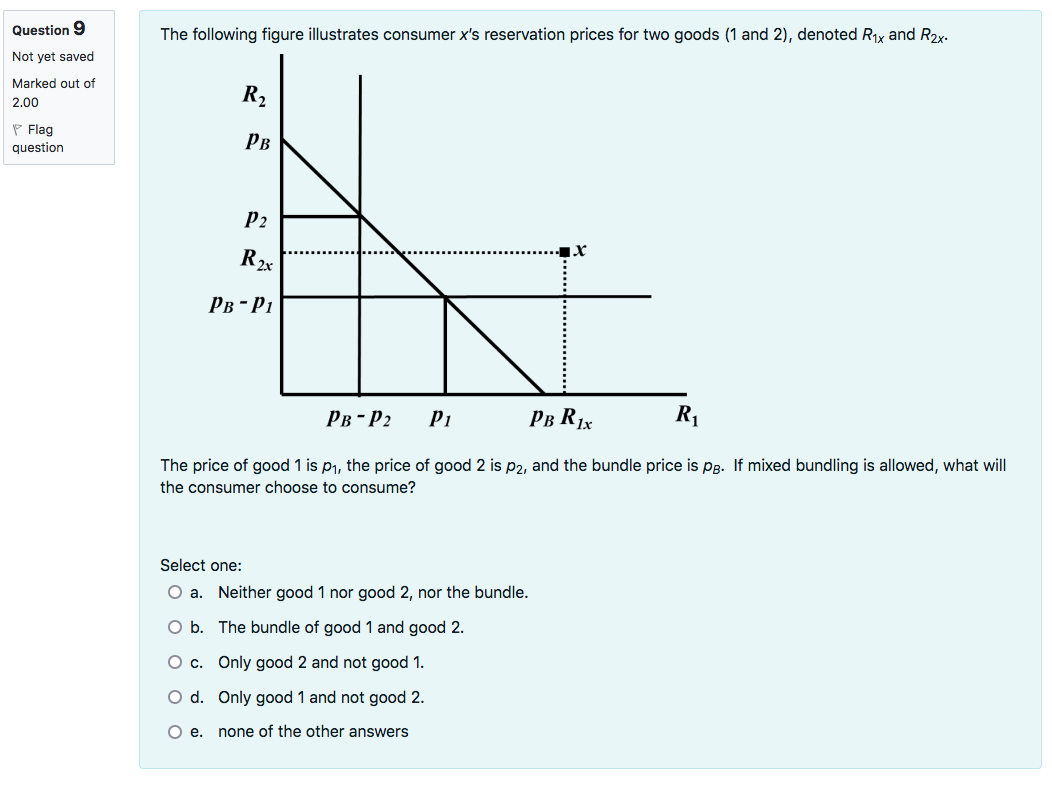

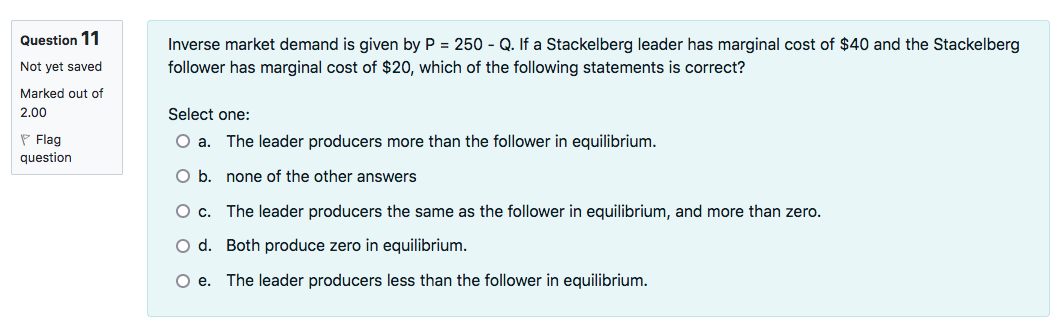

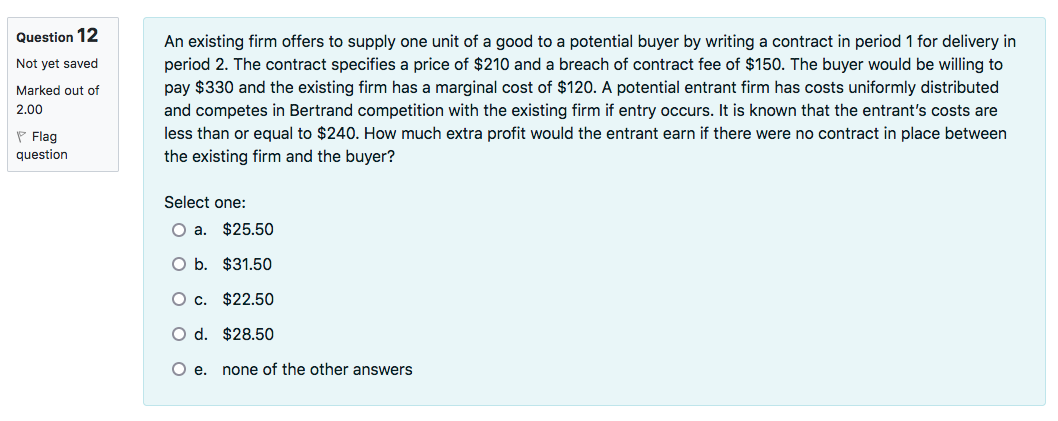

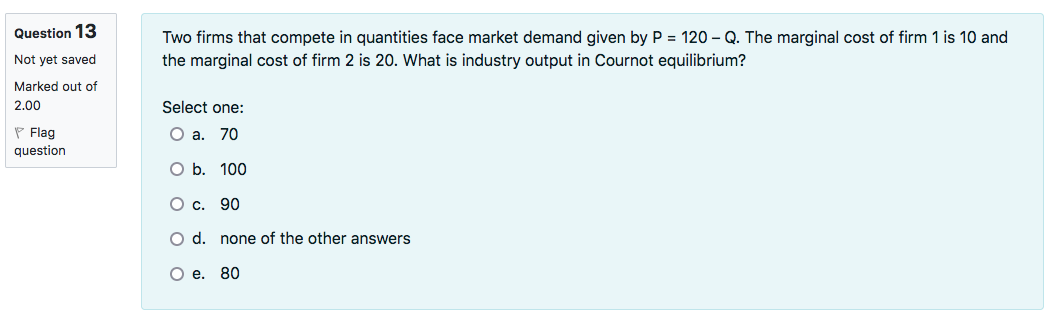

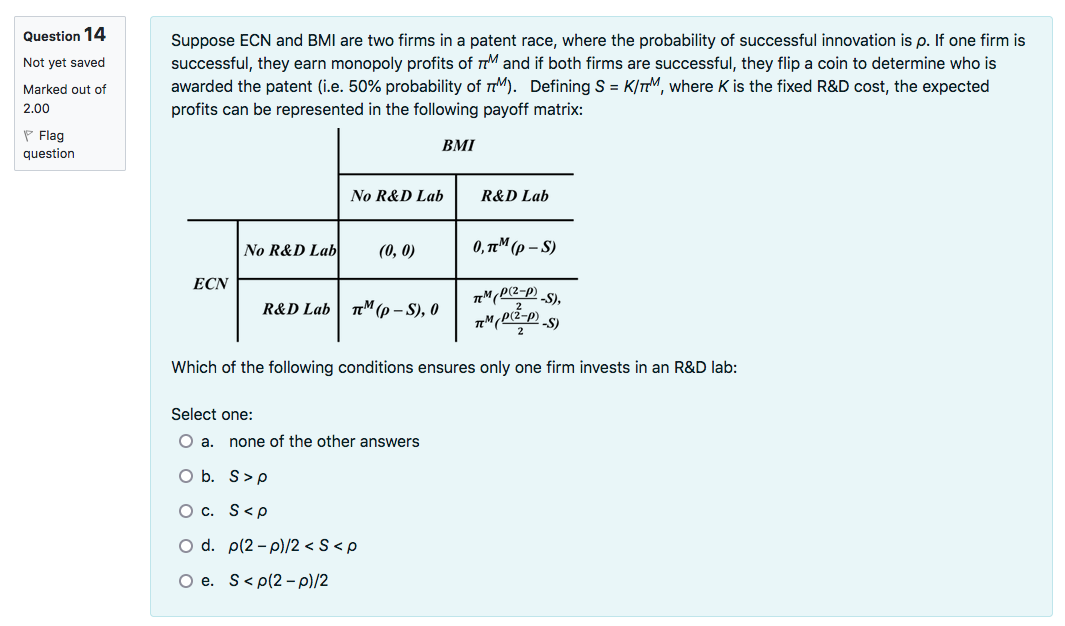

Que-\"i9\" 7 Suppose two firms producing identical products compete in prices. If demand can be written as Q = a bP and each Not yet saved rm has constant marginal cost c, what would be firm 2's best response to firm 1's price p. in the below figure: \"ark\" 0\"" \"f Firm 2': Profit 2.00 'F Flag question 1': (WW P1 Firm 2's Price Select one: 0 3- P2 = P1 0 b. p: = c O c. .02 = {a+bc)f2b 0 d. .02 = 91-8 0 e. none of the other answers Que-\"i\" 8 For a market with two firms competing through strategic choice of quantities, and a market demand of Q = 130 0.5P, Not yet saved what is the difference in profit outcomes for each firm between a Nash equilibrium and a cooperative equilibrium? Marked out or Marginal costs are $20 for each firm. 200 t7 Flag Select one: \"\"95\"\" O a. profit is lower by 200 in the cooperative equilibrium compared to the Nash equilibrium 0 b. profit is lower by 800 in the Nash equilibrium compared to the cooperative equilibrium 0 c. profit is lower by 400 in the Nash equilibrium compared to the cooperative equilibrium 0 d. profit is lower by 200 in the Nash equilibrium compared to the cooperative equilibrium O e. none of the other answers \""5\"\" 9 The following figure illustrates consumerx's reservation prices for two goods [1 and 2), denoted Ru and R2 Not yet saved Marked out of 2.00 t' Flag question The price of good 1 is p1, the price of good 2 is p2, and the bundle price is 133. If mixed bundling is allowed, what will the consumer choose to consume? Select one: 0 a. Neither good 1 nor good 2, nor the bundle. O b. The bundle of good 1 and good 2. O c. Only good 2 and not good 1. 0 d. Only good 1 and not good 2. 0 e. none of the other answers Question 10 Suppose two consumers have the following demand curves Qh = 10 - P and Q, = 8 -P. What is the combined Not yet saved marginal revenue curve Marked out of 2.00 Select one: Flag O a. 10 -Q if Qs2 question MR = 8 -0.50 if Q > 2 O b. 10 -20 if Q s2 MR = 9 -Q if Q>2 O c. none of the other answers O d. 10 - 20 if es2 MR = 8 - 20 if Q> 2 O e. 10 - Q if Q2\"\"93\"\" 11 Inverse market demand is given by P = 250 - Q. If a Stackelberg leader has marginal cost of $40 and the Stackelberg Not yet saved follower has marginal cost of $20, which of the following statements is correct? Marked out of 2'00 Select one: V Fig? 0 a. The leader producers more than the follower in equilibrium. que Ion O b. none of the other answers 0 c. The leader producers the same as the follower in equilibrium, and more than zero. 0 d. Both produce zero in equilibrium. 0 e. The leader producers less than the follower in equilibrium. Question 12 Not yet saved Marked out of 2.00 \"F Flag q uestion An existing firm offers to supply one unit of a good to a potential buyer by writing a contract in period 1 for delivery in period 2. The contract specifies a price of $210 and a breach of contract fee of $150. The buyer would be willing to pay $330 and the existing firm has a marginal cost of $120. A potential entrant rm has costs uniformly distributed and competes in Bertrand competition with the existing firm if entry occurs. It is known that the entrant's costs are less than or equal to $240. How much extra prot would the entrant earn if there were no contract in place between the existing firm and the buyer? Select one: 0 a. $25.50 0 in. $31.50 0 c. $22.50 0 cl. $28.50 0 e. none of the other answers Question 13 Two firms that compete in quantities face market demand given by P = 120 - Q. The marginal cost of firm 1 is 10 and Not yet saved the marginal cost of firm 2 is 20. What is industry output in Cournot equilibrium? Marked out of 2.00 Select one: Flag O a. 70 question O b. 100 O c. 90 O d. none of the other answers O e. 80Question 14 Suppose ECN and BMI are two firms in a patent race, where the probability of successful innovation is p. If one firm is Not yet saved successful, they earn monopoly profits of my and if both firms are successful, they flip a coin to determine who is Marked out of awarded the patent (i.e. 50% probability of mr). Defining S = K/wry, where K is the fixed R&D cost, the expected 2.00 profits can be represented in the following payoff matrix: Flag BMI question No R&D Lab R &D Lab No R&D Lab (0, 0) 0, TIM (p - S) ECN R&D Lab TM (p - S), 0 TIM ( P(2-P) _S), TIM ( P(2-P) _S) Which of the following conditions ensures only one firm invests in an R&D lab: Select one: O a. none of the other answers Ob. S >p O c. S