Question: Multiple choice questions This is an assignment which is due, please help as soon as possible. Urgent Ciri 0 ing TUTORIAL LETTER 1 ASSIGNMENT 1)

Multiple choice questions

This is an assignment which is due, please help as soon as possible.

Urgent

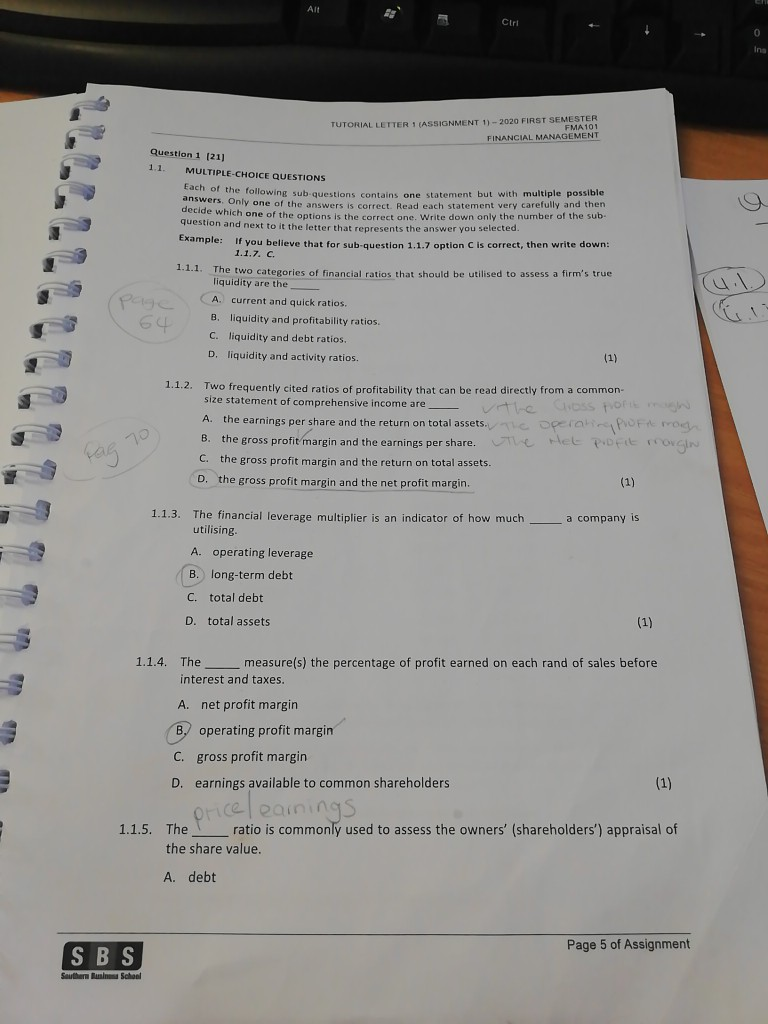

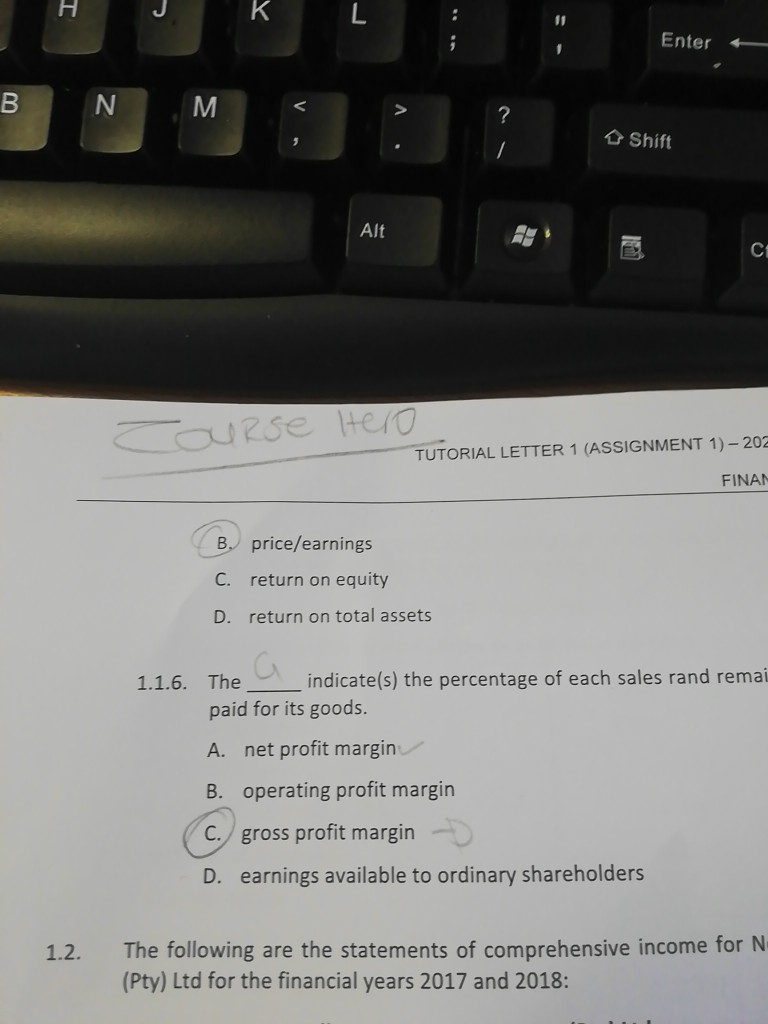

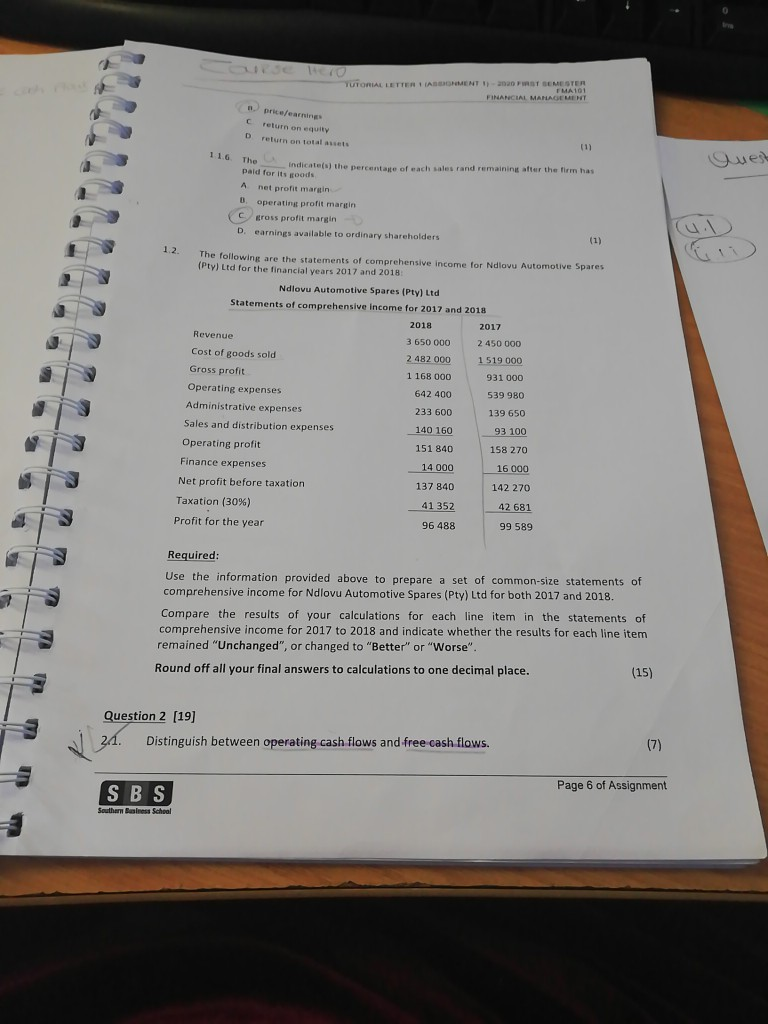

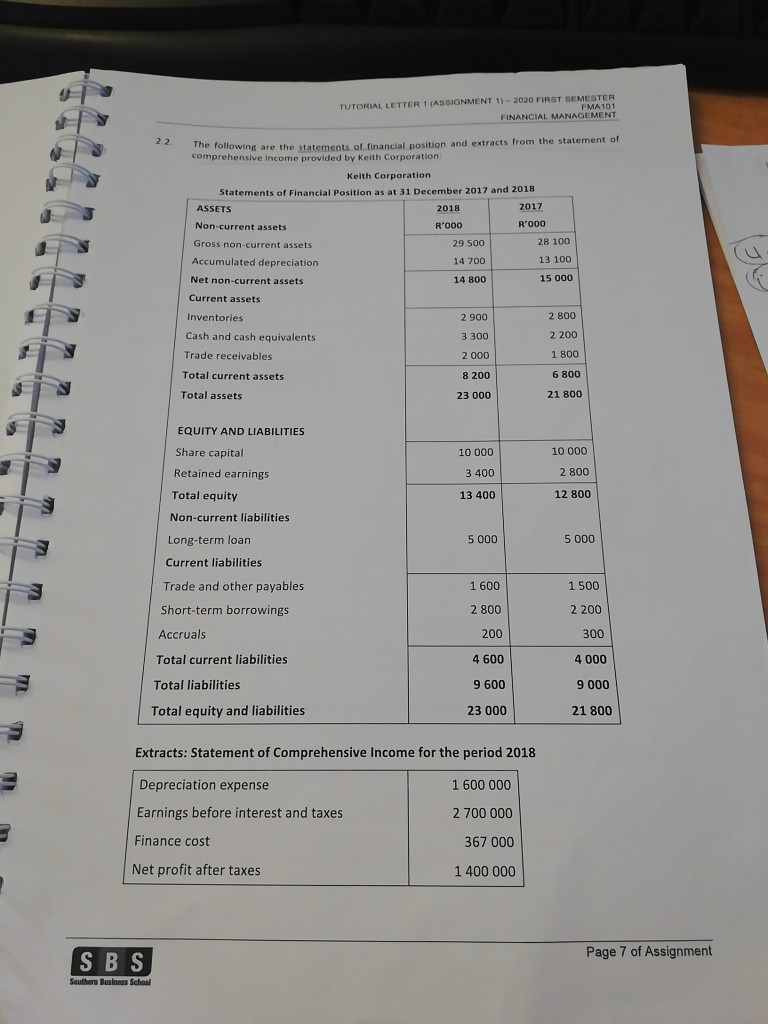

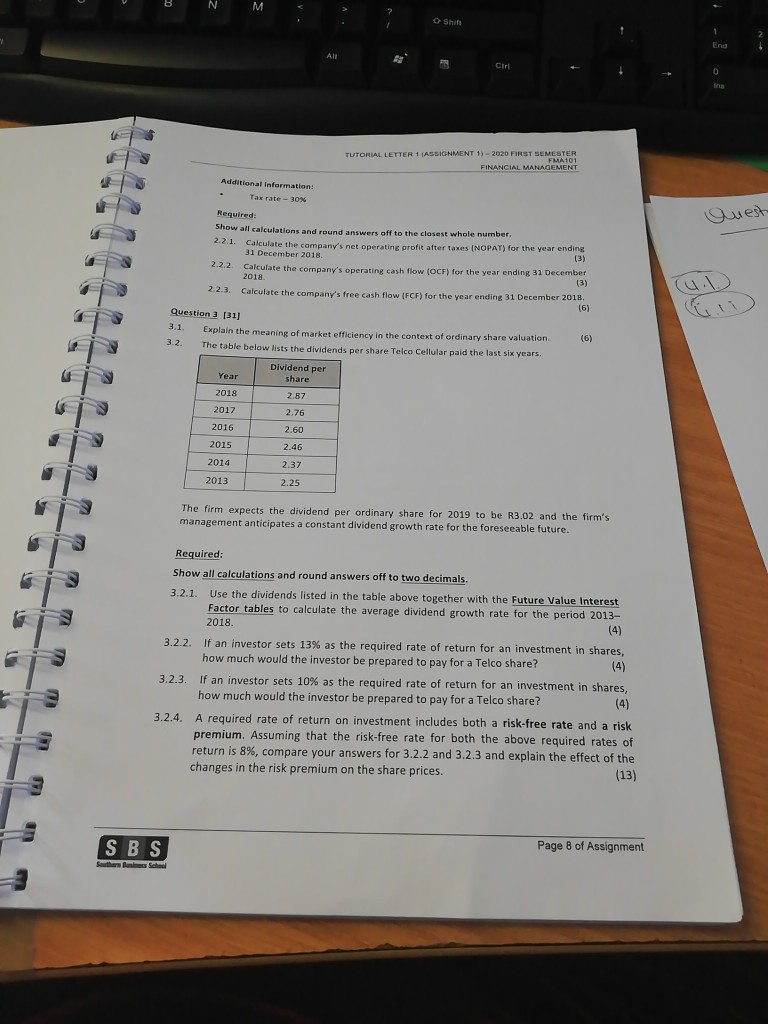

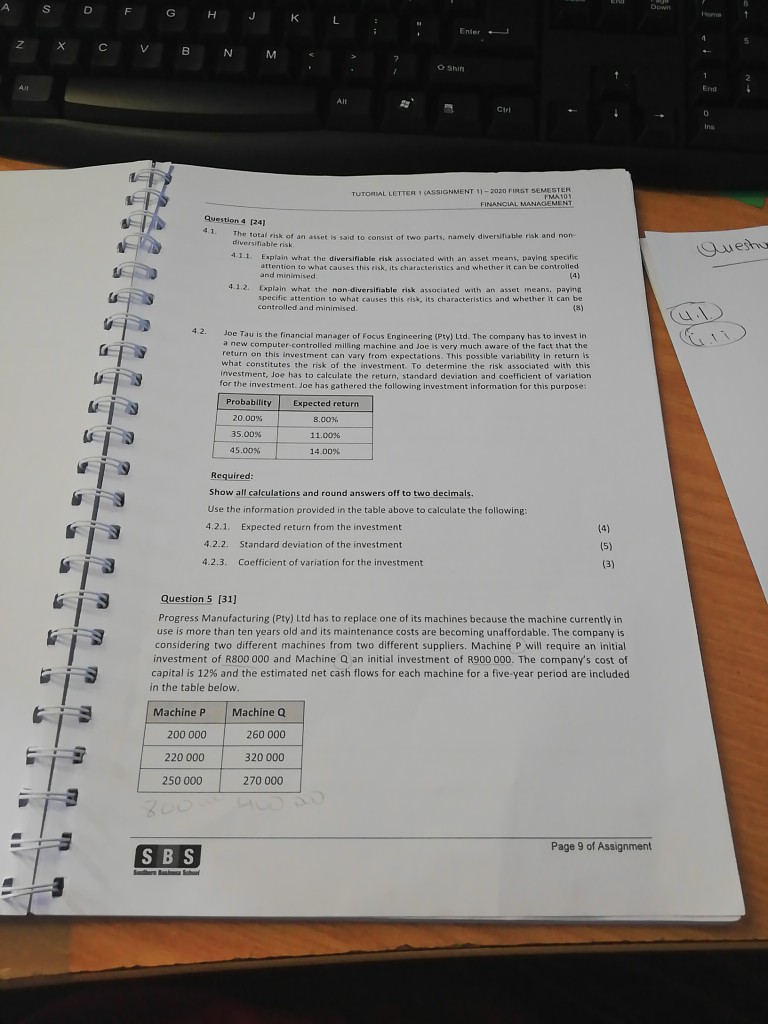

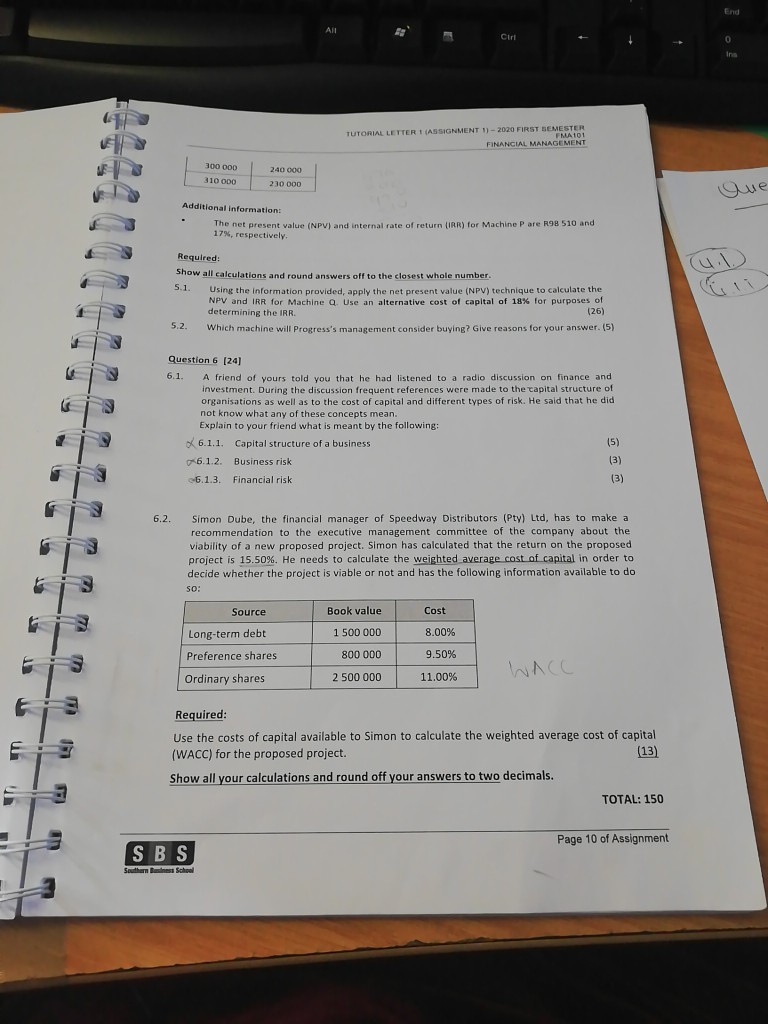

Ciri 0 ing TUTORIAL LETTER 1 ASSIGNMENT 1) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT Question 1 (21) MULTIPLE-CHOICE QUESTIONS Each of the following he following sub-questions contains one statement but with multiple possible answers. Only one of the answers is correct Read each statement very carefully and then decide which one of the options is the correct ane Write down only the number of the sub- question and next to it the letter that represents the answer you selected. Example: If you believe that far sub-question 1.1.7 option is correct, then write down: 1.1.7. C. 1.1.1. The two categories of financial raties that should be utilised to assess a firm's true liquidity are the A current and quick ratios. 8. liquidity and profitability ratios. C liquidity and debt ratios. D. liquidity and activity ratios. (1) 1.1.2. Two frequently cited ratios of profitability that can be read directly from a common- Two frequentlit size statement of comprehensive income are A. the earnings per share and the return on total assets. CELL B. the gross profit margin and the earnings per share. C. the gross profit margin and the return on total assets. D. the gross profit margin and the net profit margin. a company is 1.1.3. The financial leverage multiplier is an indicator of how much utilising A. operating leverage B. long-term debt C. total debt D. total assets 1.1.4. The measure(s) the percentage of profit earned on each rand of sales before interest and taxes. A. net profit margin B, operating profit margin C. gross profit margin D. earnings available to common shareholders (1) price learnings 1.1.5. The ratio is commonly used to assess the owners' (shareholders') appraisal of the share value. A. debt Page 5 of Assignment SBS Southern School Enter M Shift Alt course Hero TUTORIAL LETTER 1 (ASSIGNMENT 1) - 202 FINAN B. price/earnings C. return on equity D. return on total assets 1.1.6. The indicate(s) the percentage of each sales rand remai paid for its goods. A. net profit margin B. operating profit margin (C. gross profit margin D. earnings available to ordinary shareholders 1.2. The following are the statements of comprehensive income for N (Pty) Ltd for the financial years 2017 and 2018: TUTORIAL LETTERIAMENT) FT SEMESTER FMA 101 FINANCIAL MANAGEMENT prie/earning return on Dreturn totalt (1) The indicates the percent of each sales and remaining after the firm has paid for its goods A net profit margin 0 operating profit margin C ross profit margin D earnings available to ordinary shareholders 12. The following are the statements of comprehensive income for Ndlovu Automotive Spares (Pty) Ltd for the financial years 2017 and 2018 Ndlovu Automotive Spares (Pty) Ltd Statements of comprehensive income for 2017 and 2018 2018 2017 Revenue 3 650 000 2 450 000 Cost of goods sold 2 482 000 1 519 000 Gross profit 1168 000 931 000 Operating expenses 642 400 539 980 Administrative expenses 233 600 139 650 Sales and distribution expenses 140 160 93 100 Operating profit 151 840 158 270 Finance expenses 14 000 16 000 Net profit before taxation 137 840 142 270 Taxation (30%) 41 352 42 681 Profit for the year 96 488 99 589 Required: Use the information provided above to prepare a set of common-size statements of comprehensive income for Ndlovu Automotive Spares (Pty) Ltd for both 2017 and 2018. Compare the results of your calculations for each line item in the statements of comprehensive income for 2017 to 2018 and indicate whether the results for each line item remained "Unchanged", or changed to "Better" or "Worse". Round off all your final answers to calculations to one decimal place. (15) Question 2 (19) 24. Distinguish between operating cash flows and free cash flows. (7) Page 6 of Assignment SBS Southern Business School TUTORIAL LETTER 1 (ASSIGNMENT 1) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT 2.2 The following are the statements of financial position and extracts from the statement of comprehensive income provided by Keith Corporation Keith Corporation Statements of Financial Position as at 31 December 2017 and 2018 ASSETS 2018 2017 Non-current assets R'000 R'000 Gross non-current assets 29 500 28 100 Accumulated depreciation 14 700 13 100 Net non-current assets 14 800 15 000 Current assets Inventories 2 900 2 800 Cash and cash equivalents 3 300 2 200 Trade receivables 2 000 1 800 Total current assets 8 200 6 800 Total assets 23 000 21 800 EQUITY AND LIABILITIES Share capital Retained earnings Total equity Non-current liabilities 10 000 3.400 13 400 10 000 2 800 12 800 5000 5 000 Long-term loan Current liabilities 1 600 2 800 1 500 2 200 300 200 m m nmn Trade and other payables Short-term borrowings Accruals Total current liabilities Total liabilities Total equity and liabilities 4600 9600 23 000 4000 9 000 21 800 n Extracts: Statement of Comprehensive Income for the period 2018 Depreciation expense Earnings before interest and taxes 1 600 000 2 700 000 367 000 1 400 000 Finance cost Net profit after taxes SBS Page 7 of Assignment Souther Business School TUTORIAL LETTER 1 ASSIGNMENT 1) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT Additional Information: Tax rate -30% Quest Required: Show all calculations and round answers off to the closest whole number. 2.2.1. Calculate the company's net operating profit after taxes (NOPAT) for the year ending 31 December 2018 Calculate the company's operating cash flow (OCF) for the year ending 31 December 2018 2.2.3. Calculate the company's free cash flow (FCF) for the year ending 31 December 2018 (3) Question 3 [31] 3.1. Explain the meaning of market efficiency in the context of ordinary share valuation 3.2. The table below lists the dividends per share Telco Cellular paid the last six years, (6) Year Dividend per share 2018 2017 2016 2015 2014 2.87 2.76 2.60 2.46 2.37 2013 2.25 The firm expects the dividend per ordinary share for 2019 to be R3.02 and the firm's management anticipates a constant dividend growth rate for the foreseeable future. Required: Show all calculations and round answers off to two decimals. 3.2.1. Use the dividends listed in the table above together with the Future Value Interest Factor tables to calculate the average dividend growth rate for the period 2013- 2018. (4) 3.2.2. If an investor sets 13% as the required rate of return for an investment in shares, how much would the investor be prepared to pay for a Telco share? 3.2.3. If an investor sets 10% as the required rate of return for an investment in shares, how much would the investor be prepared to pay for a Telco share? (4) 3.2.4. A required rate of return on investment includes both a risk-free rate and a risk premium. Assuming that the risk-free rate for both the above required rates of return is 8%, compare your answers for 3.2.2 and 3.2.3 and explain the effect of the changes in the risk premium on the share prices. (13) SBS Page 8 of Assignment S 0 F G H J K L Enter 2 x Ciri TUTORIAL LETTERASSIGNMENT 1 - 2020 FIRST SEMESTER FINANCIAL MANAGER Questo Question 4 1241 The total risk of an asset is said to consist of two parts, namely diversifiable risk and non- diversifiable risk Explain what the diversifiable risk associated with an asset means, paying specific attention to what causes this risk, its characteristics and whether it can be controlled and minimised 4.1.2. Explain what the non diversifiable risk associated with an asset means, paying specific attention to what causes this risk, its characteristics and whether it can be controlled and minimised Joe Tau is the financial manager of Focus Engineering (Pty) Ltd. The company has to invest in a new computer-controlled milling machine and Joe is very much aware of the fact that the return on this investment can vary from expectations. This possible variability in return is what constitutes the risk of the investment to determine the risk associated with this investment, Joe has to calculate the return, standard deviation and coefficient of variation for the investment. Joe has gathered the following investment information for this purpose: _ Probability 20.00% Expected return 8.00%. _ 35.00% 45,00% 11.00% 14.00% _ Required: Show all calculations and round answers off to two decimals. Use the information provided in the table above to calculate the following 4.2.1. Expected return from the investment 4.2.2. Standard deviation of the investment 4.2.3. Coefficient of variation for the investment _ _ Question 5 (31) Progress Manufacturing (Pty) Ltd has to replace one of its machines because the machine currently in use is more than ten years old and its maintenance costs are becoming unaffordable. The company is considering two different machines from two different suppliers. Machine P will require an initial investment of R800 000 and Machine Q an initial investment of R900 000. The company's cost of capital is 12% and the estimated net cash flows for each machine for a five-year period are included in the table below. mn m Machine P 200 000 220 000 250 000 Machine Q 260 000 320 000 mm 270 000 Page 9 of Assignment SBS TUTORIAL LETTER 1 ASSIGNMENT 1) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT 300 000 310 000 240 000 230 000 Additional information The net present value (NPVand internal rate of return LR) for Machine Pare R98 510 and 17%, respectively Required: Show all calculations and round answers off to the closest whole number 5.1. Using the information provided, apply the net present value (NPV) technique to calculate the NPV and IRR for Machine a Use an alternative cost of capital of 18% for purposes of determining the IRR. (26) 5.2. Which machine will Progress's management consider buying? Give reasons for your answer. (5) Question 6 (24) 6.1. A friend of yours told you that he had listened to a radio discussion on finance and investment. During the discussion frequent references were made to the capital structure of organisations as well as to the cost of capital and different types of risk. He said that he did not know what any of these concepts mean. Explain to your friend what is meant by the following: 6.1.1. Capital structure of a business 6.1.2. Business risk 6.1.3. Financial risk 6.2. Simon Dube, the financial manager of Speedway Distributors (Pty) Ltd, has to make a recommendation to the executive management committee of the company about the viability of a new proposed project. Simon has calculated that the return on the proposed project is 15.50%. He needs to calculate the weighted average cost of capital in order to decide whether the project is viable or not and has the following information available to do so: Source Book value Cost Long-term debt 1 500 000 8.00% Preference shares 800 000 9.50% Ordinary shares 2 500 000 11.00% W C 7 m 2 Required: Use the costs of capital available to Simon to calculate the weighted average cost of capital (WACC) for the proposed project. (13) Show all your calculations and round off your answers to two decimals. TOTAL: 150 Page 10 of Assignment SBS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts