multiple choice thanks

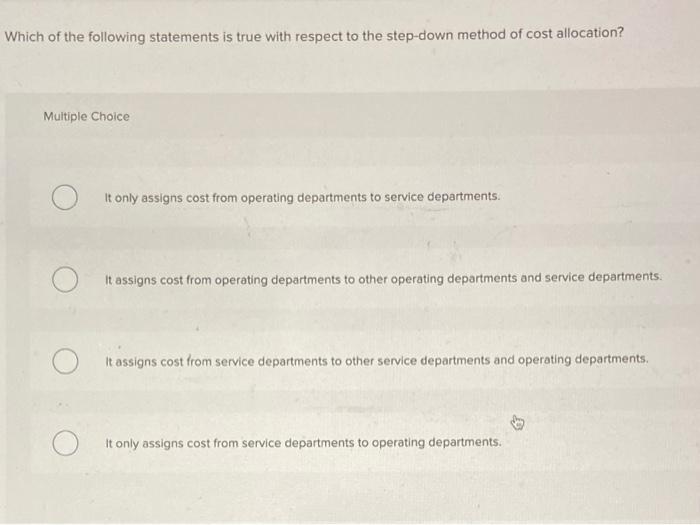

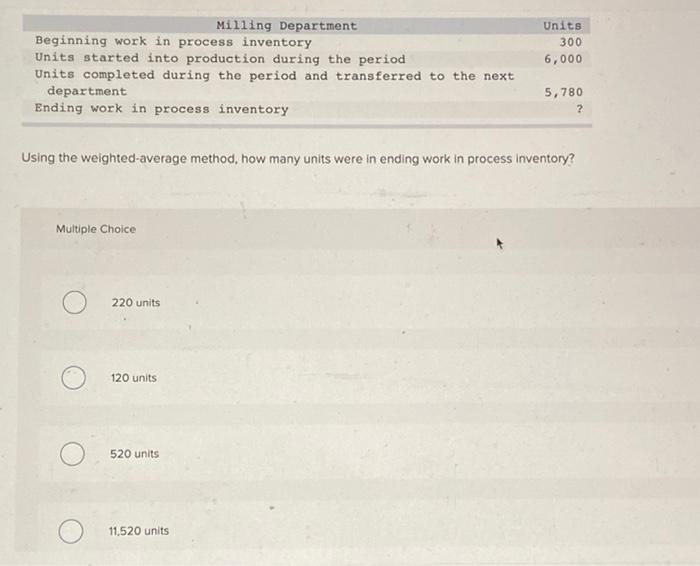

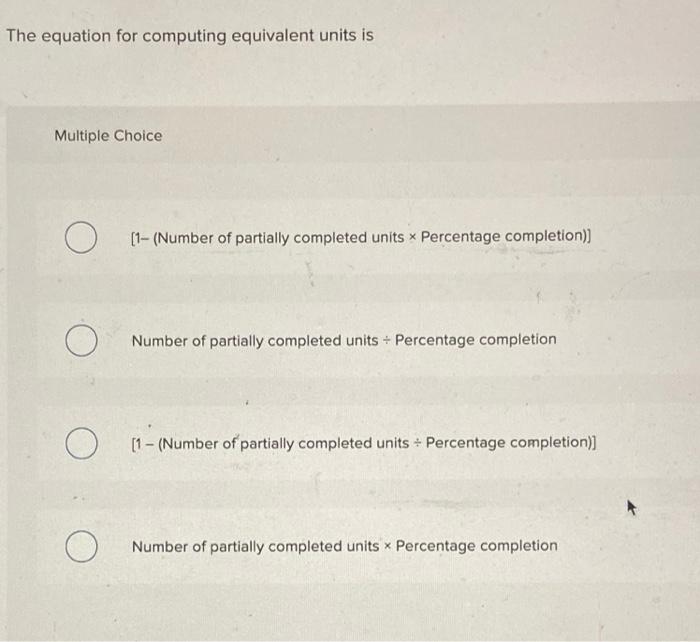

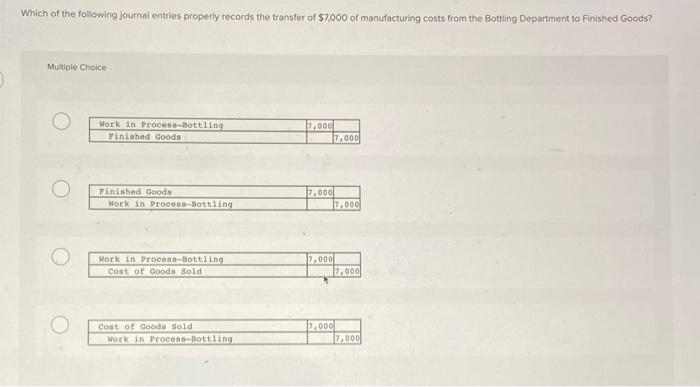

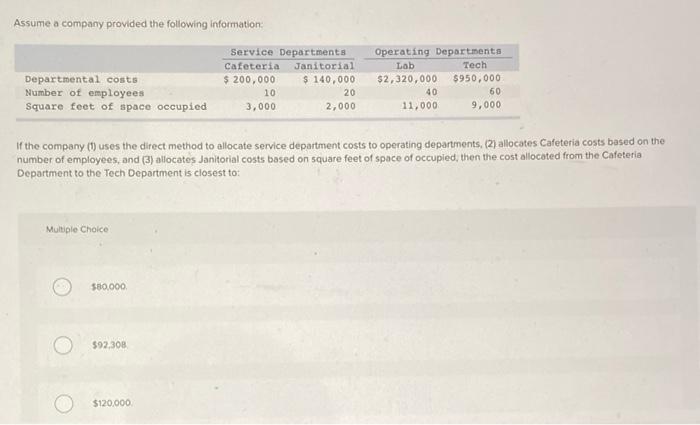

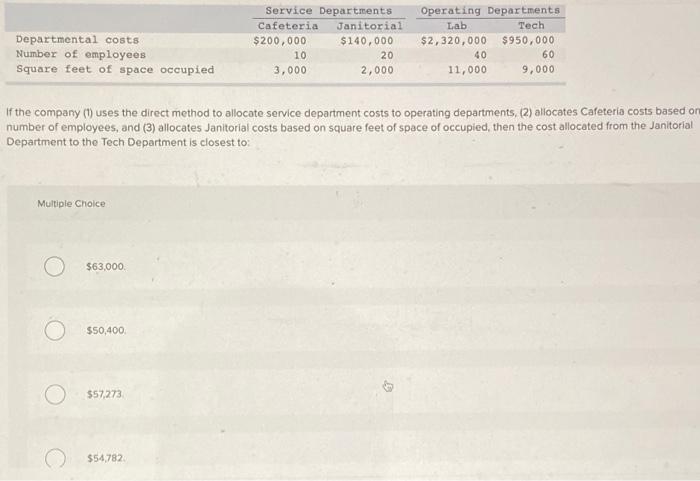

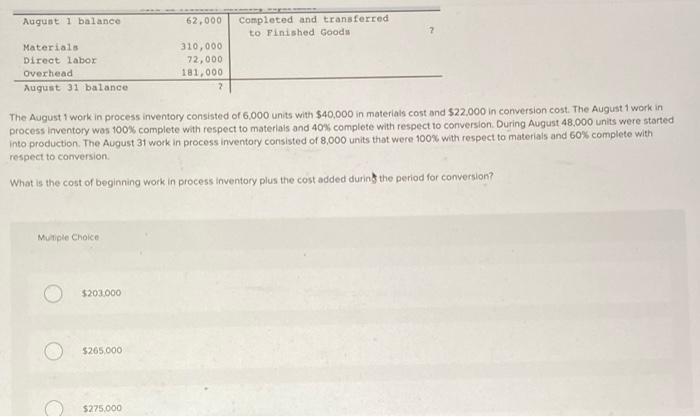

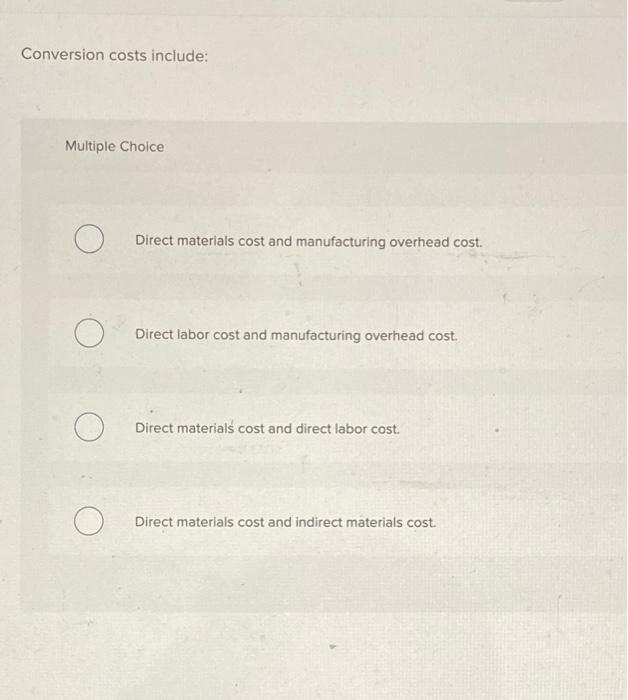

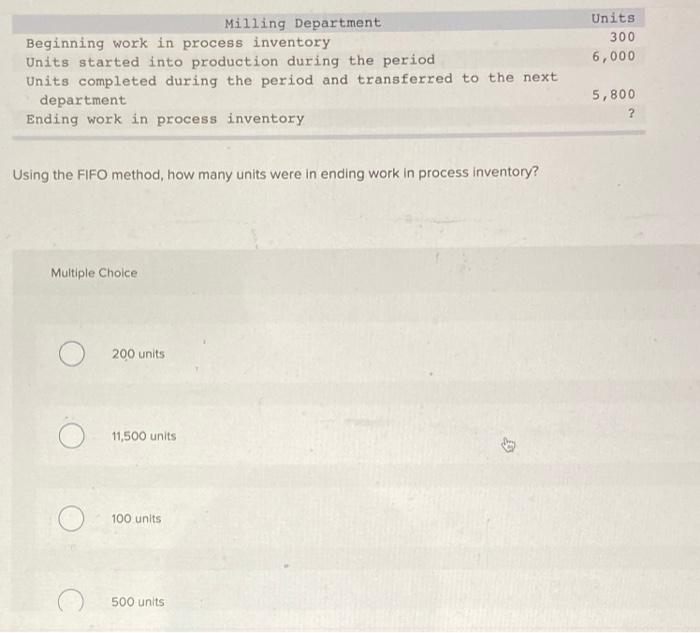

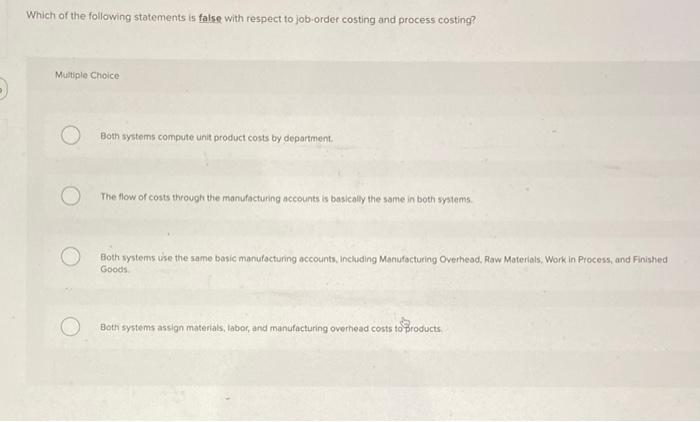

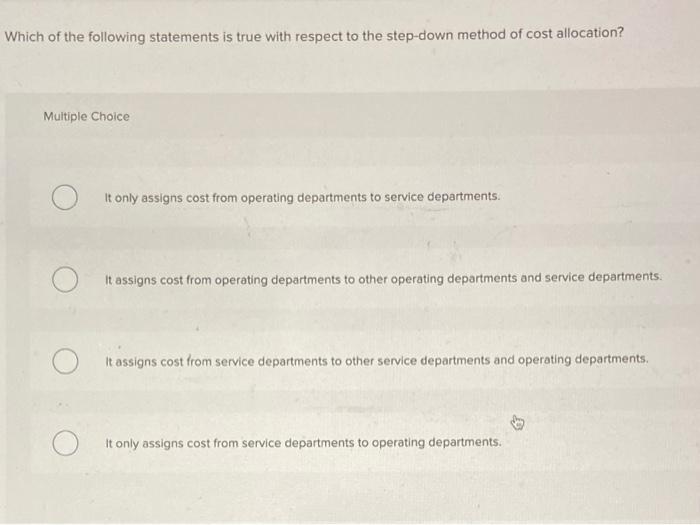

Milling Department Beginning work in process inventory Units started into production during the period Units completed during the period and transferred to the next department Ending work in process inventory Units 300 6,000 5,780 ? Using the weighted-average method, how many units were in ending work in process inventory? Multiple Choice 220 units 120 units 520 units 11.520 units The equation for computing equivalent units is Multiple Choice O [1-(Number of partially completed units * Percentage completion)) O Number of partially completed units + Percentage completion [1 - (Number of partially completed units + Percentage completion)] Number of partially completed units * Percentage completion Which of the following Journal entries properly records the transfer of $7,000 of manufacturing costs from the Botting Department to Finished Goods? Multiple Choice Work in Process-Bottling Pinished Goods 2.000 7,000 Finished Goods Work in Process-Botting 2.000 12.000 Work in Procon-Bottling cost of Goods Sold 1.000 11.000 O Cost of Goodi old Work in Procee-Bottling 7.000 7,000 Assume a company provided the following information: Departmental costs Number of employees Square feet of space occupied Service Departments Cafeteria Janitorial $ 200,000 $ 140,000 10 20 3,000 2,000 Operating Departments Lab Tech $2,320,000 $950,000 40 60 11,000 9,000 If the company (1) uses the direct method to allocate service department costs to operating departments, (2) allocates Cafeteria costs based on the number of employees, and (3) allocates Janitorial costs based on square feet of space of occupied, then the cost allocated from the Cafeteria Department to the Tech Department is closest to: Multiple Choice 580,000 $92,308 $120,000 Departmental costs Number of employees Square feet of space occupied Service Departments Cafeteria Janitorial $200,000 $140,000 10 20 3,000 2,000 Operating Departments Lab Tech $2,320,000 $950,000 40 60 11,000 9,000 if the company (1) uses the direct method to allocate service department costs to operating departments, (2) allocates Cafeteria costs based on number of employees, and (3) allocates Janitorial costs based on square feet of space of occupied, then the cost allocated from the Janitorial Department to the Tech Department is closest to Multiple Choice $63,000 $50,400 $57,273 $54,782 August i balance 62.000 Completed and transferred to Finished Goods 2 Materials Direct labor Overhead August 31 balance 310,000 72,000 181,000 2 The August 1 work in process inventory consisted of 6,000 units with $40,000 in materials cost and $22.000 in conversion cost. The August 1 work in process inventory was 100% complete with respect to materials and 40% complete with respect to conversion. During August 48,000 units were started into production. The August 31 work in process inventory consisted of 8,000 units that were 100% with respect to materials and 60% complete with respect to conversion What is the cost of beginning work in process inventory plus the cost added during the period for conversion? Multiple Choice $203000 5265.000 $275,000 Conversion costs include: Multiple Choice O Direct materials cost and manufacturing overhead cost. Direct labor cost and manufacturing overhead cost. Direct materials cost and direct labor cost. Direct materials cost and indirect materials cost. Units 300 6,000 Milling Department Beginning work in process inventory Units started into production during the period Units completed during the period and transferred to the next department Ending work in process inventory 5,800 ? Using the FIFO method, how many units were in ending work in process inventory? Multiple Choice 200 units 11,500 units 100 units 500 units Which of the following statements is false with respect to job-order costing and process costing? Multiple Choice Both systems compute unit product costs by department The flow of costs through the manufacturing accounts is basically the same in both systems Both systems use the same basic manufacturing accounts, including Manufacturing Overhead. Raw Materials, Work in Process, and Finished Goods Both systems atsion materials, labor, and manufacturing overhead costs to Products Which of the following statements is true with respect to the step-down method of cost allocation? Multiple Choice It only assigns cost from operating departments to service departments. It assigns cost from operating departments to other operating departments and service departments. It assigns cost from service departments to other service departments and operating departments, O It only assigns cost from service departments to operating departments

multiple choice thanks

multiple choice thanks