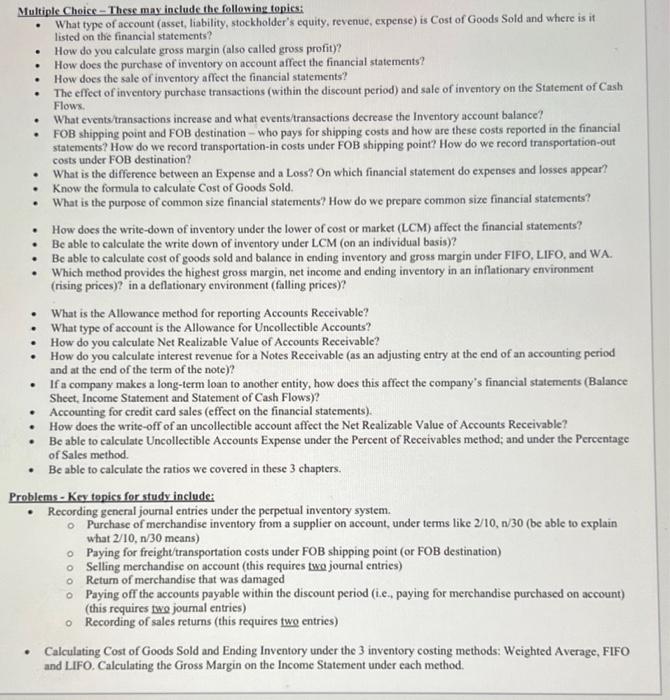

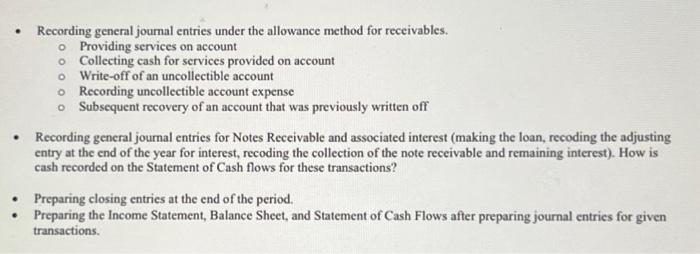

Multiple Choice - These may include the following topies: - What type of account (asset, liability, stockholder's equity, revenue, expense) is Cost of Goods Sold and where is it listed on the financial statements? - How do you calculate gross margin (also called gross profit)? - How does the purchase of inventory on account affect the financial statements? - How does the sale of inventory affect the financial statements? - The effect of inventory purchase transactions (within the discount period) and sale of inventory on the Statement of Cash Flows. - What events/ransactions increase and what events/ransactions decrease the Inventory account balance? - FOB shipping point and FOB destination - who pays for shipping costs and how are these costs reported in the financial statements? How do we record transportation-in costs under FOB shipping point? How do we record transportation-out costs under FOB destination? - What is the difference between an Expense and a Loss? On which financial statement do expenses and losses appear? - Know the formula to calculate Cost of Goods Sold. - What is the purpose of common size financial statements? How do we prepare common size financial statements? - How does the write-down of inventory under the lower of cost or market (LCM) affect the financial statements? - Be able to calculate the write down of inventory under LCM (on an individual basis)? - Be able to calculate cost of goods sold and balance in ending inventory and gross margin under FIFO, LIFO, and WA. - Which method provides the highest gross margin, net income and ending inventory in an inflationary environment (rising prices)? in a deflationary environment (falling prices)? - What is the Allowance method for reporting Accounts Receivable? - What type of account is the Allowance for Uncollectible Accounts? - How do you calculate Net Realizable Value of Accounts Receivable? - How do you calculate interest revenue for a Notes Receivable (as an adjusting entry at the end of an accounting period and at the end of the term of the note)? - If a company makes a long-term loan to another entity, how does this affect the company's financial statements (Balance Sheet, Income Statement and Statement of Cash Flows)? - Accounting for credit card sales (effect on the financial statements). - How does the write-off of an uncollectible account affect the Net Realizable Value of Accounts Receivable? - Be able to calculate Uncollectible Accounts Expense under the Percent of Receivables method; and under the Percentage of Sales method. - Be able to calculate the ratios we covered in these 3 chapters. roblems - Key topics for study include: - Recording general journal entries under the perpetual inventory system. - Purchase of merchandise inventory from a supplier on account, under terms like 2/10,n/30 (be able to explain what 2/10,n/30 means) - Paying for freight/transportation costs under FOB shipping point (or FOB destination) - Selling merchandise on account (this requires twe journal entries) - Return of merchandise that was damaged Paying off the accounts payable within the discount period (i.e., paying for merchandise purchased on account) (this requires twe joumal entries) Recording of sales returns (this requires two entries) - Calculating Cost of Goods Sold and Ending Inventory under the 3 inventory costing methods: Weighted Average, FIFO and LIFO. Calculating the Gross Margin on the Income Statement under each method. - Recording general journal entries under the allowance method for receivables. Providing services on account Collecting cash for services provided on account Write-off of an uncollectible account Recording uncollectible account expense Subsequent recovery of an account that was previously written off - Recording general journal entries for Notes Receivable and associated interest (making the loan, recoding the adjusting entry at the end of the year for interest, recoding the collection of the note receivable and remaining interest). How is cash recorded on the Statement of Cash flows for these transactions? - Preparing closing entries at the end of the period. - Preparing the Income Statement, Balance Sheet, and Statement of Cash Flows after preparing journal entries for given transactions