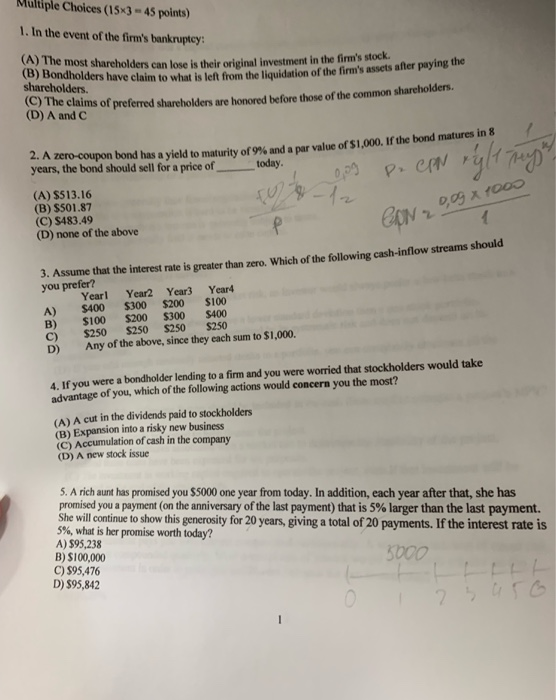

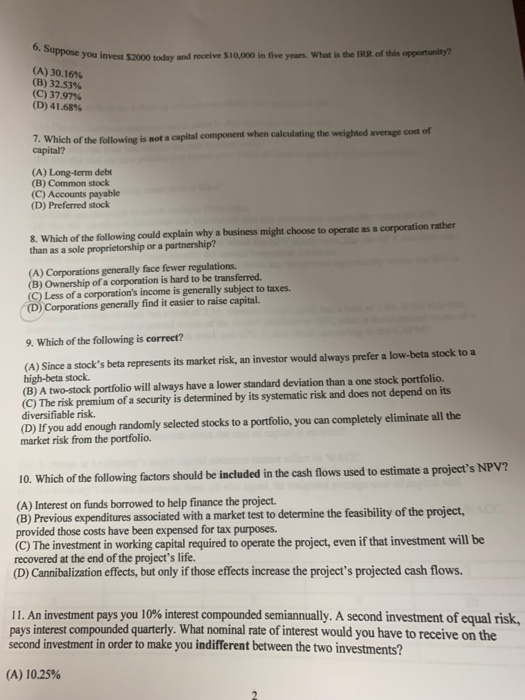

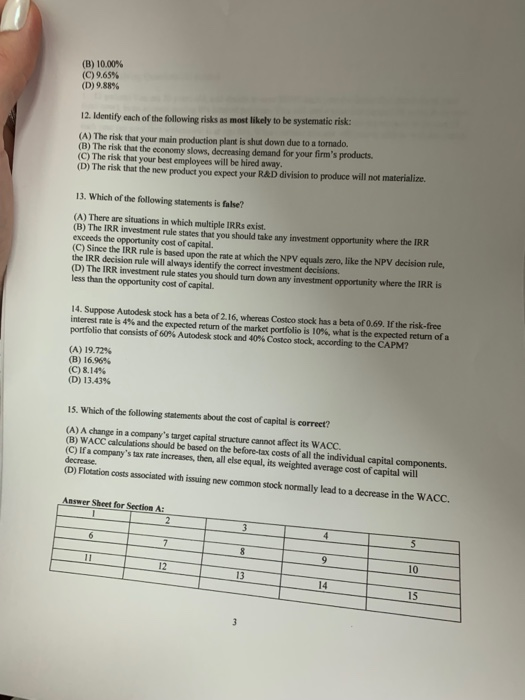

Multiple Choices (15x3- 45 points) 1. In the event of the firm's bankruptcy (B) Be most shareholders can lose is their original investment in the firm's stock rs have claim to what is left from the liquidation of the firm's asscts after paying the (C) The claims of preferred shareholdern are honored before those o the common shareholders. (A) The ers. (D) A and C 2. A zero-coupon bond has a yield years, the bond should sell for a price of to maturity of 9% and a par value of $1,000. If the bond matures in 8 today (A) S513.16 (B) $501.87 (C) $483.49 (D) none of the above that the interest rate is greater than zero. Which of the following cash-inflow streams should 3. Assume you prefer? Yearl Year2 Year3 Year4 A) $400 $300 $200 S100 B) $100 $200 $300 $400 C) $250 $250 $250 $250 D) Any of the above, since they each sum to $1,000 4. If you were a bondholder lending to a firm and you were worried that stockholders would take advantage of you, which of the following actions would concern you the most? (A) A cut in the dividends paid to stockholders (B) Expansion into a risky new business (C) Accumulation of cash in the company (D) A new stock issue 5. A rich aunt has promised you $5000 one year from today. In addition, each year after that, she has promised you a payment (on the anniversary of the last payment) that is 5% larger than the last payment. She will continue to show this generosity for 20 years, giving a total of 20 payments. If the interest rate is 5%, what is her promise worth today? A) $95,238 B) $100,000 C)$95,476 D) $95,842 3000 uppose you invest $2000 today and receive $10,000 in five years. What is the IRR of this opportunit? (A) 30.16% (B) 32.53% (C) 37.97% (D) 41.68% 7. Whic capital? h of the following is not a capital component when calculating the weighted average cost of (A) Long-term debt (B) Common stock (C) Accounts payable (D) Preferred stock 8. Which of the following could explain why a business might choose to operate as a corporation rather than as a sole proprietorship or a partnership? (A) Corporations generally face fewer regulations. (B) Ownership of a corporation is hard to be transferred. (C) Less of a corporation's income is generally subject to taxes. D) Corporations generally find it easier to raise capital. 9. Which of the following is correct? (A) Since a stock's beta represents its market risk, an investor would always prefer a low-beta stock to a high-beta stock. (B) A two-stock portfolio will always have a lower standard deviation than a one stock portfolio. (C) The risk premium of a security is determined by its systematic risk and does not depend on its diversifiable risk. (D) If you add enough randomly selected stocks to a portfolio, you can completely eliminate all the market risk from the portfolio. 10. Which of the following factors should be included in the cash flows used to estimate a project's NPV? (A) Interest on funds borrowed to help finance the project. (B) Previous expenditures associated with a market test to determine the feasibility of the project, provided those costs have been expensed for tax purposes. (C) The investment in working capital required to operate the project, even if that investment will be recovered at the end of the project's life. (D) Cannibalization effects, but only if those effects increase the project's projected cash flows. 11. An investment pays you 10% interest compounded semiannually. A second investment of equal risk, pays interest compounded quarterly. What nominal rate of interest would you have to receive on the second investment in order to make you indifferent between the two investments? (A) 10.25% (B) 10.00% (C) 9.65% (D) 9.88% 12. Identify each of the following risks as most likely to be systematic risk: (A) The risk that your main production plant is shut down due to a tornado. (B) The risk that the economy slows, decreasing demand for your firm's products (C) The risk that your best employees will be hired away (D) The risk that the new product you expect your R&D division to produce will not materialize. 13. Which of the following statements is false? (A) There are situations in which multiple IRRs exist. (B) The IRR investment rule states that you should take any investment opportunity where the IRR exceeds the opportunity cost of capital. (C) Since the IRR rule is based upon the rate at which the NPV equals zero, like the NPV decision rule, the IRR decision rule will always identify the correct investment decisions. (D) The IRR investment rule states you should turn down any investment opportunity where the IRR is ess than the opportunity cost of capital. 14. Suppose Autodesk stock has a beta of 2.16, whereas Costco stock has a beta of 0.69. If the risk-free interest rate is 4% and the expected return ofthe market portfolio is i05, what is the expected return of a portfolio that consists of 60% Autodesk stock and 40% Costco stock, according to the CAPM? (A) 19.72% (B) 16.96% (C) 8.14% (D) 13.43% 15. Which of the following statements about the cost of capital is correet? (A) A change (B) WACC calculations should be based on the before-tax costs of all the individual capital components. (C) If a company's tax rate increases, then, all else equal, its weighted average cost of capital will in a company's target capital structure cannot affect its WACC. (D) Flotation costs associated with issuing new common stock normally lead to a decrease in the WACC. Answer Sheet for Section A: 10 13 14 15