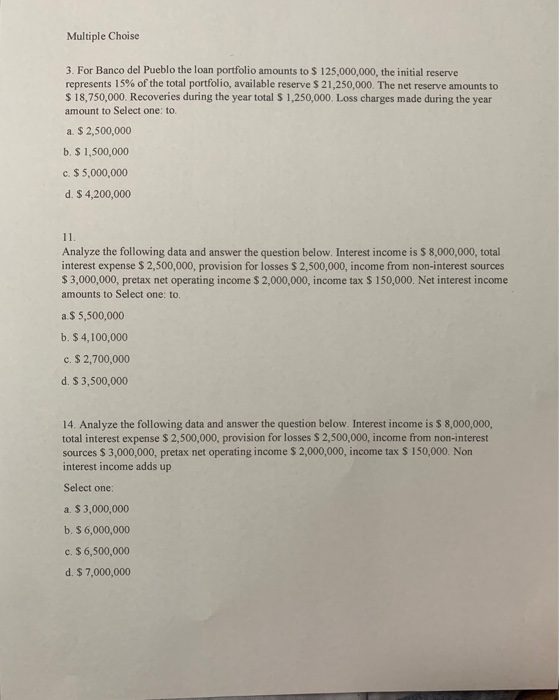

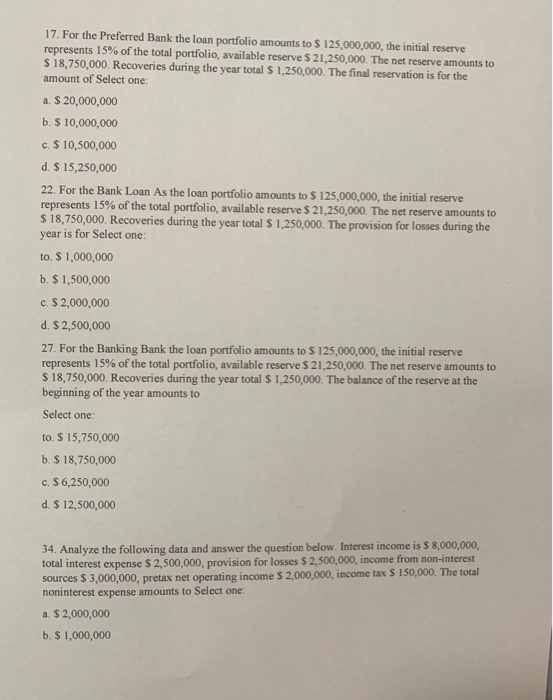

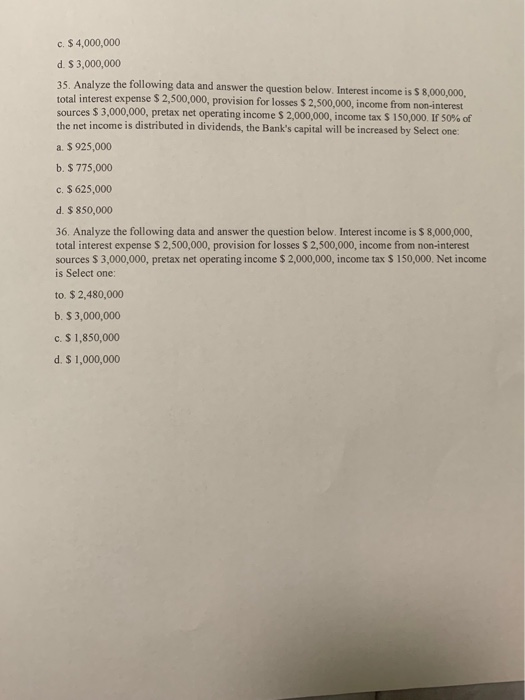

Multiple Choise 3. For Banco del Pueblo the loan portfolio amounts to $ 125,000,000, the initial reserve represents 15% of the total portfolio, available reserve $ 21,250,000. The net reserve amounts to $ 18,750,000. Recoveries during the year total $ 1,250,000 Loss charges made during the year amount to Select one: to. a $ 2,500,000 b. $ 1,500,000 c. $5,000,000 d. $4,200,000 11. Analyze the following data and answer the question below. Interest income is $ 8,000,000, total interest expense $ 2,500,000, provision for losses $ 2,500,000, income from non-interest sources $3,000,000, pretax net operating income $ 2,000,000, income tax $ 150,000. Net interest income amounts to Select one to a $ 5,500,000 b. $ 4,100,000 c. $ 2,700,000 d. $3,500,000 14. Analyze the following data and answer the question below. Interest income is $ 8,000,000, total interest expense $ 2,500,000, provision for losses $ 2,500,000, income from non-interest sources $3,000,000, pretax net operating income $ 2,000,000, income tax $ 150,000. Non interest income adds up Select one: a. $3,000,000 b. S 6,000,000 c. $ 6,500,000 d. $ 7,000,000 17. For the Preferred Bank the loan portfolio amounts to $ 125,000,000, the initial reserve represents 15% of the total portfolio, available reserve $ 21,250,000. The net reserve amounts to S 18,750,000. Recoveries during the year total $ 1,250,000. The final reservation is for the amount of Select one: a. $ 20,000,000 b. $ 10,000,000 c. $ 10,500,000 d. $ 15,250,000 22. For the Bank Loan As the loan portfolio amounts to $ 125,000,000, the initial reserve represents 15% of the total portfolio, available reserve $ 21,250,000. The net reserve amounts to $ 18,750,000. Recoveries during the year total $ 1,250,000. The provision for losses during the year is for Select one: to $ 1,000,000 b. $1,500,000 c. $ 2,000,000 d. $ 2,500,000 27. For the Banking Bank the loan portfolio amounts to $ 125,000,000, the initial reserve represents 15% of the total portfolio, available reserve $ 21,250,000. The net reserve amounts to $ 18,750,000. Recoveries during the year total $ 1,250,000. The balance of the reserve at the beginning of the year amounts to Select one: to. $ 15,750,000 b. $ 18,750,000 c. $ 6,250,000 d. $ 12,500,000 34. Analyze the following data and answer the question below. Interest income is S 8,000,000, total interest expense $ 2,500,000, provision for losses $ 2,500,000, income from non-interest sources $3,000,000, pretax net operating income $ 2,000,000, income tax $ 150,000. The total noninterest expense amounts to Select one: a. $ 2,000,000 b. $ 1,000,000 c. $ 4,000,000 d. S 3,000,000 35. Analyze the following data and answer the question below. Interest income is $8,000,000, total interest expense $ 2,500,000, provision for losses $ 2,500,000, income from non-interest sources $ 3,000,000, pretax net operating income $ 2,000,000, income tax $ 150,000. If 50% of the net income is distributed in dividends, the Bank's capital will be increased by Select one: a $ 925,000 b. $ 775,000 c. $ 625,000 d. $ 850,000 36. Analyze the following data and answer the question below. Interest income is $8,000,000, total interest expense $ 2,500,000, provision for losses $ 2,500,000, income from non-interest sources $3,000,000, pretax net operating income $ 2,000,000, income tax $ 150,000. Net income is Select one: to $ 2,480,000 b. $3,000,000 c. $ 1,850,000 d. $ 1,000,000