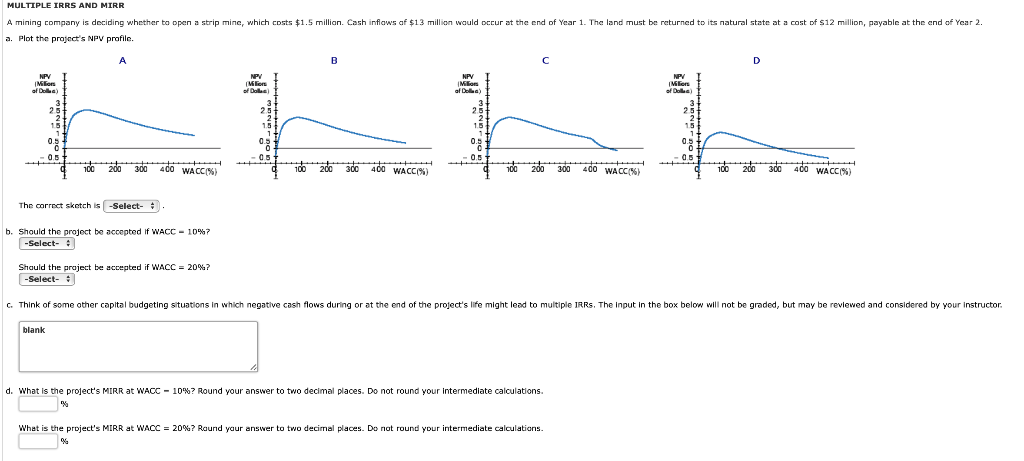

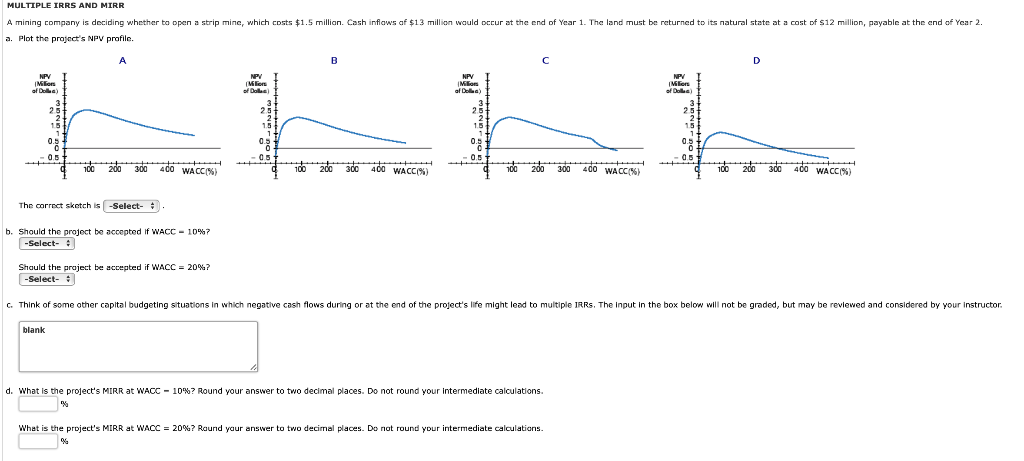

MULTIPLE IRRS AND MIRR A mining company is deciding whether to open a strip mine, which costs $1.5 million. Cash inflows af $13 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $12 million, payable at the end of Year 2. a. Plot the project's NPV profile. B D NPV NPY Milion of Dolla) Milios of Dolls NPV IME of Dolla) NPV Milion of Dolba) 3 25 2 25 2 151 21 15 0.5 0.5 0.5 05 as 100 200 300 400 WACC%) 100 300 400 WACC) 100 200 300 400 WACC/%) 100 200 300 400 WACC(%) The correct sketch is -Select- b. Should the project be accepted if WACC - 10%7 -Select- : Should the project be accepted if WACC = 20%? -Select- c. Think of some other capital budgeting situations in which negative cash flows during or at the end of the project's life might lead to multiple IRRs. The input in the box below will not be graded, but may be reviewed and considered by your instructor blank d. What is the project's MIRR at WACC - 10%? Round your answer to two decimal places. Do not round your intermediate calculations. What is the project's MIRR at WACC = 20%? Round your answer to two decimal places. Do not round your intermediate calculations. MULTIPLE IRRS AND MIRR A mining company is deciding whether to open a strip mine, which costs $1.5 million. Cash inflows af $13 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $12 million, payable at the end of Year 2. a. Plot the project's NPV profile. B D NPV NPY Milion of Dolla) Milios of Dolls NPV IME of Dolla) NPV Milion of Dolba) 3 25 2 25 2 151 21 15 0.5 0.5 0.5 05 as 100 200 300 400 WACC%) 100 300 400 WACC) 100 200 300 400 WACC/%) 100 200 300 400 WACC(%) The correct sketch is -Select- b. Should the project be accepted if WACC - 10%7 -Select- : Should the project be accepted if WACC = 20%? -Select- c. Think of some other capital budgeting situations in which negative cash flows during or at the end of the project's life might lead to multiple IRRs. The input in the box below will not be graded, but may be reviewed and considered by your instructor blank d. What is the project's MIRR at WACC - 10%? Round your answer to two decimal places. Do not round your intermediate calculations. What is the project's MIRR at WACC = 20%? Round your answer to two decimal places. Do not round your intermediate calculations