Answered step by step

Verified Expert Solution

Question

1 Approved Answer

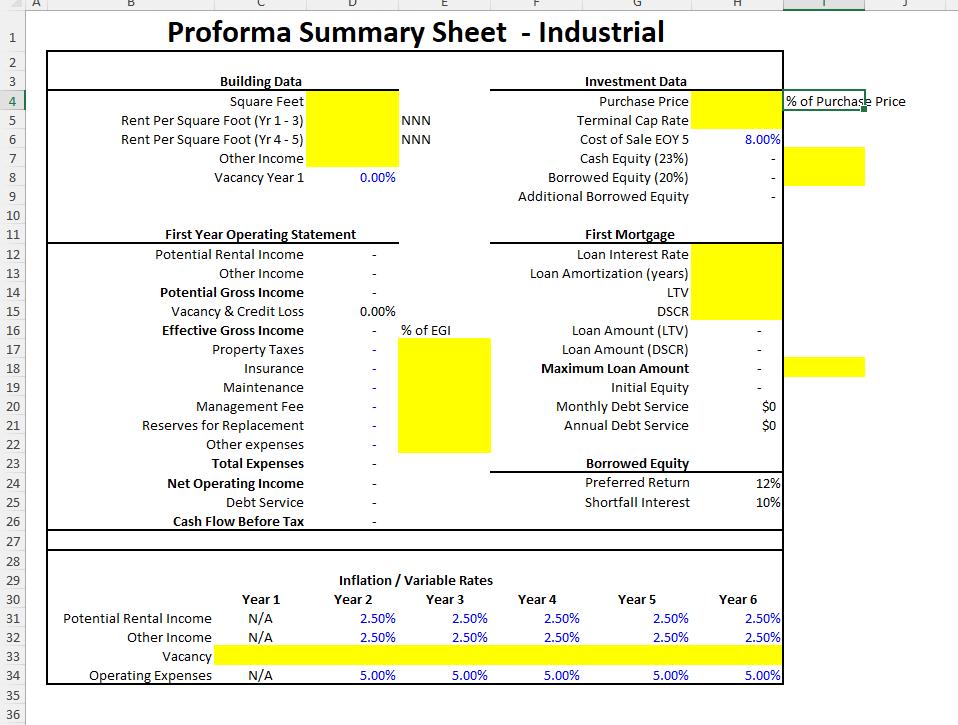

Multiple Occupancy 300,000 SF Multistory Industrial Building with consistent 5% vacancy. Class B Buildings with 24' Clear Ceiling Heights In addition, 150,000 SF of tenants

- Multiple Occupancy 300,000 SF Multistory Industrial Building with consistent 5% vacancy. Class "B" Buildings with 24' Clear Ceiling Heights

- In addition, 150,000 SF of tenants leave at end of year 3, and are replaced in 6 months with tenants paying $15/SF NNN

- Lease Term = 5-year leases with 5-year options

- Initial Rent $12/SF NNN, Replacement Tenant Rent $15/SF NNN

- Additional income consists of 40 truck parking spaces rented for $400/month each. Spaces are fully rented all the time with no vacancy.

- Expenses are as follows (all as a % of EGI)

- Property Taxes 15%

- Insurance 3%

- Maintenance 20%

- Management Fee 8%

- Reserves for Replacement 5%

- Other expenses 5%

- Price = $65,000,000

- Capital Stack:

- 80% LTV @6.5% Interest Rate, 25 Year Term, Fully Amortized

- Constrained by 1.2 DSCR, requiring

- 20% Borrowed Equity@ 12% Preferred Return (Interest)

- 10% Interest Rate on Shortfalls

- Remainder Cash Equity

- Terminal Cap Rate = 5.5%

Fill the yellow box by above instructions

1 23 B Proforma Summary Sheet - Industrial Building Data st Square Feet 5 6 7 Rent Per Square Foot (Yr 1-3) Rent Per Square Foot (Yr 4-5) Other Income NNN NNN 8 Vacancy Year 1 0.00% 9 10 11 12 456 13 14 15 First Year Operating Statement Potential Rental Income Other Income Potential Gross Income Vacancy & Credit Loss 0.00% % of EGI Investment Data Purchase Price Terminal Cap Rate % of Purchase Price Cost of Sale EOY 5 8.00% Cash Equity (23%) Borrowed Equity (20%) Additional Borrowed Equity First Mortgage Loan Interest Rate Loan Amortization (years) LTV DSCR 16 17 18 19 20 21 22 23 24 25 26 Effective Gross Income Property Taxes Insurance Maintenance Management Fee Reserves for Replacement Other expenses Total Expenses Net Operating Income Debt Service Cash Flow Before Tax Loan Amount (LTV) Loan Amount (DSCR) Maximum Loan Amount Initial Equity Monthly Debt Service Annual Debt Service Borrowed Equity Preferred Return 12% Shortfall Interest 10% 27 28 29 Inflation/Variable Rates 30 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 31 Potential Rental Income N/A 2.50% 2.50% 2.50% 2.50% 2.50% 32 Other Income N/A 2.50% 2.50% 2.50% 2.50% 2.50% 33 Vacancy 34 Operating Expenses N/A 5.00% 5.00% 5.00% 5.00% 5.00% 35 36

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started