Answered step by step

Verified Expert Solution

Question

1 Approved Answer

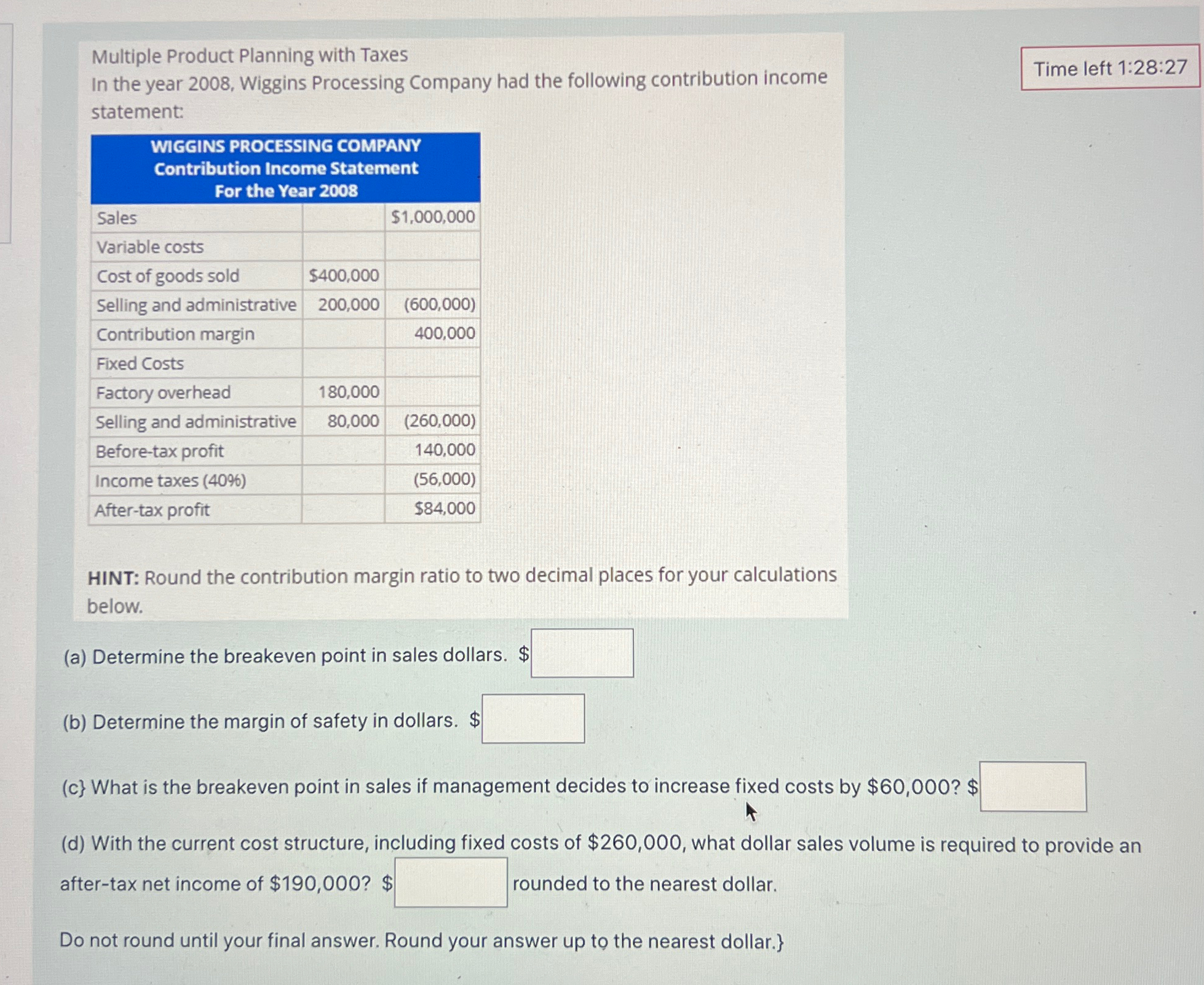

Multiple Product Planning with Taxes In the year 2008, Wiggins Processing Company had the following contribution income statement: WIGGINS PROCESSING COMPANY Contribution Income Statement

Multiple Product Planning with Taxes In the year 2008, Wiggins Processing Company had the following contribution income statement: WIGGINS PROCESSING COMPANY Contribution Income Statement Sales Variable costs For the Year 2008 Cost of goods sold $400,000 $1,000,000 Selling and administrative 200,000 (600,000) Contribution margin 400,000 Fixed Costs Factory overhead 180,000 Selling and administrative 80,000 (260,000) Before-tax profit Income taxes (40%) 140,000 (56,000) $84,000 Time left 1:28:27 After-tax profit HINT: Round the contribution margin ratio to two decimal places for your calculations below. (a) Determine the breakeven point in sales dollars. $ (b) Determine the margin of safety in dollars. $ (c) What is the breakeven point in sales if management decides to increase fixed costs by $60,000? $ (d) With the current cost structure, including fixed costs of $260,000, what dollar sales volume is required to provide an after-tax net income of $190,000? $ rounded to the nearest dollar. Do not round until your final answer. Round your answer up to the nearest dollar.}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started