Answered step by step

Verified Expert Solution

Question

1 Approved Answer

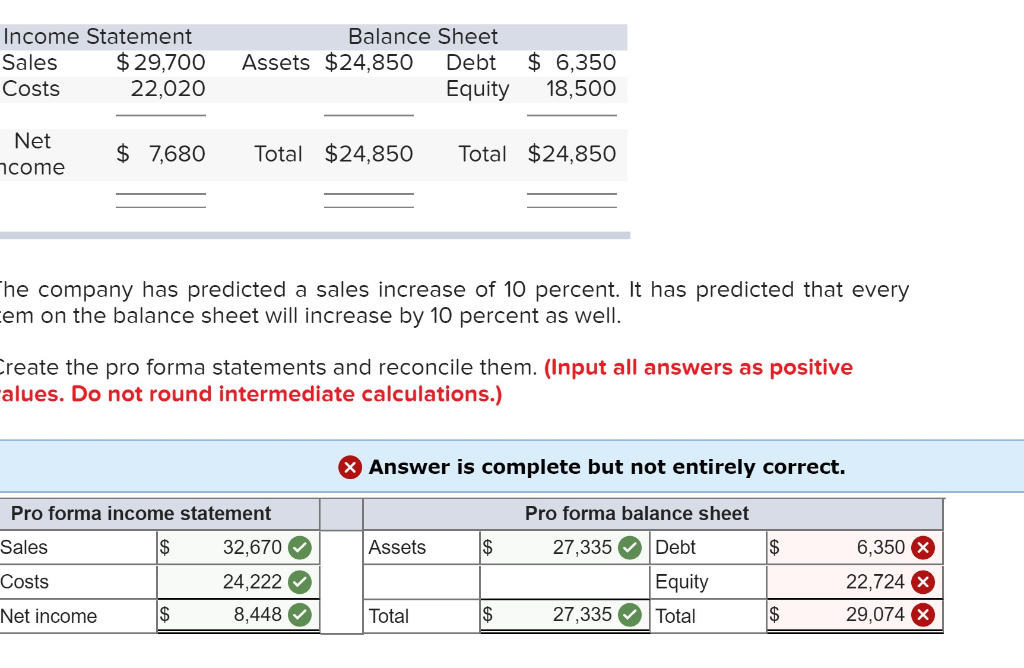

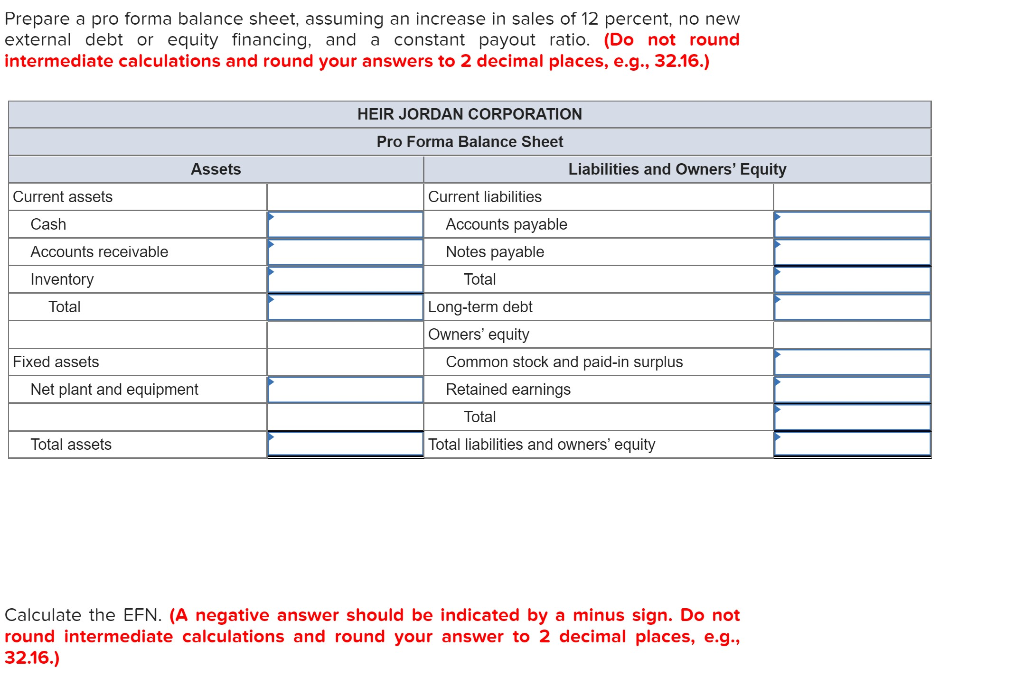

multiple question for whole problem' part 1 part 2 Part 3 Income Statement Sales $ 29,700 Costs 22,020 Balance Sheet Assets $24,850 Debt Equity $

multiple question for whole problem'

part 1

part 2

Part 3

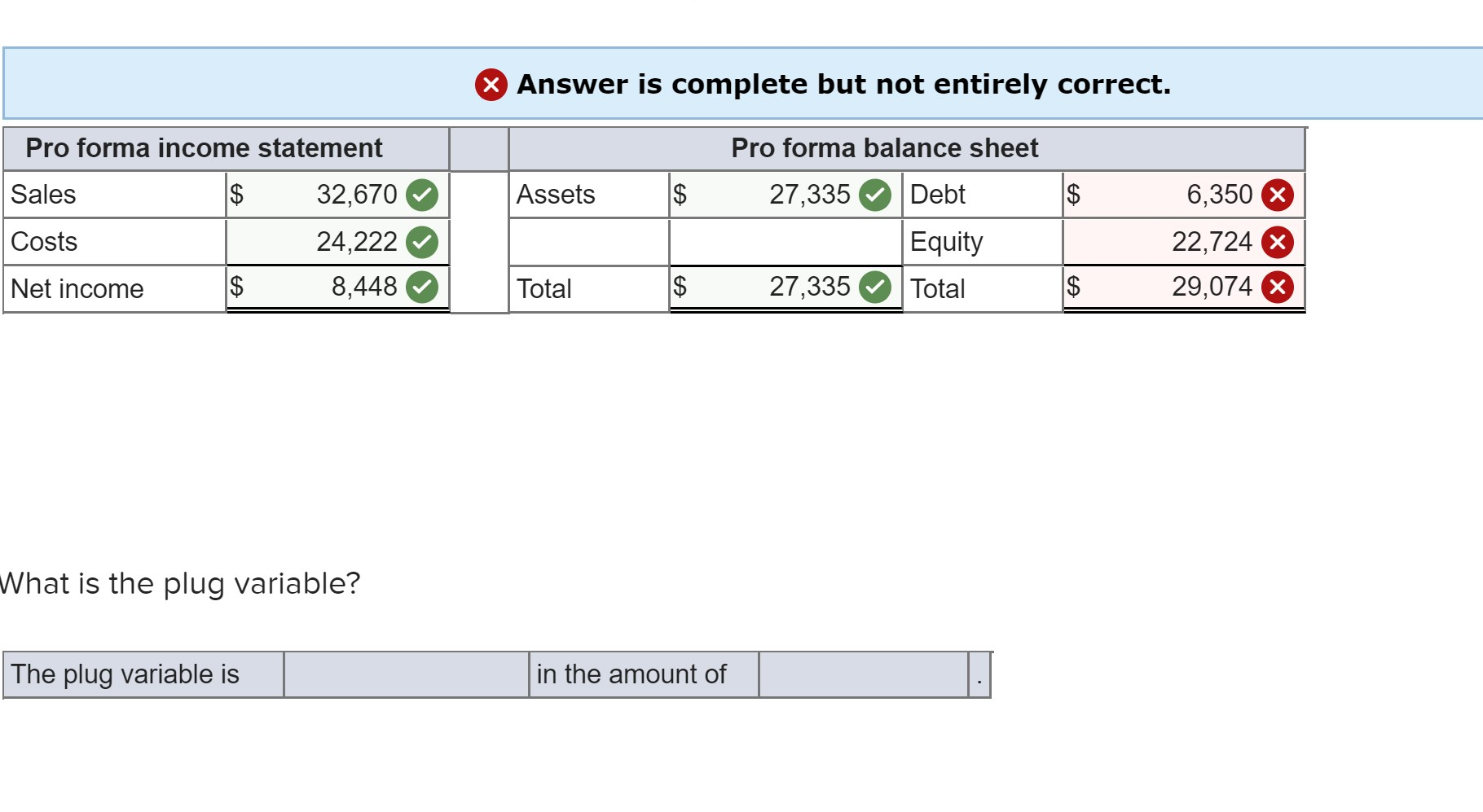

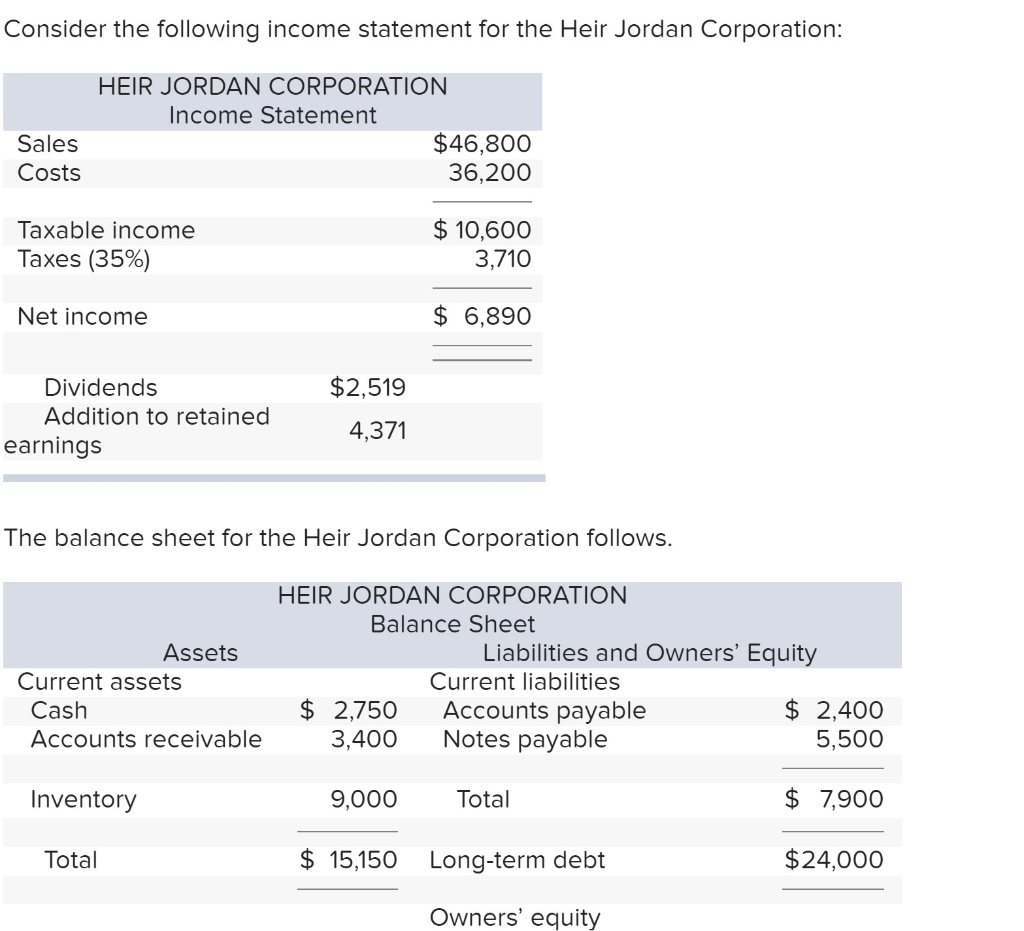

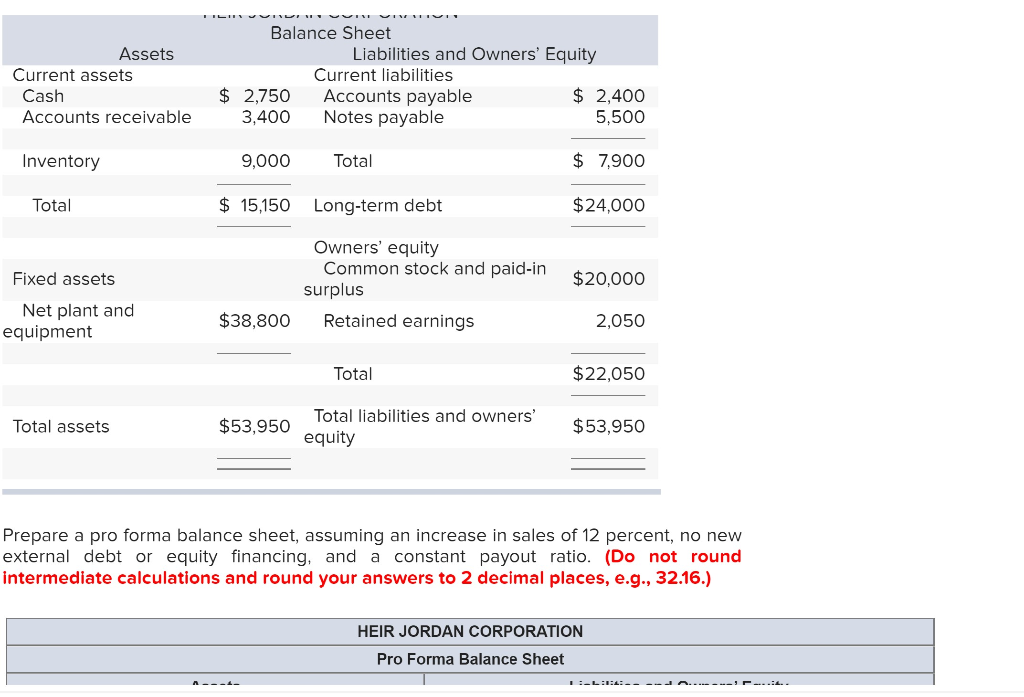

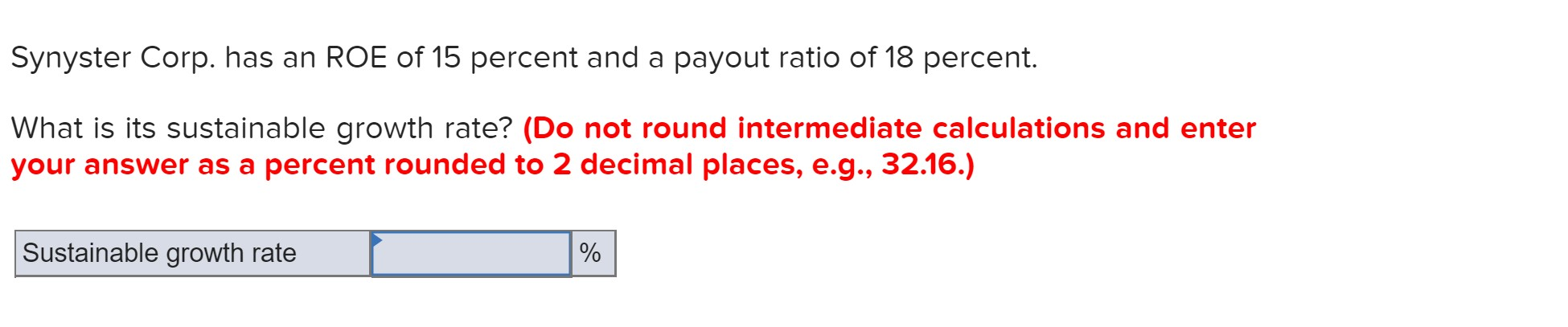

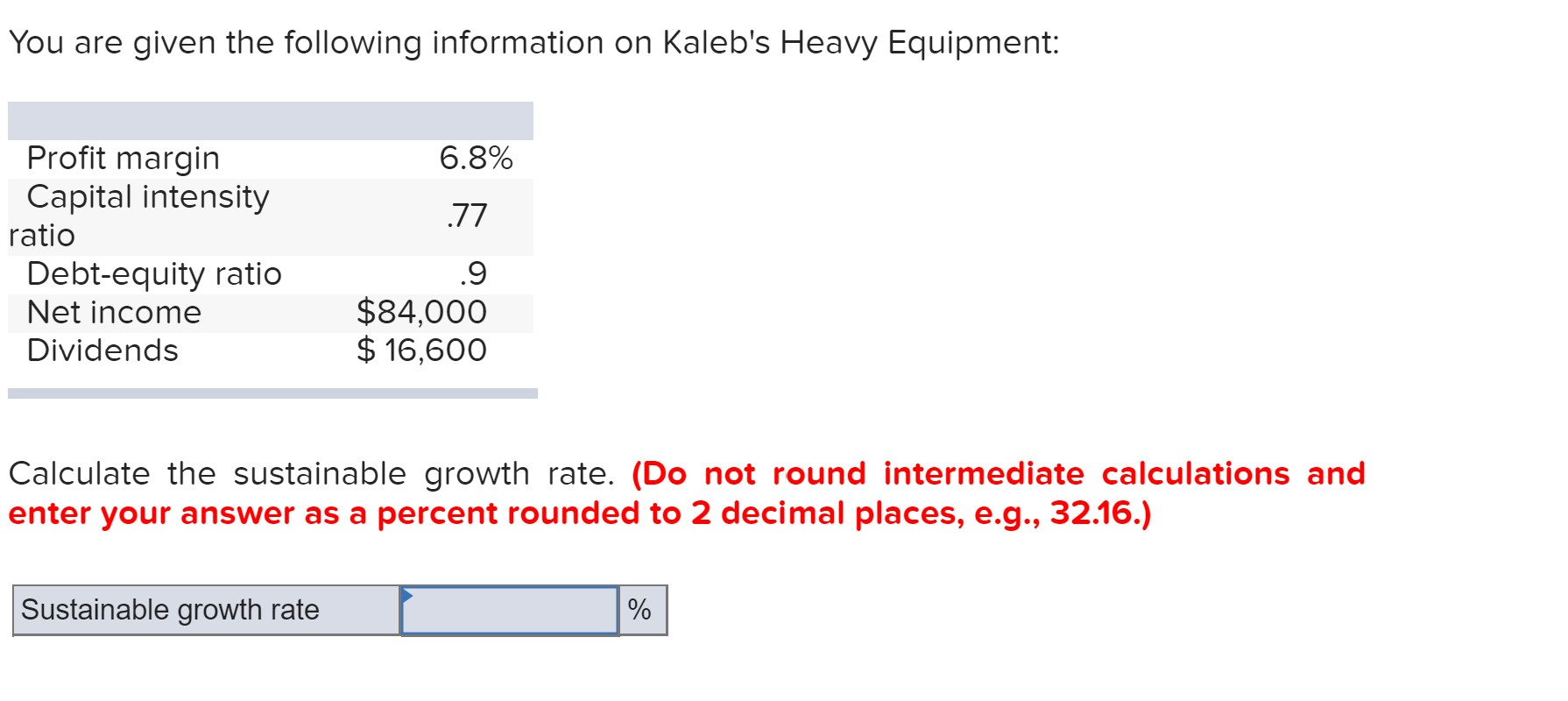

Income Statement Sales $ 29,700 Costs 22,020 Balance Sheet Assets $24,850 Debt Equity $ 6,350 18,500 Net ncome $ 7,680 Total $24,850 Total $24,850 The company has predicted a sales increase of 10 percent. It has predicted that every cem on the balance sheet will increase by 10 percent as well. Create the pro forma statements and reconcile them. (Input all answers as positive alues. Do not round intermediate calculations.) Answer is complete but not entirely correct. Assets $ $ Pro forma income statement Sales $ 32,670 Costs 24,222 Net income $ 8,448 Pro forma balance sheet 27,335 Debt Equity 27,335 Total 6,350 X 22,724 X 29,074 X Total $ $ Answer is complete but not entirely correct. Assets $ $ Pro forma income statement Sales $ 32,670 Costs 24,222 Net income $ 8,448 Pro forma balance sheet 27,335 Debt Equity 27,335 Total Costs 6,350 X 22,724 X 29,074 Total $ $ What is the plug variable? The plug variable is in the amount of Consider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Statement $46,800 36,200 Sales Costs Taxable income Taxes (35%) $ 10,600 3,710 Net income $ 6,890 $2,519 Dividends Addition to retained earnings 4.371 The balance sheet for the Heir Jordan Corporation follows. HEIR JORDAN CORPORATION Balance Sheet Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 2,750 Accounts payable $ 2,400 Accounts receivable 3,400 Notes payable 5,500 Inventory 9,000 Total $ 7,900 Total $ 15,150 Long-term debt $24,000 Owners' equity Assets Current assets Cash Accounts receivable Balance Sheet Liabilities and Owners' Equity Current liabilities $ 2,750 Accounts payable $ 2,400 3,400 Notes payable 5,500 Inventory 9,000 Total $ 7,900 Total $ 15,150 Long-term debt $24,000 Owners' equity Common stock and paid-in surplus Retained earnings Fixed assets Net plant and equipment $20,000 $38,800 2,050 Total $22,050 Total assets $53,950 Total liabilities and owners' equity $53,950 Prepare a pro forma balance sheet, assuming an increase in sales of 12 percent, no new external debt or equity financing, and a constant payout ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) HEIR JORDAN CORPORATION Pro Forma Balance Sheet :-LAI::-- - Prepare a pro forma balance sheet, assuming an increase in sales of 12 percent, no new external debt or equity financing, and a constant payout ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Assets Current assets Cash Accounts receivable Inventory HEIR JORDAN CORPORATION Pro Forma Balance Sheet Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity Total Fixed assets Net plant and equipment Total assets Calculate the EFN. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Synyster Corp. has an ROE of 15 percent and a payout ratio of 18 percent. What is its sustainable growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Sustainable growth rate You are given the following information on Kaleb's Heavy Equipment: 6.8% 77 Profit margin Capital intensity ratio Debt-equity ratio Net income Dividends $84,000 $ 16,600 Calculate the sustainable growth rate. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Sustainable growth rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started