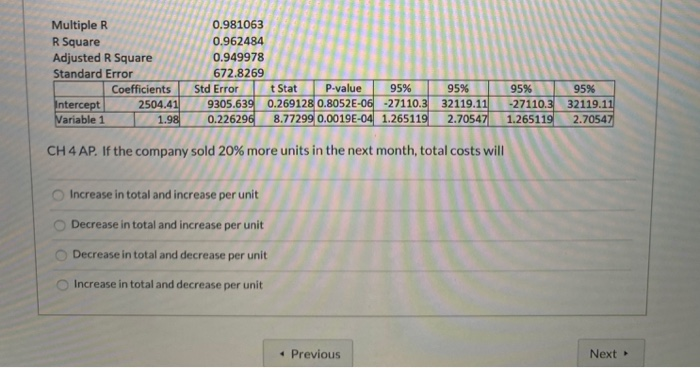

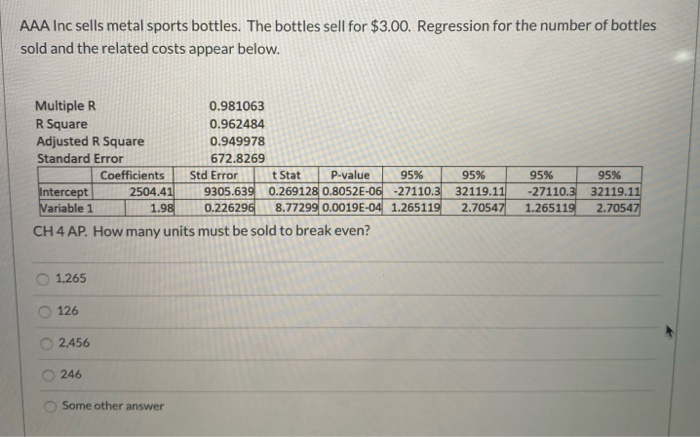

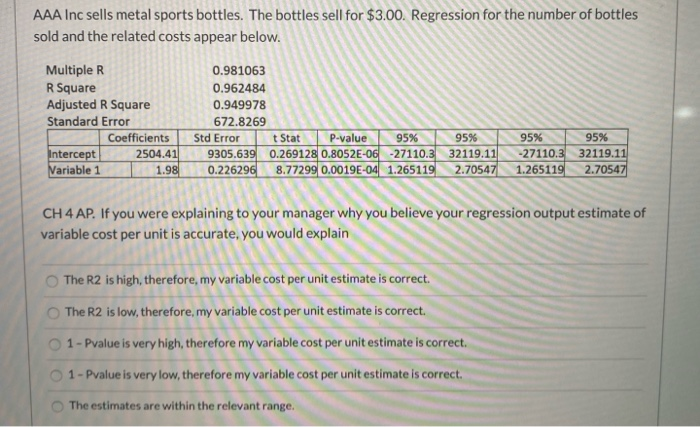

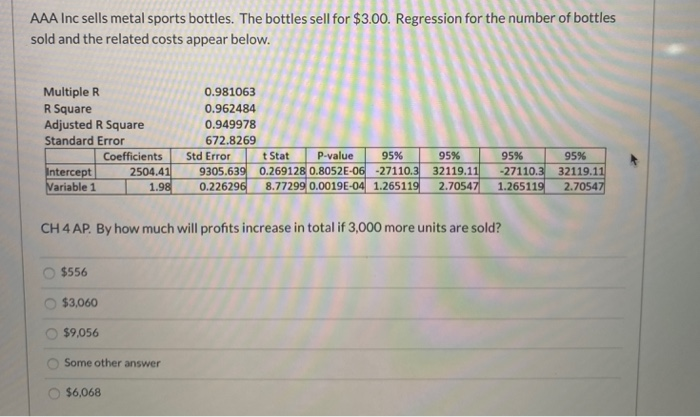

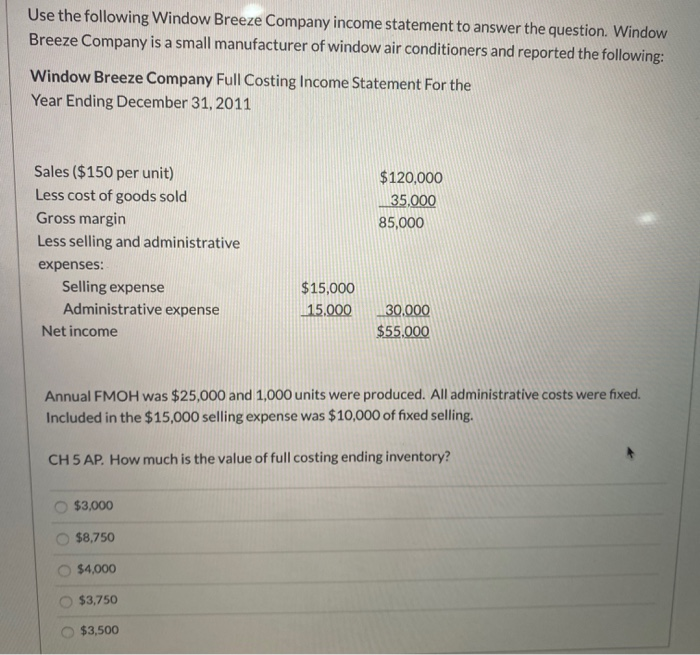

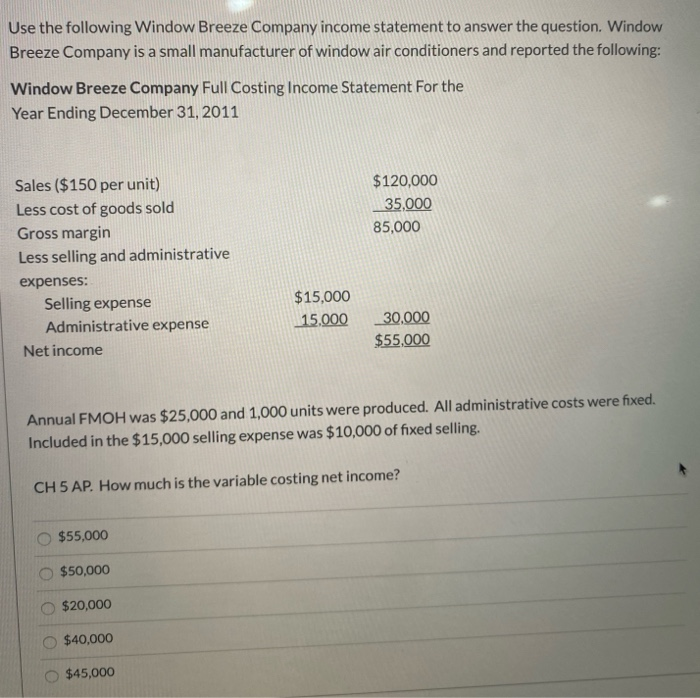

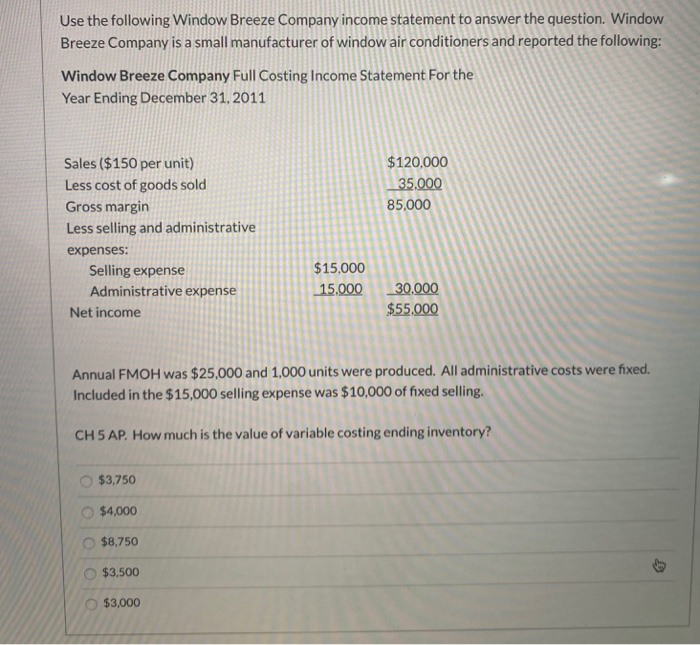

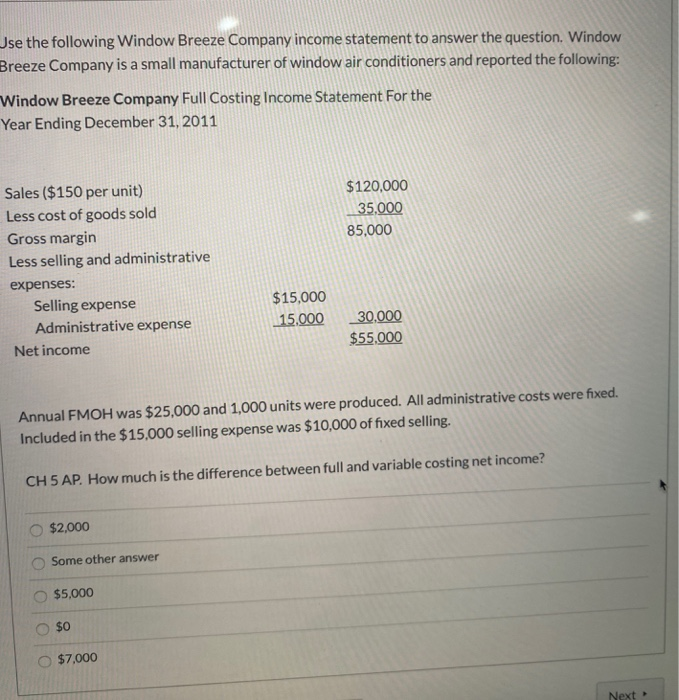

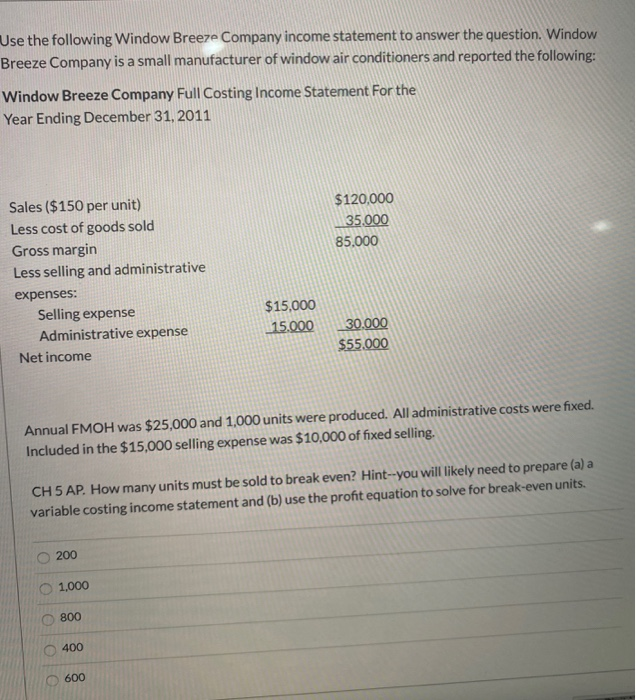

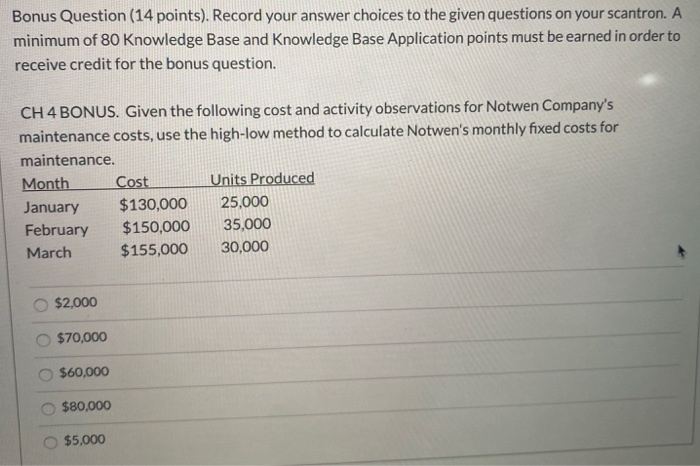

Multiple R R Square Adjusted R Square Standard Error Coefficients Intercept 2504.41 Variable 1 1.98 0.981063 0.962484 0.949978 672.8269 Std Error t Stat P-value 95% 9305.639 0.269128 0.8052E-06 -27110.3 0.226296 8.77299 0.0019E-04 1.265119 95% 32119.11 2.70547 95% 95% -27110.3 32119.11 1.265119 2.70547 CH 4 AP. If the company sold 20% more units in the next month, total costs will Increase in total and increase per unit Decrease in total and increase per unit Decrease in total and decrease per unit Increase in total and decrease per unit Previous Next AAA Inc sells metal sports bottles. The bottles sell for $3.00. Regression for the number of bottles sold and the related costs appear below. Multiple R 0.981063 R Square 0.962484 Adjusted R Square 0.949978 Standard Error 672.8269 Coefficients Std Error t Stat P-value 95% Intercept 2504.41 9305.639 0.269128 0.8052E-06-27110.3 Variable 1 1.98 0.226296 8.77299 0.0019E-04 1.265119 CH 4 AP. How many units be sold to break even? 95% 32119.11 2.70547 95% -27110.3 1.265119 95% 32119.11 2.70547 1.265 126 2,456 246 Some other answer AAA Inc sells metal sports bottles. The bottles sell for $3.00. Regression for the number of bottles sold and the related costs appear below. Multiple R R Square Adjusted R Square Standard Error Coefficients Intercept 2504.41 Variable 1 1.98 0.981063 0.962484 0.949978 672.8269 Std Error t Stat P-value 95% 95% 9305.639 0.269128 0.8052E-06 -27110.3 32119.11 0.226296 8.77299 0.0019E-04 1.265119 2.70547 95% 95% -27110.3 32119.11 1.265119 2.70547 CH 4 AP. If you were explaining to your manager why you believe your regression output estimate of variable cost per unit is accurate, you would explain The R2 is high, therefore, my variable cost per unit estimate is correct. The R2 is low, therefore, my variable cost per unit estimate is correct. 1- Pvalue is very high, therefore my variable cost per unit estimate is correct. 1 - Pvalue is very low, therefore my variable cost per unit estimate is correct. The estimates are within the relevant range. AAA Inc sells metal sports bottles. The bottles sell for $3.00. Regression for the number of bottles sold and the related costs appear below. Multiple R R Square Adjusted R Square Standard Error Coefficients Intercept 2504.41 Variable 1 1.98 0.981063 0.962484 0.949978 672.8269 Std Error t Stat P-value 95% 9305.639 0.269128 0.8052E-06 -27110.3 0.226296 8.77299 0.0019E-04 1.265119 95% 32119.11 2.70547 95% -27110.3 1.265119 95% 32119.11 2.70547 CH 4 AP. By how much will profits increase in total if 3,000 more units are sold? $556 $3,060 $9,056 Some other answer $6,068 Use the following Window Breeze Company income statement to answer the question. Window Breeze Company is a small manufacturer of window air conditioners and reported the following: Window Breeze Company Full Costing Income Statement For the Year Ending December 31, 2011 $120,000 35,000 85,000 Sales ($150 per unit) Less cost of goods sold Gross margin Less selling and administrative expenses: Selling expense Administrative expense Net income $15,000 15.000 30.000 $55.000 Annual FMOH was $25,000 and 1,000 units were produced. All administrative costs were fixed. Included in the $15,000 selling expense was $10,000 of fixed selling. CH 5 AP. How much is the value of full costing ending inventory? $3,000 $8,750 $4,000 $3,750 $3,500 Use the following Window Breeze Company income statement to answer the question. Window Breeze Company is a small manufacturer of window air conditioners and reported the following: Window Breeze Company Full Costing Income Statement For the Year Ending December 31, 2011 $120,000 35,000 85,000 Sales ($150 per unit) Less cost of goods sold Gross margin Less selling and administrative expenses: Selling expense Administrative expense Net income $15,000 15.000 30,000 $55,000 Annual FMOH was $25,000 and 1,000 units were produced. All administrative costs were fixed. Included in the $15,000 selling expense was $10,000 of fixed selling. CH 5 AP. How much is the variable costing net income? $55,000 $50,000 $20,000 $40,000 $45,000 Use the following Window Breeze Company income statement to answer the question. Window Breeze Company is a small manufacturer of window air conditioners and reported the following: Window Breeze Company Full Costing Income Statement For the Year Ending December 31, 2011 $120,000 35,000 85,000 Sales ($150 per unit) Less cost of goods sold Gross margin Less selling and administrative expenses: Selling expense Administrative expense Net income $15,000 15.000 30,000 $55,000 Annual FMOH was $25,000 and 1,000 units were produced. All administrative costs were fixed. Included in the $15,000 selling expense was $10,000 of fixed selling. CH 5 AP. How much is the value of variable costing ending inventory? $3,750 $4,000 $8,750 $3,500 $3,000 Jse the following Window Breeze Company income statement to answer the question. Window Breeze Company is a small manufacturer of window air conditioners and reported the following: Window Breeze Company Full Costing Income Statement For the Year Ending December 31, 2011 $120,000 35,000 85.000 Sales ($150 per unit) Less cost of goods sold Gross margin Less selling and administrative expenses: Selling expense Administrative expense Net income $15,000 15.000 30.000 $55,000 Annual FMOH was $25,000 and 1,000 units were produced. All administrative costs were fixed. Included in the $15,000 selling expense was $10,000 of fixed selling. CH 5 AP. How much is the difference between full and variable costing net income? $2,000 Some other answer $5,000 $0 $7,000 Next Use the following Window Breeze Company income statement to answer the question. Window Breeze Company is a small manufacturer of window air conditioners and reported the following: Window Breeze Company Full Costing Income Statement for the Year Ending December 31, 2011 $120,000 35.000 85.000 Sales ($150 per unit) Less cost of goods sold Gross margin Less selling and administrative expenses: Selling expense Administrative expense Net income $15,000 15.000 30.000 $55.000 Annual FMOH was $25,000 and 1,000 units were produced. All administrative costs were fixed. Included in the $15,000 selling expense was $10,000 of fixed selling. CH 5 AP. How many units must be sold to break even? Hint--you will likely need to prepare (a) a variable costing income statement and (b) use the profit equation to solve for break-even units. 200 1,000 800 400 600 Bonus Question (14 points). Record your answer choices to the given questions on your scantron. A minimum of 80 Knowledge Base and Knowledge Base Application points must be earned in order to receive credit for the bonus question. CH 4 BONUS. Given the following cost and activity observations for Notwen Company's maintenance costs, use the high-low method to calculate Notwen's monthly fixed costs for maintenance. Month Cost Units Produced January $130,000 25.000 February $150,000 35,000 March $155,000 30,000 $2,000 $70,000 $60,000 $80,000 $5,000