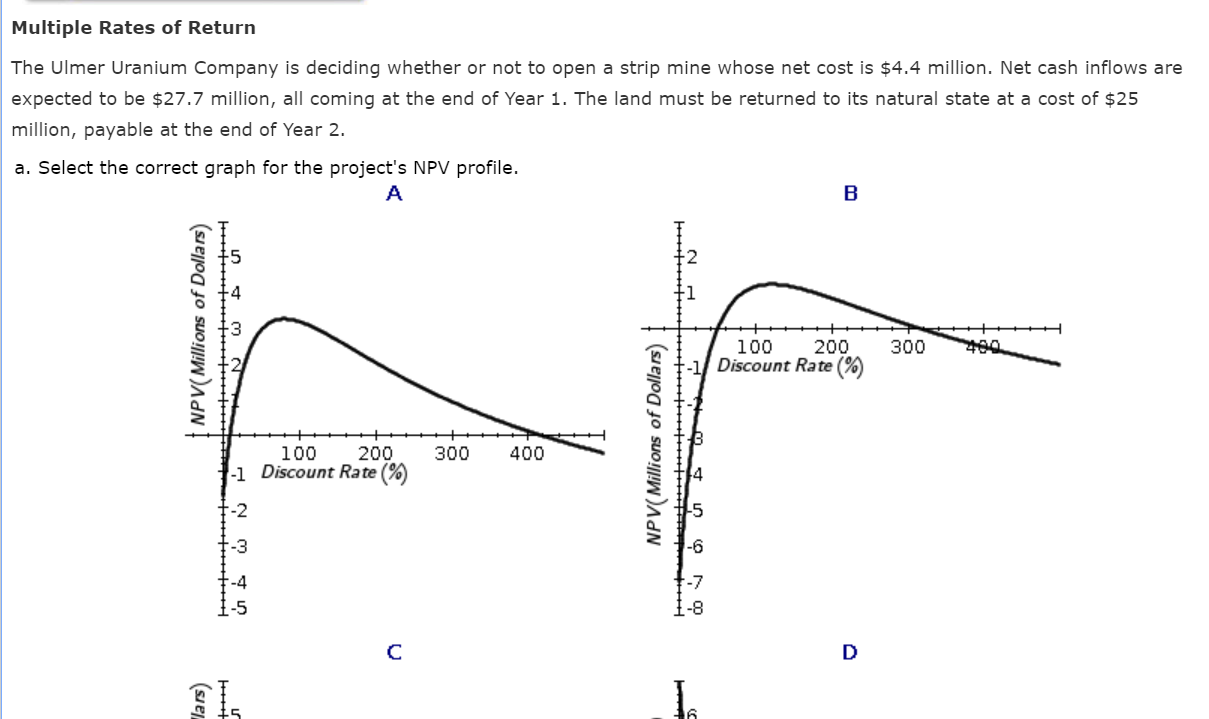

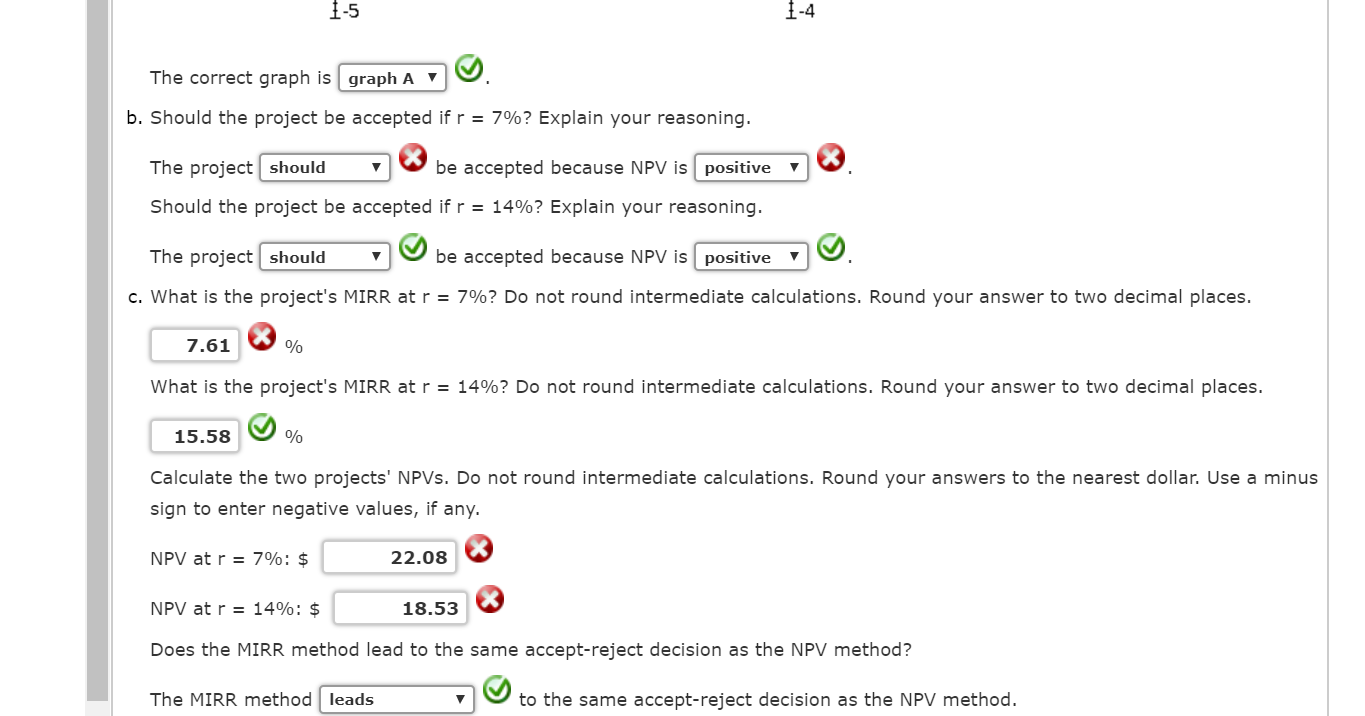

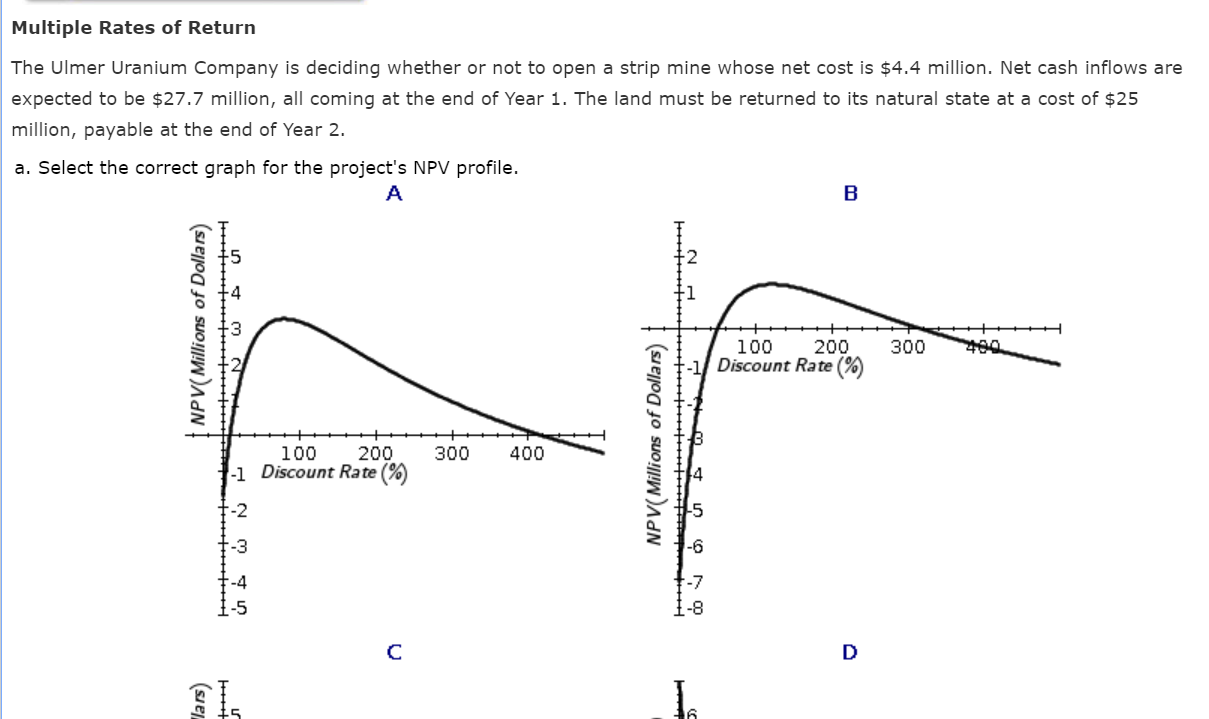

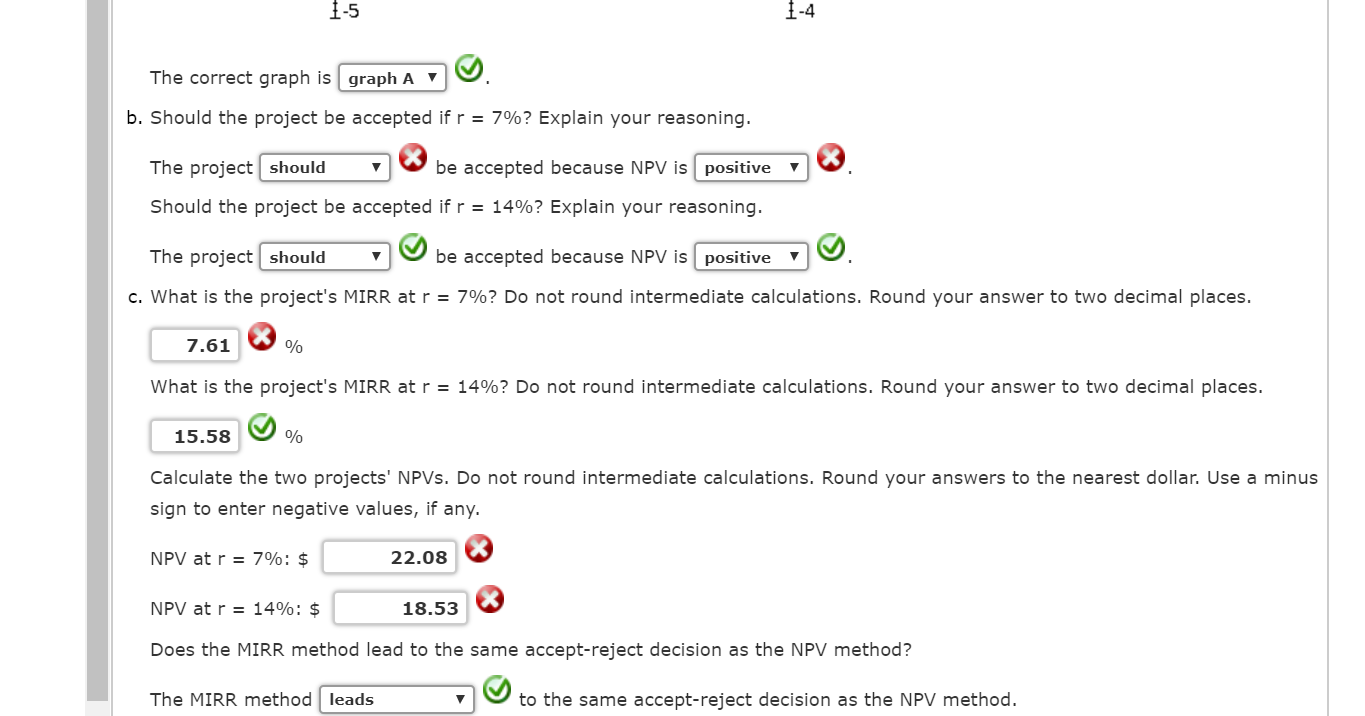

Multiple Rates of Return The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2. a. Select the correct graph for the project's NPV profile. A B 1 | NPV Millions of Dollars) 300 100 200 Discount Rate(%) NPV Millions of Dollars) 300 400 100 200 -1 Discount Rate(%) +-2 1-3 do o D lars) 6 1-5 1-4 The correct graph is graph A V b. Should the project be accepted if r = 7%? Explain your reasoning. The project should be accepted because NPV is positive Should the project be accepted if r = 14%? Explain your reasoning. The project should be accepted because NPV is positive c. What is the project's MIRR at r = 7%? Do not round intermediate calculations. Round your answer to two decimal places. 7.61 % What is the project's MIRR at r = 14%? Do not round intermediate calculations. Round your answer to two decimal places. 15.58 % Calculate the two projects' NPVs. Do not round intermediate calculations. Round your answers to the nearest dollar. Use a minus sign to enter negative values, if any. NPV at r = 7%: $ 22.08 NPV at r = 14%: $ 18.53 Does the MIRR method lead to the same accept-reject decision as the NPV method? The MIRR method leads to the same accept-reject decision as the NPV method. Multiple Rates of Return The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2. a. Select the correct graph for the project's NPV profile. A B 1 | NPV Millions of Dollars) 300 100 200 Discount Rate(%) NPV Millions of Dollars) 300 400 100 200 -1 Discount Rate(%) +-2 1-3 do o D lars) 6 1-5 1-4 The correct graph is graph A V b. Should the project be accepted if r = 7%? Explain your reasoning. The project should be accepted because NPV is positive Should the project be accepted if r = 14%? Explain your reasoning. The project should be accepted because NPV is positive c. What is the project's MIRR at r = 7%? Do not round intermediate calculations. Round your answer to two decimal places. 7.61 % What is the project's MIRR at r = 14%? Do not round intermediate calculations. Round your answer to two decimal places. 15.58 % Calculate the two projects' NPVs. Do not round intermediate calculations. Round your answers to the nearest dollar. Use a minus sign to enter negative values, if any. NPV at r = 7%: $ 22.08 NPV at r = 14%: $ 18.53 Does the MIRR method lead to the same accept-reject decision as the NPV method? The MIRR method leads to the same accept-reject decision as the NPV method