Answered step by step

Verified Expert Solution

Question

1 Approved Answer

multiple screenshots of the same question to help guide you to the possible answers. please explain Cash management is a very important function of managers.

multiple screenshots of the same question to help guide you to the possible answers. please explain

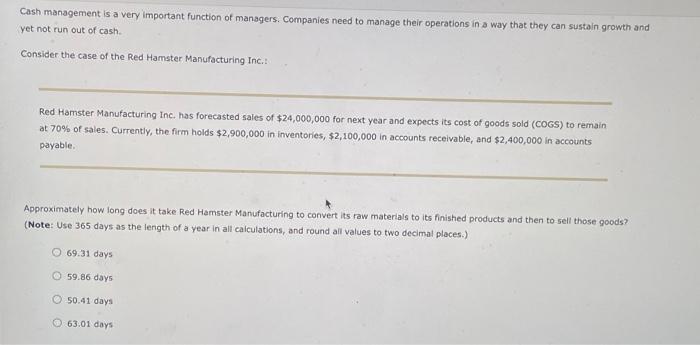

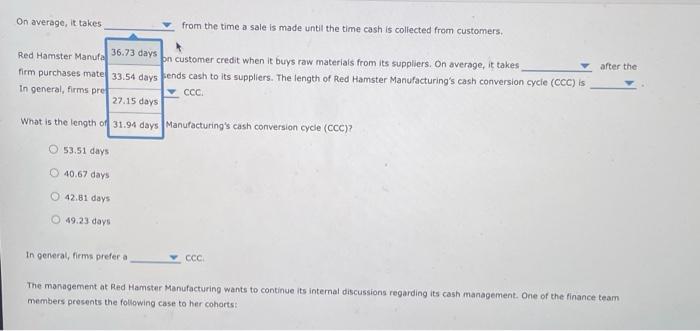

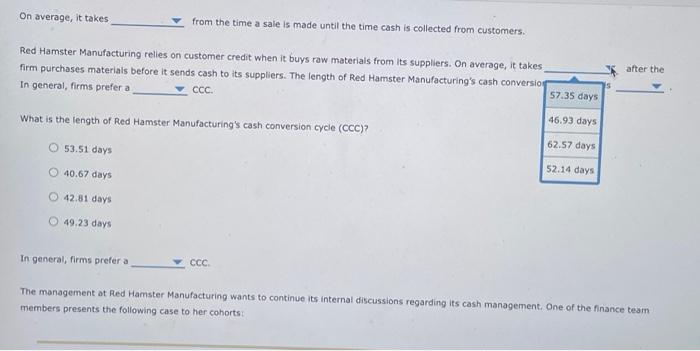

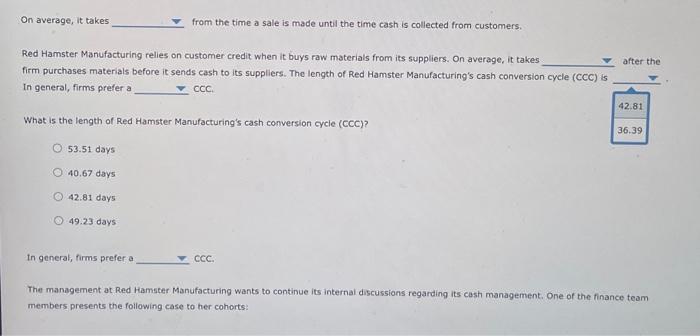

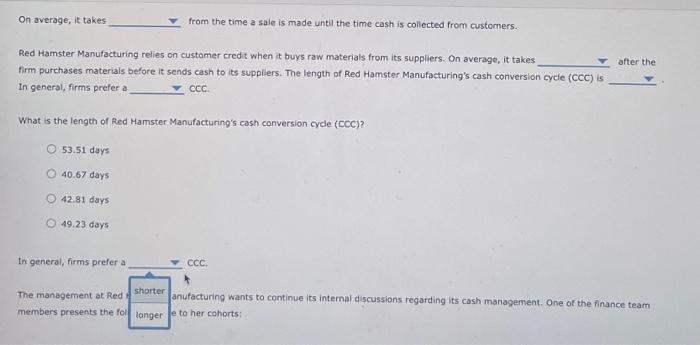

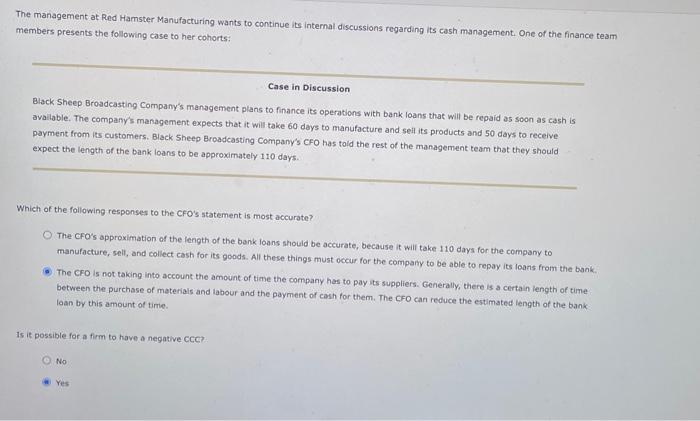

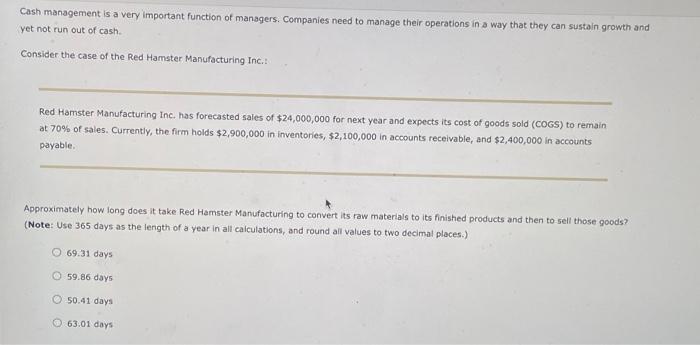

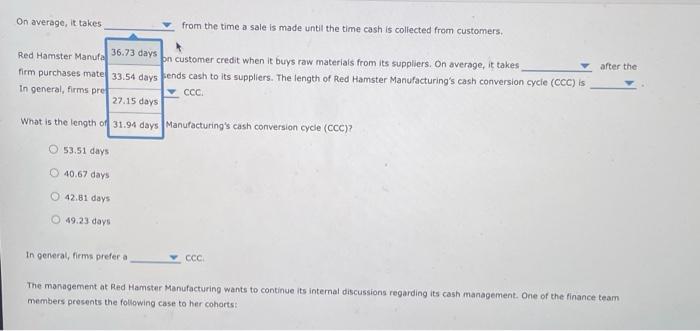

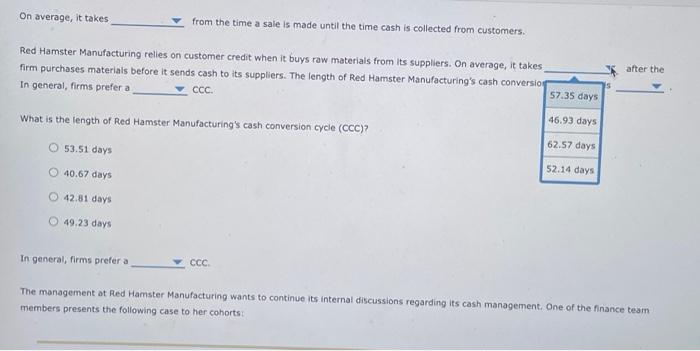

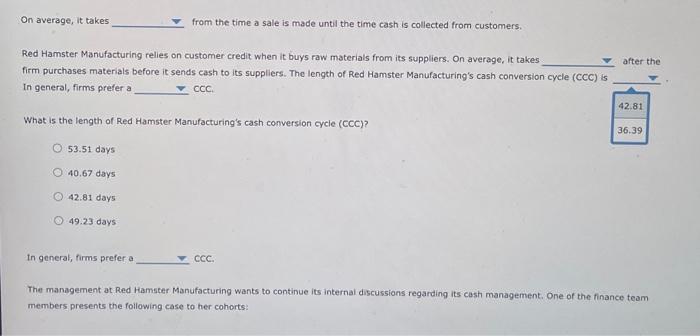

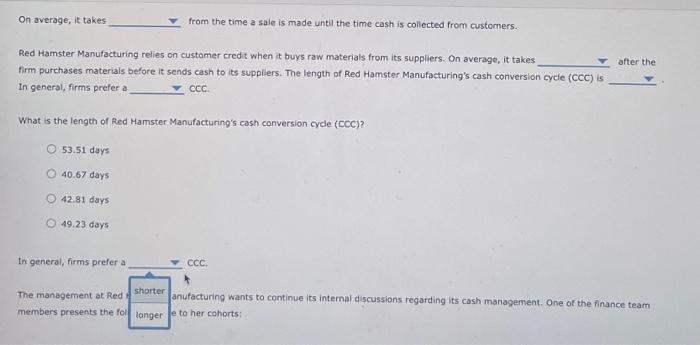

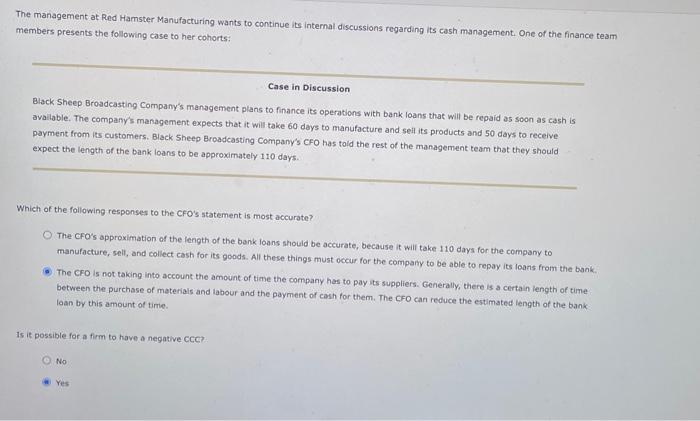

Cash management is a very important function of managers. Companies need to manage their operations in a way that they can sustain growth and yet not run out of cash. Consider the case of the Red Hamster Manufacturing Inc.: Red Hamster Manufacturing Inc. has forecasted sales of $24,000,000 for next year and expects its cost of goods sold (COGS) to remain at 70% of sales. Currently, the firm holds $2,900,000 in inventories, $2,100,000 in accounts receivable, and $2,400,000 in accounts payable. Approximately how long does it take Red Hamster Manufacturing to convert its raw materials to its finished products and then to sell those goods? (Note: Use 365 days as the length of a year in all calculations, and round all values to two decimal places.) O69.31 days 59.86 days O 50.41 days O 63.01 days On average, it takes from the time a sale is made until the time cash is collected from customers. 36.73 days on customer credit when it buys raw materials from its suppliers. On average, it takes Red Hamster Manufa firm purchases mate 33.54 days sends cash to its suppliers. The length of Red Hamster Manufacturing's cash conversion cycle (CCC) is In general, firms pre CCC. 27.15 days What is the length of 31.94 days Manufacturing's cash conversion cycle (CCC)? O53.51 days O40.67 days 42.81 days O 49.23 days In general, firms prefer a cce The management at Red Hamster Manufacturing wants to continue its internal discussions regarding its cash management. One of the finance team members presents the following case to her cohorts: after the On average, it takes from the time a sale is made until the time cash is collected from customers. Red Hamster Manufacturing relies on customer credit when it buys raw materials from its suppliers. On average, it takes firm purchases materials before it sends cash to its suppliers. The length of Red Hamster Manufacturing's cash conversion In general, firms prefer a 57.35 days CCC. 46.93 days What is the length of Red Hamster Manufacturing's cash conversion cycle (CCC)? 62.57 days O53.51 days 52.14 days 40.67 days 42.81 days O49.23 days In general, firms prefer a CCC. The management at Red Hamster Manufacturing wants to continue its internal discussions regarding its cash management. One of the finance team members presents the following case to her cohorts: after the On average, it takes from the time a sale is made until the time cash is collected from customers. after the Red Hamster Manufacturing relies on customer credit when it buys raw materials from its suppliers. On average, it takes firm purchases materials before it sends cash to its suppliers. The length of Red Hamster Manufacturing's cash conversion cycle (CCC) is In general, firms prefer a CCC. 42.81 What is the length of Red Hamster Manufacturing's cash conversion cycle (CCC)? 36.39 53.51 days O40.67 days 42.81 days 49.23 days In general, firms prefer a CCC. The management at Red Hamster Manufacturing wants to continue its internal discussions regarding its cash management. One of the finance team members presents the following case to her cohorts: On average, it takes from the time a sale is made until the time cash is collected from customers. after the Red Hamster Manufacturing relies on customer credit when it buys raw materials from its suppliers. On average, it takes firm purchases materials before it sends cash to its suppliers. The length of Red Hamster Manufacturing's cash conversion cycle (CCC) is In general, firms prefer a CCC. What is the length of Red Hamster Manufacturing's cash conversion cycle (CCC)? O53.51 days O40.67 days O42.81 days O 49.23 days In general, firms prefer a CCC. shorter The management at Red anufacturing wants to continue its internal discussions regarding its cash management. One of the finance team members presents the foll longere to her cohorts: The management at Red Hamster Manufacturing wants to continue its internal discussions regarding its cash management. One of the finance team members presents the following case to her cohorts: Case in Discussion Black Sheep Broadcasting Company's management plans to finance its operations with bank loans that will be repaid as soon as cash is available. The company's management expects that it will take 60 days to manufacture and sell its products and 50 days to receive payment from its customers. Black Sheep Broadcasting Company's CFO has told the rest of the management team that they should expect the length of the bank loans to be approximately 110 days. Which of the following responses to the CFO's statement is most accurate? O The CFO's approximation of the length of the bank loans should be accurate, because it will take 110 days for the company to manufacture, sell, and collect cash for its goods. All these things must occur for the company to be able to repay its loans from the bank. The CFO is not taking into account the amount of time the company has to pay its suppliers. Generally, there is a certain length of time between the purchase of materials and labour and the payment of cash for them. The CFO can reduce the estimated length of the bank loan by this amount of time. Is it possible for a firm to have a negative CCC? No Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started