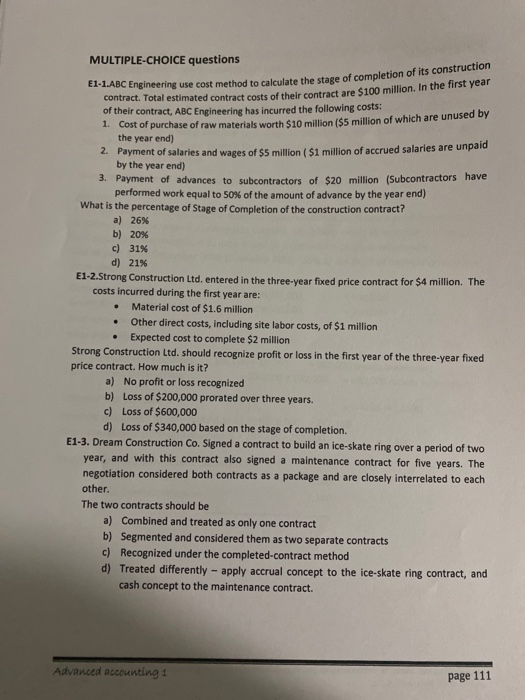

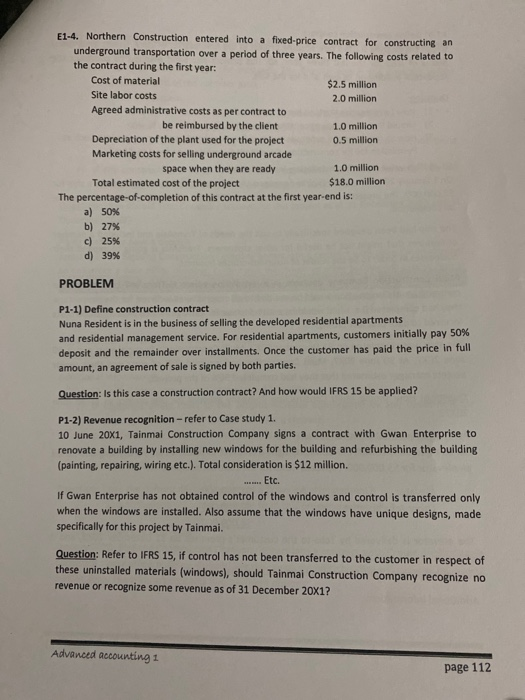

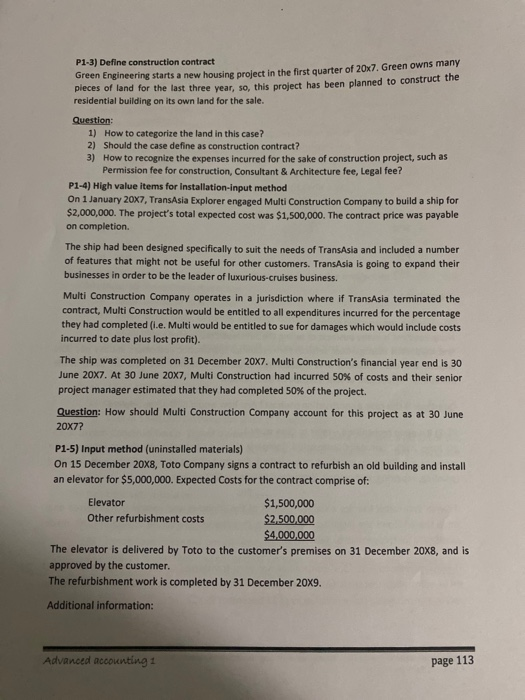

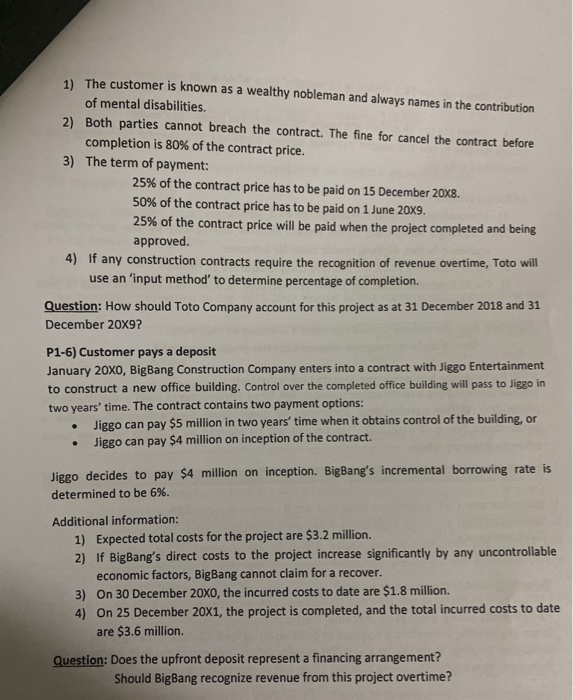

MULTIPLE-CHOICE questions E1-1.ABC Engineering use cost method to cart engineering use cost method to calculate the stage of completion of its construction act. Total estimated contract costs of their contract are $100 million. In the first year of their contract, ABC Engineering has incurred the following costs: Cost of purchase of raw materials worth $10 million ($5 million of which are unused by the year end) 2. Payment of salaries and wages of $5 million ($1 million of accrued salaries are unpaid by the year end) 3. Payment of advances to subcontractors of $20 million (Subcontractors have performed work equal to 50% of the amount of advance by the year end) What is the percentage of Stage of Completion of the construction contract? a) 26% b) 20% c) 31% d) 21% E1-2.Strong Construction Ltd. entered in the three-year fixed price contract for $4 million. The costs incurred during the first year are: Material cost of $1.6 million Other direct costs, including site labor costs, of $1 million Expected cost to complete $2 million Strong Construction Ltd. should recognize profit or loss in the first year of the three-year fixed price contract. How much is it? a) No profit or loss recognized b) Loss of $200,000 prorated over three years. c) Loss of $600,000 d) Loss of $340,000 based on the stage of completion. E1-3. Dream Construction Co. Signed a contract to build an ice-skate ring over a period of two year, and with this contract also signed a maintenance contract for five years. The negotiation considered both contracts as a package and are closely interrelated to each other. The two contracts should be a) Combined and treated as only one contract b) Segmented and considered them as two separate contracts c) Recognized under the completed-contract method d) Treated differently - apply accrual concept to the ice-skate ring contract, and cash concept to the maintenance contract. Advanced accounting 1 page 111 E1-4. Northern Construction entered into a fixed-price contract for constructing an underground transportation over a period of three years. The following costs related to the contract during the first year: Cost of material $2.5 million Site labor costs 2.0 million Agreed administrative costs as per contract to be reimbursed by the client 1.0 million Depreciation of the plant used for the project 0.5 million Marketing costs for selling underground arcade space when they are ready 1.0 million Total estimated cost of the project $18.0 million The percentage-of-completion of this contract at the first year-end is: a) 50% b) 27% c) 25% d) 39% PROBLEM P1-1) Define construction contract Nuna Resident is in the business of selling the developed residential apartments and residential management service. For residential apartments, customers initially pay 50% deposit and the remainder over installments. Once the customer has paid the price in full amount, an agreement of sale is signed by both parties. Question: Is this case a construction contract? And how would IFRS 15 be applied? P1-2) Revenue recognition-refer to Case study 1. 10 June 20X1. Tainmal Construction Company signs a contract with Gwan Enterprise to renovate a building by installing new windows for the building and refurbishing the building (painting, repairing, wiring etc.). Total consideration is $12 million. ... Etc. If Gwan Enterprise has not obtained control of the windows and control is transferred only when the windows are installed. Also assume that the windows have unique designs, made specifically for this project by Tainmai. Question: Refer to IFRS 15, if control has not been transferred to the customer in respect of these uninstalled materials (windows), should Tainmal Construction Company recognize no revenue or recognize some revenue as of 31 December 20X1? Advanced accounting 1 page 112 P1-3) Define construction contract Green Engineering starts a new housing project in the first quarter of 20x7. Green owns many pieces of land for the last three year, so, this project has been planned to construct the residential building on its own land for the sale. Question: 1) How to categorize the land in this case? 2) Should the case define as construction contract? 3) How to recognize the expenses incurred for the sake of construction project, such as Permission fee for construction, Consultant & Architecture fee, Legal fee? P1-4) High value items for installation-input method On 1 January 20X7, TransAsia Explorer engaged Multi Construction Company to build a ship for $2,000,000. The project's total expected cost was $1,500,000. The contract price was payable on completion The ship had been designed specifically to suit the needs of TransAsia and included a number of features that might not be useful for other customers. TransAsia is going to expand their businesses in order to be the leader of luxurious-cruises business. Multi Construction Company operates in a jurisdiction where if TransAsia terminated the contract, Multi Construction would be entitled to all expenditures incurred for the percentage they had completed (ie. Multi would be entitled to sue for damages which would include costs incurred to date plus lost profit). The ship was completed on 31 December 20X7. Multi Construction's financial year end is 30 June 20x7. At 30 June 20x7, Multi Construction had incurred 50% of costs and their senior project manager estimated that they had completed 50% of the project. Question: How should Multi Construction Company account for this project as at 30 June 20X7? P1-5) Input method (uninstalled materials) On 15 December 20x8, Toto Company signs a contract to refurbish an old building and install an elevator for $5,000,000. Expected Costs for the contract comprise of: $1,500,000 Other refurbishment costs $2,500,000 $4,000,000 The elevator is delivered by Toto to the customer's premises on 31 December 20x8, and is approved by the customer. The refurbishment work is completed by 31 December 20X9. Elevator Additional information: Advanced accounting 1 page 113 1) The customer is known as a wealthy nobleman and always names in the contribution of mental disabilities. 2) Both parties cannot breach the contract. The fine for cancel the contract before completion is 80% of the contract price. 3) The term of payment: 25% of the contract price has to be paid on 15 December 20X8. 50% of the contract price has to be paid on 1 June 20X9. 25% of the contract price will be paid when the project completed and being approved. 4) If any construction contracts require the recognition of revenue overtime, Toto will use an 'input method' to determine percentage of completion. Question: How should Toto Company account for this project as at 31 December 2018 and 31 December 20X9? P1-6) Customer pays a deposit January 20x0, BigBang Construction Company enters into a contract with Jiggo Entertainment to construct a new office building. Control over the completed office building will pass to Jiggo in two years' time. The contract contains two payment options: Jiggo can pay $5 million in two years' time when it obtains control of the building, or Jiggo can pay $4 million on inception of the contract. Jiggo decides to pay $4 million on inception. BigBang's incremental borrowing rate is determined to be 6%. Additional information: 1) Expected total costs for the project are $3.2 million. 2) If BigBang's direct costs to the project increase significantly by any uncontrollable economic factors, BigBang cannot claim for a recover. 3) On 30 December 20x0, the incurred costs to date are $1.8 million. 4) On 25 December 20X1, the project is completed, and the total incurred costs to date are $3.6 million. Question: Does the upfront deposit represent a financing arrangement? Should BigBang recognize revenue from this project overtime