Answered step by step

Verified Expert Solution

Question

1 Approved Answer

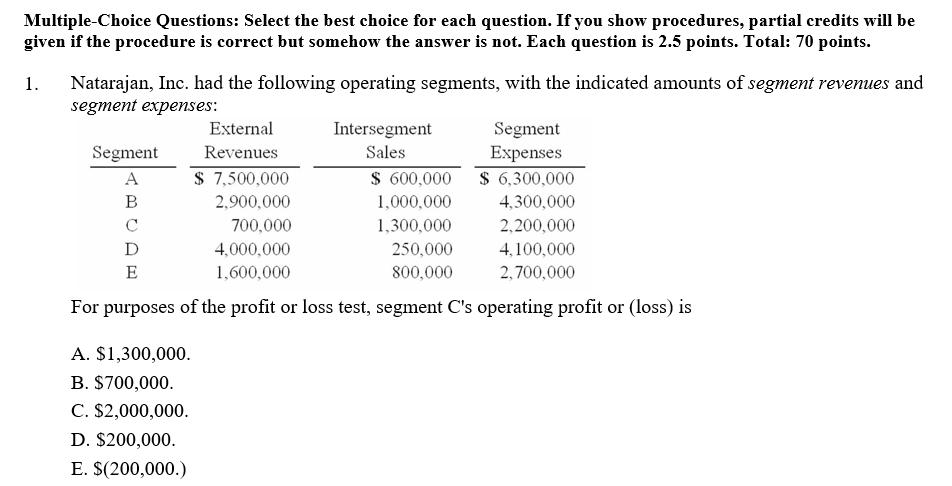

Multiple-Choice Questions: Select the best choice for each question. If you show procedures, partial credits will be given if the procedure is correct but

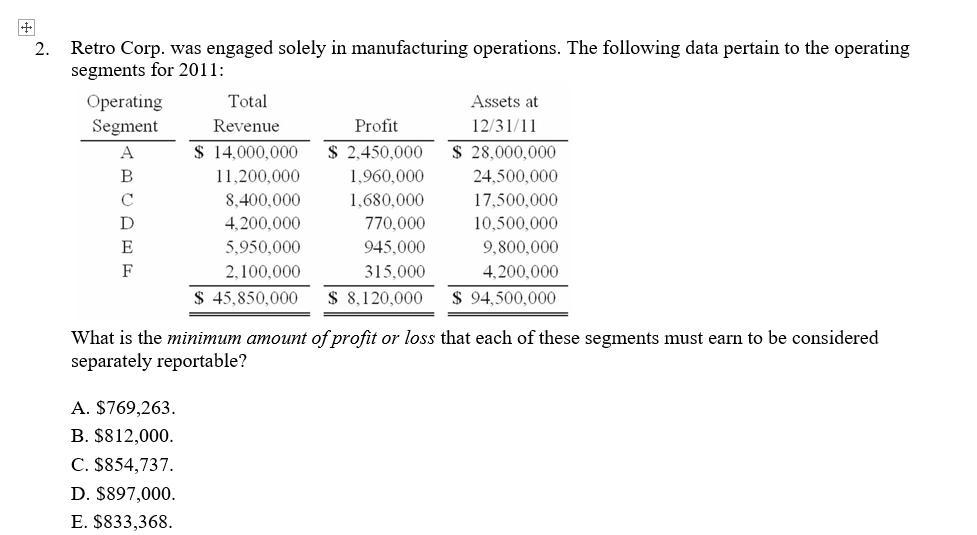

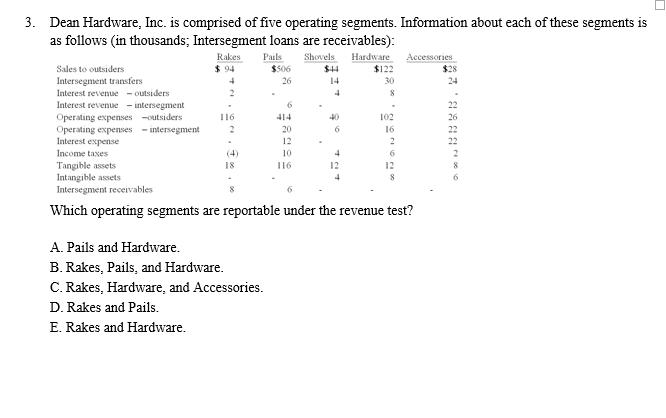

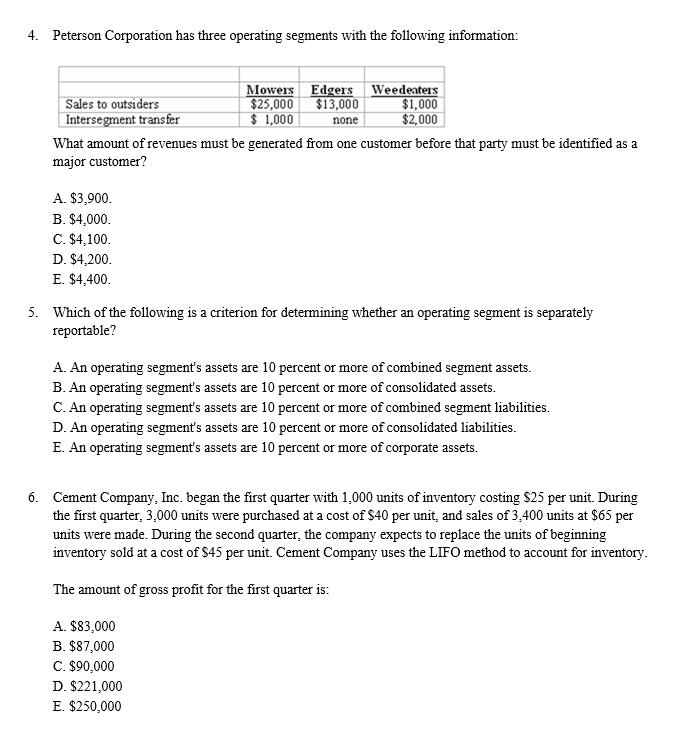

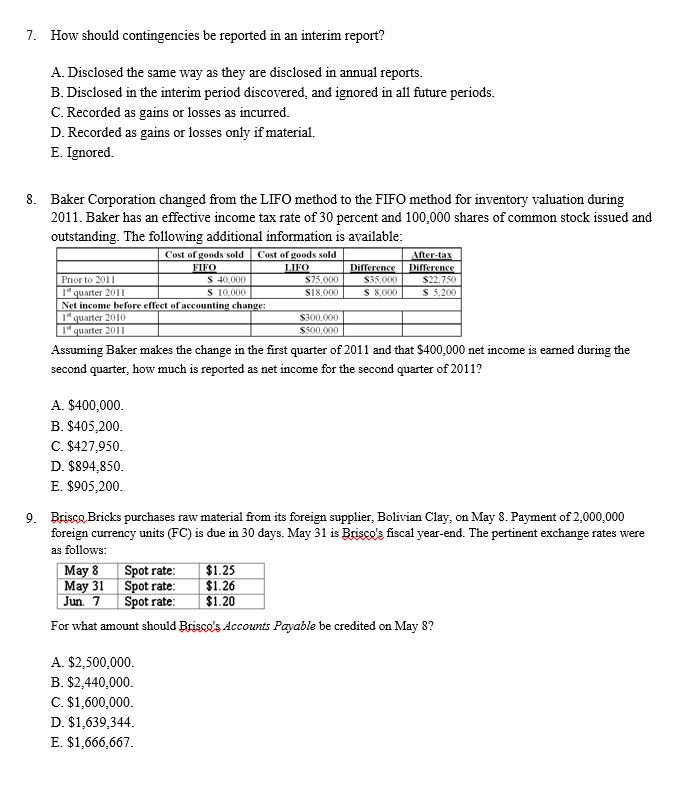

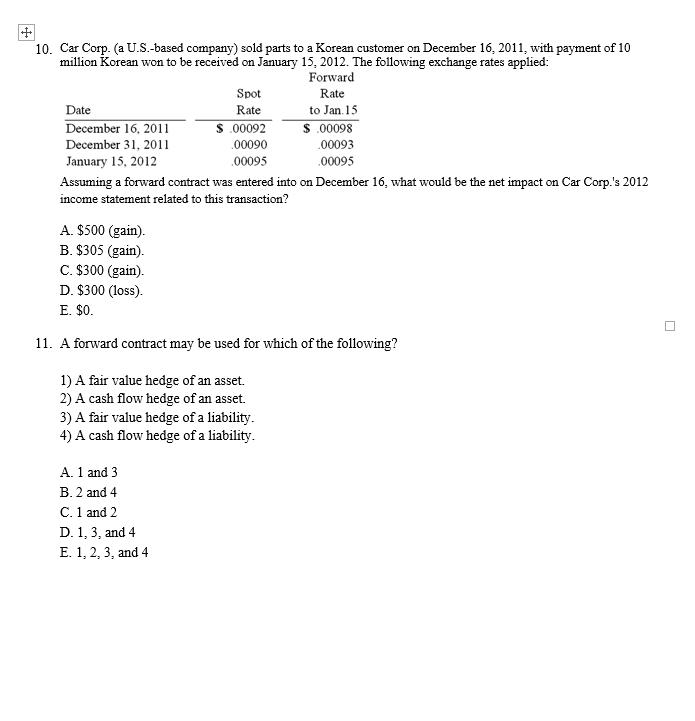

Multiple-Choice Questions: Select the best choice for each question. If you show procedures, partial credits will be given if the procedure is correct but somehow the answer is not. Each question is 2.5 points. Total: 70 points. 1. Natarajan, Inc. had the following operating segments, with the indicated amounts of segment revenues and segment expenses: Segment A B C D E External Revenues A. $1,300,000. B. $700,000. C. $2,000,000. D. $200,000. E. $(200,000.) Intersegment Sales $ 7,500,000 2,900,000 700,000 4,000,000 1,600,000 For purposes of the profit or loss test, segment C's operating profit or (loss) is $ 600,000 1,000,000 1,300,000 250,000 800,000 Segment Expenses $ 6,300,000 4,300,000 2,200,000 4,100,000 2,700,000 Retro Corp. was engaged solely in manufacturing operations. The following data pertain to the operating segments for 2011: Operating Segment A B C D E F Total Revenue A. $769,263. B. $812,000. C. $854,737. D. $897,000. E. $833,368. Profit $2,450,000 1,960,000 1,680,000 770,000 945,000 315,000 $ 45,850,000 $ 8,120,000 $ 14,000,000 11,200,000 8,400,000 4,200,000 5,950,000 2,100,000 Assets at 12/31/11 $ 28,000,000 24,500,000 17,500,000 10,500,000 9,800,000 4,200,000 $ 94,500,000 What is the minimum amount of profit or loss that each of these segments must earn to be considered separately reportable? 3. Dean Hardware, Inc. is comprised of five operating segments. Information about each of these segments is as follows (in thousands; Intersegment loans are receivables): Rakes Shovels Hardware Accessories $94 Sales to outsiders Intersegment transfers Interest revenue - outsiders Interest revenue - intersegment Operating expenses outsiders Operating expenses - intersegment Interest expense Income taxes 4 2 116 2 (4) 18 Pails $506 26 A. Pails and Hardware. B. Rakes, Pails, and Hardware. C. Rakes, Hardware, and Accessories. D. Rakes and Pails. E. Rakes and Hardware. 6 20 12 10 116 $44 14 4 6 $122 30 8 102 16 2 6 12 Tangible assets Intangible assets Intersegment receivables Which operating segments are reportable under the revenue test? $28 28210 4. Peterson Corporation has three operating segments with the following information: Sales to outsiders Intersegment transfer A. $3,900. B. $4,000. C. $4,100. D. $4,200. E. $4,400. Mowers Edgers Weedeaters $13,000 $25,000 $1,000 none What amount of revenues must be generated from one customer before that party must be identified as a major customer? $1,000 $2,000 5. Which of the following is a criterion for determining whether an operating segment is separately reportable? A. An operating segment's assets are 10 percent or more of combined segment assets. B. An operating segment's assets are 10 percent or more of consolidated assets. C. An operating segment's assets are 10 percent or more of combined segment liabilities. D. An operating segment's assets are 10 percent or more of consolidated liabilities. E. An operating segment's assets are 10 percent or more of corporate assets. D. $221,000 E. $250,000 6. Cement Company, Inc. began the first quarter with 1,000 units of inventory costing $25 per unit. During the first quarter, 3,000 units were purchased at a cost of $40 per unit, and sales of 3,400 units at $65 per units were made. During the second quarter, the company expects to replace the units of beginning inventory sold at a cost of $45 per unit. Cement Company uses the LIFO method to account for inventory. The amount of gross profit for the first quarter is: A. $83,000 B. $87,000 C. $90,000 7. How should contingencies be reported in an interim report? A. Disclosed the same way as they are disclosed in annual reports. B. Disclosed in the interim period discovered, and ignored in all future periods. C. Recorded as gains or losses as incurred. D. Recorded as gains or losses only if material. E. Ignored. 8. Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available: Prior to 2011 1 quarter 2011 $ 40,000 S 10,000 Net income before effect of accounting change: 1 quarter 2010 1 quarter 2011 A. $400,000. B. $405,200. C. $427,950. D. $894,850. E. $905,200. Cost of goods sold Cost of goods sold FIFO LIFO May 8 May 31 Jun. 7 $75,000 $18,000 Assuming Baker makes the change in the first quarter of 2011 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2011? A. $2,500,000. B. $2,440,000. C. $1,600,000. D. $1,639,344. E. $1,666,667. $300,000 $500,000 Difference $35,000 $ 8.000 9. Brisco Bricks purchases raw material from its foreign supplier, Bolivian Clay, on May 8. Payment of 2,000,000 foreign currency units (FC) is due in 30 days. May 31 is Brisco's fiscal year-end. The pertinent exchange rates were as follows: $1.25 $1.26 $1.20 After-tax Difference $22,750 $ 5,200 Spot rate: Spot rate: Spot rate: For what amount should Brisco's Accounts Payable be credited on May 8? + 10. Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2011, with payment of 10 million Korean won to be received on January 15, 2012. The following exchange rates applied: Forward Date December 16, 2011 December 31, 2011 January 15, 2012 Spot Rate $.00092 00090 00095 A. 1 and 3 B. 2 and 4 C. 1 and 2 D. 1, 3, and 4 E. 1, 2, 3, and 4 Rate to Jan. 15 Assuming a forward contract was entered into on December 16, what would be the net impact on Car Corp.'s 2012 income statement related to this transaction? 3) A fair value hedge of a liability. 4) A cash flow hedge of a liability. $.00098 00093 00095 A. $500 (gain). B. $305 (gain). C. $300 (gain). D. $300 (loss). E. $0. 11. A forward contract may be used for which of the following? 1) A fair value hedge of an asset. 2) A cash flow hedge of an asset. 7

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question Q1 Segment Cs operating profit or loss External Revenues Intersegment Sales Segment Expenses 700000 1300000 2200000 200000 hence option D is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started