Answered step by step

Verified Expert Solution

Question

1 Approved Answer

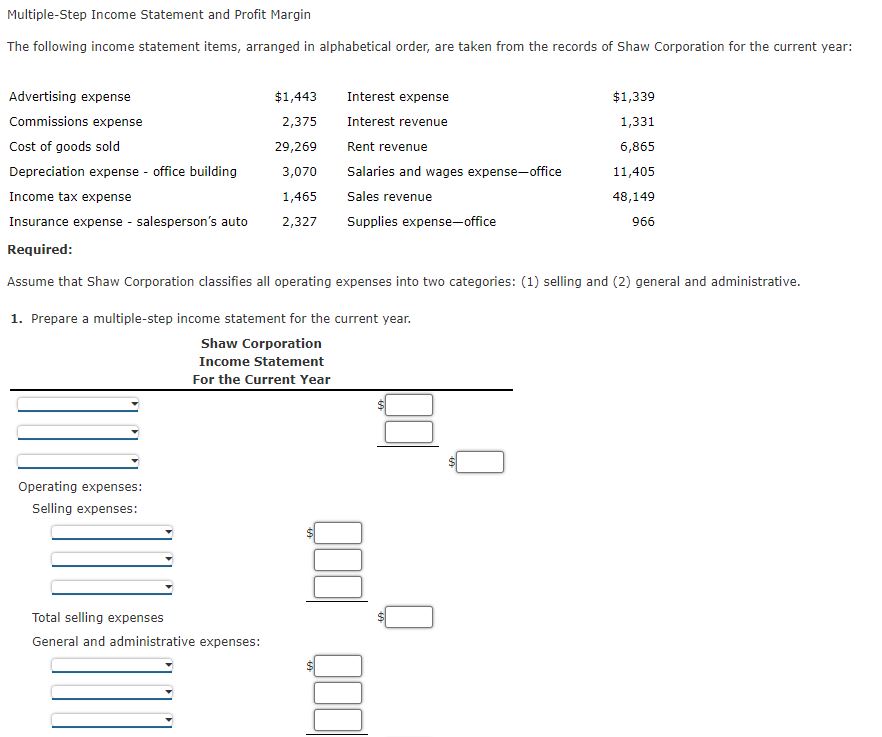

Multiple-Step Income Statement and Profit Margin The following income statement items, arranged in alphabetical order, are taken from the records of Shaw Corporation for

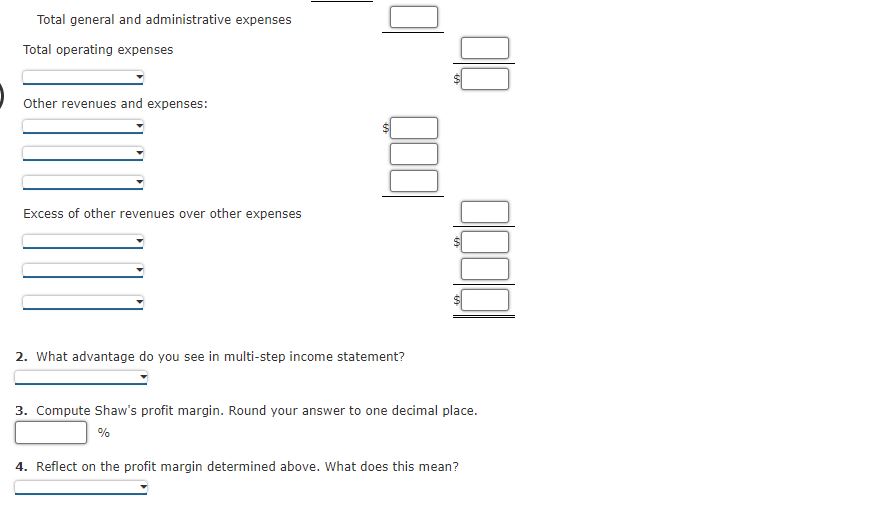

Multiple-Step Income Statement and Profit Margin The following income statement items, arranged in alphabetical order, are taken from the records of Shaw Corporation for the current year: Advertising expense $1,443 Interest expense $1,339 Commissions expense 2,375 Interest revenue 1,331 Cost of goods sold 29,269 Rent revenue 6,865 Depreciation expense - office building 3,070 Salaries and wages expense-office 11,405 Income tax expense 1,465 Sales revenue 48,149 Insurance expense salesperson's auto Required: 2,327 Supplies expense-office 966 Assume that Shaw Corporation classifies all operating expenses into two categories: (1) selling and (2) general and administrative. 1. Prepare a multiple-step income statement for the current year. Shaw Corporation Income Statement For the Current Year Operating expenses: Selling expenses: Total selling expenses General and administrative expenses: Total general and administrative expenses Total operating expenses Other revenues and expenses: Excess of other revenues over other expenses 2. What advantage do you see in multi-step income statement? 3. Compute Shaw's profit margin. Round your answer to one decimal place. % 4. Reflect on the profit margin determined above. What does this mean?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The multistep income statement is given below Shaw Corporation Income Statement For the Current Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started