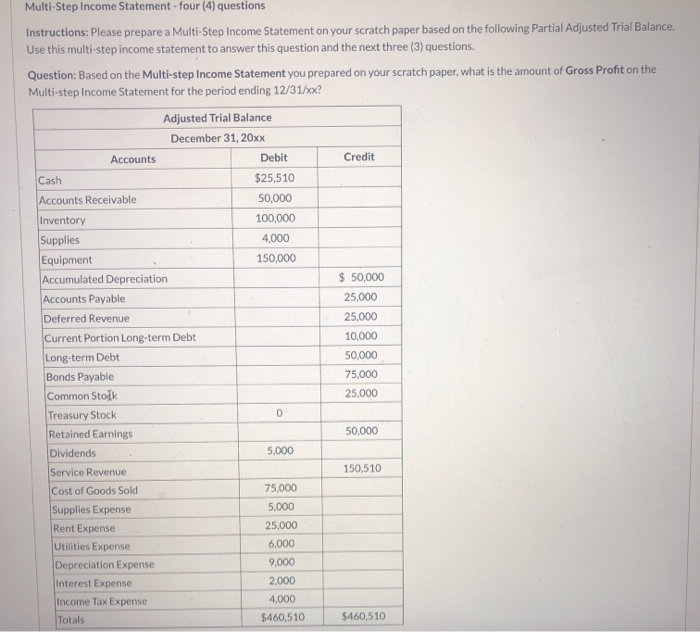

Multi-Step Income Statement-four (4) questions Instructions: Please prepare a Multi-Step Income Statement on your scratch paper based on the following Partial Adjusted Trial Balance. Use this multi-step income statement to answer this question and the next three (3) questions. Question: Based on the Multi-step Income Statement you prepared on your scratch paper, what is the amount of Gross Profit on the Multi-step Income Statement for the period ending 12/31/xx? Adjusted Trial Balance December 31, 20xx Debit Accounts Credit $25,510 50,000 100,000 4,000 150,000 $ 50,000 25,000 25,000 10,000 50,000 75,000 25.000 Cash Accounts Receivable Inventory Supplies Equipment Accumulated Depreciation Accounts Payable Deferred Revenue Current Portion Long-term Debt Long-term Debt Bonds Payable Common Stock Treasury Stock Retained Earnings Dividends Service Revenue Cost of Goods Sold Supplies Expense Rent Expense Utilities Expense Depreciation Expense Interest Expense Income Tax Expense Totals 50,000 5,000 150,510 75,000 5.000 25,000 6,000 9,000 2.000 4,000 $460,510 $460,510 Cash $25,510 50,000 100,000 4,000 150,000 $ 50,000 25,000 25,000 10,000 50,000 75,000 25,000 Accounts Receivable Inventory Supplies Equipment Accumulated Depreciation Accounts Payable Deferred Revenue Current Portion Long-term Debt Long-term Debt Bonds Payable Common Stock Treasury Stock Retained Earnings Dividends Service Revenue Cost of Goods Sold Supplies Expense Rent Expense Utilities Expense Depreciation Expense Interest Expense Income Tax Expense Totals 50,000 5,000 150,510 75,000 5,000 25,000 6.000 9,000 2,000 4,000 $460,510 $460,510 Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. For example, if you calculated the answer to be $24,123 you would only input: 24123 Webcourses will add commas to your answer. Multi-Step Income Statement Question: Based on the Multi-step Income Statement you prepared on your scratch paper, what is the amount of "Operating Income" on the Multi-step Income Statement for the period ending 12/31/xx? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. For example, if you calculated the answer to be $24,123 you would only input: 24123 Webcourses will add commas to your answer. Multi-Step Income Statement Question: Based on the Multi-step Income Statement you prepared on your scratch paper, what is the amount of "Net Income Before Taxes" on the Multi-step Income Statement for the period ending 12/31/xx? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc, just enter the raw number. For example, if you calculated the answer to be $24,123 you would only input: 24123 Webcourses will add commas to your answer. Multi-Step Income Statement Question: Based on the Multi-step Income Statement you prepared on your scratch paper, what is the amount of "Net Income After-Taxes" on the Multi-step Income Statement for the period ending 12/31/xx? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. For example, if you calculated the answer to be $24,123 you would only input: 24123 Webcourses will add commas to your