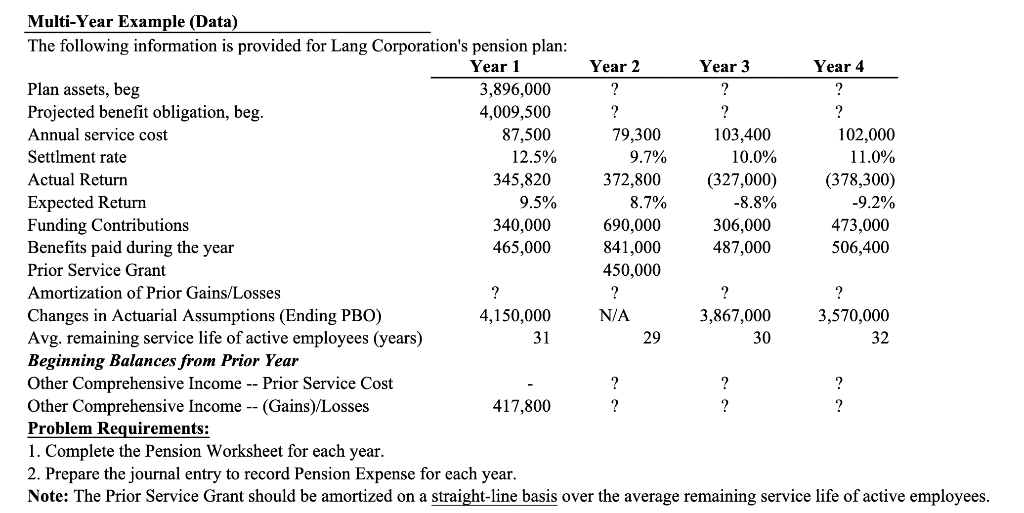

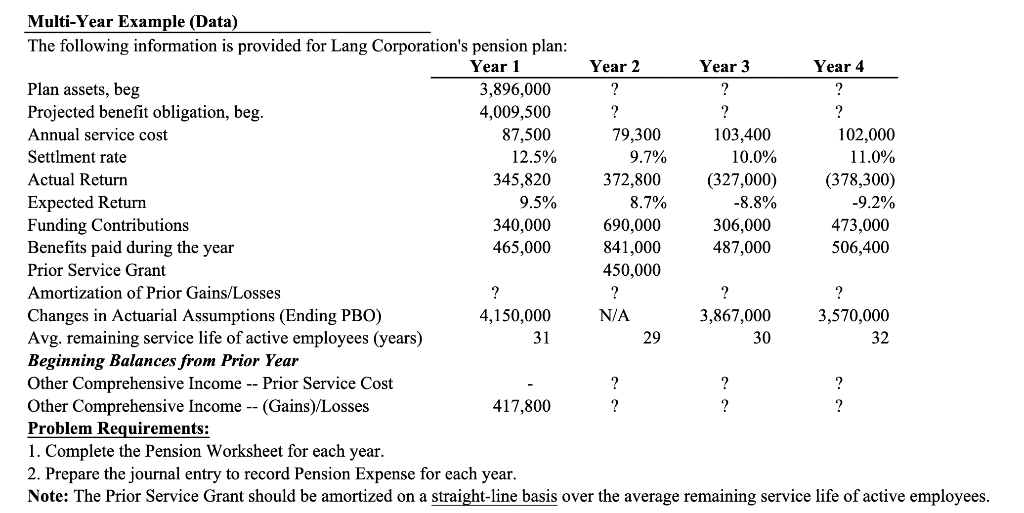

Multi-Year Example (Data) The following information is provided for Lang Corporation's pension plan: Year 1 Year 2 Year 3 Year 4 Plan assets, beg 3,896,000 Projected benefit obligation, beg. 4,009,500 Annual service cost 87,500 79.300 103,400 102,000 Settlment rate 12.5% 9.7% 10.0% 11.0% Actual Return 345,820 372,800 (327,000) (378,300) Expected Return 9.5% 8.7% -8.8% -9.2% Funding Contributions 340,000 690,000 306,000 473,000 Benefits paid during the year 465,000 841,000 487,000 506,400 Prior Service Grant 450,000 Amortization of Prior Gains/Losses Changes in Actuarial Assumptions (Ending PBO) 4,150,000 N/A 3,867,000 3,570,000 Avg. remaining service life of active employees (years) 29 30 Beginning Balances from Prior Year Other Comprehensive Income -- Prior Service Cost Other Comprehensive Income -- (Gains)/Losses 417,800 Problem Requirements: 1. Complete the Pension Worksheet for each year. 2. Prepare the journal entry to record Pension Expense for each year. Note: The Prior Service Grant should be amortized on a straight-line basis over the average remaining service life of active employees. 31 32 Multi-Year Example (Data) The following information is provided for Lang Corporation's pension plan: Year 1 Year 2 Year 3 Year 4 Plan assets, beg 3,896,000 Projected benefit obligation, beg. 4,009,500 Annual service cost 87,500 79.300 103,400 102,000 Settlment rate 12.5% 9.7% 10.0% 11.0% Actual Return 345,820 372,800 (327,000) (378,300) Expected Return 9.5% 8.7% -8.8% -9.2% Funding Contributions 340,000 690,000 306,000 473,000 Benefits paid during the year 465,000 841,000 487,000 506,400 Prior Service Grant 450,000 Amortization of Prior Gains/Losses Changes in Actuarial Assumptions (Ending PBO) 4,150,000 N/A 3,867,000 3,570,000 Avg. remaining service life of active employees (years) 29 30 Beginning Balances from Prior Year Other Comprehensive Income -- Prior Service Cost Other Comprehensive Income -- (Gains)/Losses 417,800 Problem Requirements: 1. Complete the Pension Worksheet for each year. 2. Prepare the journal entry to record Pension Expense for each year. Note: The Prior Service Grant should be amortized on a straight-line basis over the average remaining service life of active employees. 31 32