Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Munana Ltd is a a copany dealing with textiles since June 30 2005 when it was incorporated. In June 30 2010,the company whose head

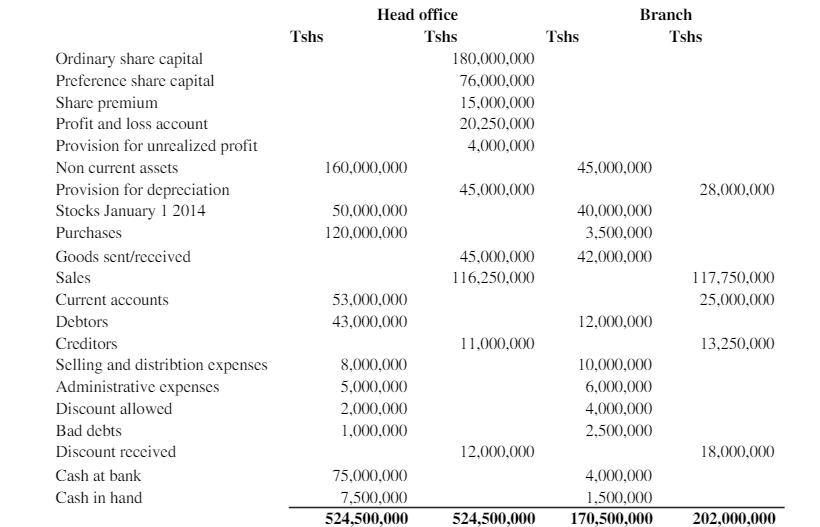

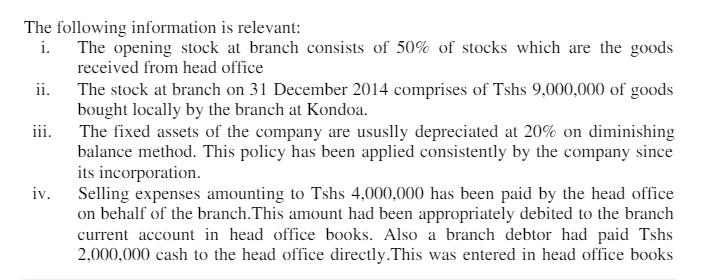

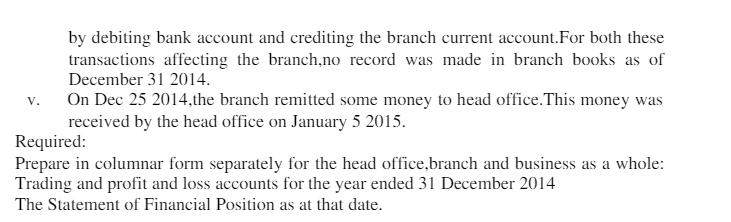

Munana Ltd is a a copany dealing with textiles since June 30 2005 when it was incorporated. In June 30 2010,the company whose head office is in Dar es salaam opened a branch in Kondoa. The company has a general policy of a uniform selling price to all goods at head office and branch at a markup of 50% on cost. The goods from head office to branch are invoiced at less 20% of the fixed selling price. The following is the trial balance for the year ended Dec 31 2014. Ordinary share capital Preference share capital Share premium Profit and loss account Provision for unrealized profit Non current assets Provision for depreciation Stocks January 1 2014 Purchases Goods sent/received Sales Current accounts Debtors Creditors Selling and distribtion expenses Administrative expenses Discount allowed Bad debts Discount received Cash at bank Cash in hand Tshs Head office Tshs 160,000,000 50,000,000 120,000,000 53,000,000 43,000,000 8,000,000 5,000,000 2,000,000 1,000,000 75,000,000 7,500,000 524,500,000 Tshs Branch 180,000,000 76,000,000 15,000,000 20,250,000 4,000,000 45,000,000 45,000,000 40,000,000 3,500,000 45,000,000 42,000,000 116,250,000 12,000,000 11,000,000 10,000,000 6,000,000 4,000,000 2,500,000 12,000,000 4,000,000 1,500,000 524,500,000 170,500,000 Tshs 28,000,000 117,750,000 25,000,000 13,250,000 18,000,000 202,000,000 The following information is relevant: i. The opening stock at branch consists of 50% of stocks which are the goods received from head office ii. The stock at branch on 31 December 2014 comprises of Tshs 9,000,000 of goods bought locally by the branch at Kondoa. iii. The fixed assets of the company are usually depreciated at 20% on diminishing balance method. This policy has been applied consistently by the company since its incorporation. iv. Selling expenses amounting to Tshs 4,000,000 has been paid by the head office on behalf of the branch. This amount had been appropriately debited to the branch current account in head office books. Also a branch debtor had paid Tshs 2,000,000 cash to the head office directly. This was entered in head office books by debiting bank account and crediting the branch current account.For both these transactions affecting the branch,no record was made in branch books as of December 31 2014. V. On Dec 25 2014, the branch remitted some money to head office. This money was received by the head office on January 5 2015. Required: Prepare in columnar form separately for the head office,branch and business as a whole: Trading and profit and loss accounts for the year ended 31 December 2014 The Statement of Financial Position as at that date.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Head Office Branch Trading and Profit and Loss accounts Trading and Profit and Loss accounts opening stock 50000000 sales 116250000 opening stock 40000000 sales 117750000 purchases 120000000 goods sen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started