Answered step by step

Verified Expert Solution

Question

1 Approved Answer

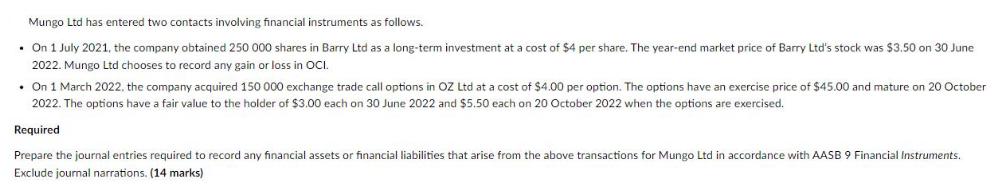

Mungo Ltd has entered two contacts involving financial instruments as follows. On 1 July 2021, the company obtained 250 000 shares in Barry Ltd

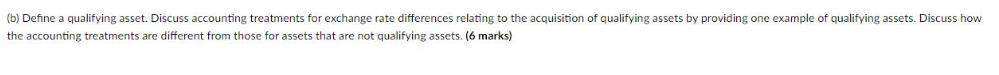

Mungo Ltd has entered two contacts involving financial instruments as follows. On 1 July 2021, the company obtained 250 000 shares in Barry Ltd as a long-term investment at a cost of $4 per share. The year-end market price of Barry Ltd's stock was $3.50 on 30 June 2022. Mungo Ltd chooses to record any gain or loss in OCI. On 1 March 2022, the company acquired 150 000 exchange trade call options in OZ Ltd at a cost of $4.00 per option. The options have an exercise price of $45.00 and mature on 20 October 2022. The options have a fair value to the holder of $3.00 each on 30 June 2022 and $5.50 each on 20 October 2022 when the options are exercised. Required Prepare the journal entries required to record any financial assets or financial liabilities that arise from the above transactions for Mungo Ltd in accordance with AASB 9 Financial Instruments. Exclude journal narrations. (14 marks) (b) Define a qualifying asset. Discuss accounting treatments for exchange rate differences relating to the acquisition of qualifying assets by providing one example of qualifying assets. Discuss how the accounting treatments are different from those for assets that are not qualifying assets. (6 marks)

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Sure here are the journal entries for Mungo Ltds financial instruments transactions in accordance with AASB 9 Financial Instruments 1 On 1 July 2021 D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started