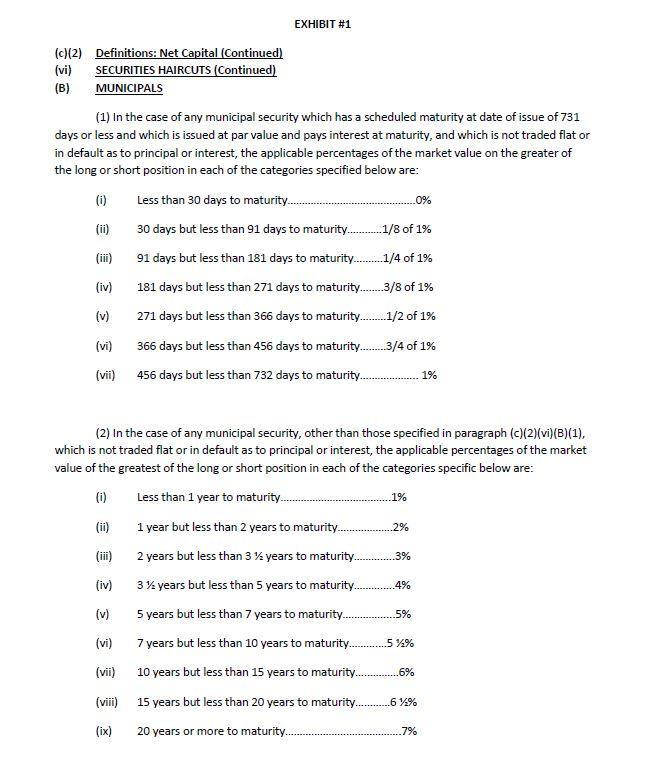

Bonds 1. Municipal Bonds - Municipal bonds are haircut per Exhibit 1 based on both their time to maturity and scheduled maturity at date of

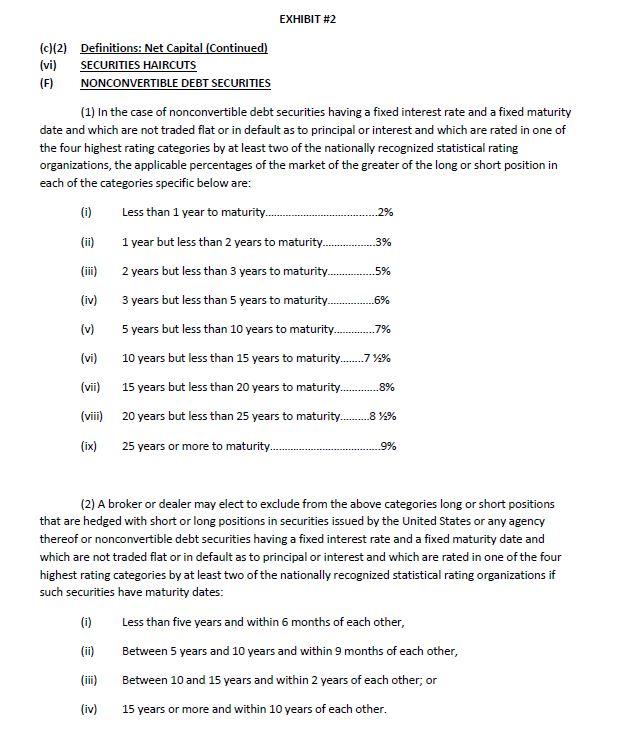

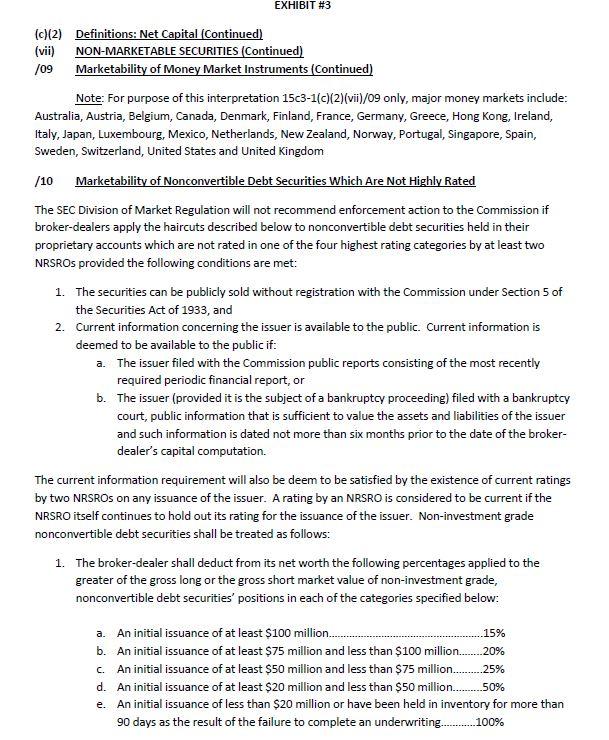

Bonds 1. Municipal Bonds - Municipal bonds are haircut per Exhibit 1 based on both their time to maturity and scheduled maturity at date of issue. 2. Corporate Bonds - Corporate bonds are haircut based on both their time to maturity and whether they are rated as investment grade (defined by S&P and Fitch as BBB- and above and by Moody's as Baa3 and above)1 by at least two of the nationally recognized statistical rating organizations. If the bonds qualify as investment grade, use Exhibit 2 to determine the haircut of the bonds. If they do not qualify as investment grade, then they are considered non-marketable and follow the haircut rules as stated in Exhibit 3. It is important to note that the haircut is calculated using the absolute value of the market value of the relevant bond. What is the total haircut in USD on the positions in the accompanying spreadsheet?

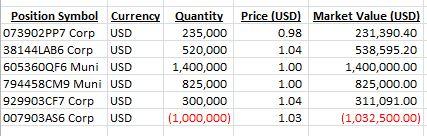

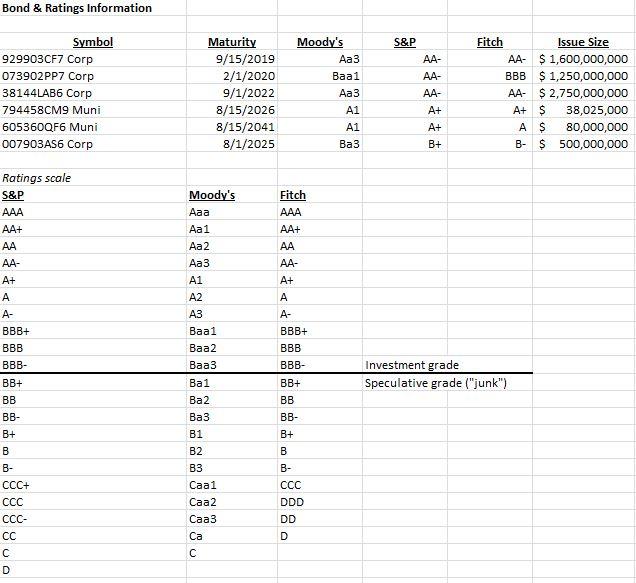

Position Symbol Currency Quantity Price (USD) Market Value (USD) 073902PP7 Corp USD 235,000 0.98 231,390.40 38144LAB6 Corp USD 520,000 1.04 538,595.20 605360QF6 Muni USD 1,400,000 1.00 1,400,000.00 794458CM9 Muni USD 825,000 1.00 825,000.00 929903CF7 Corp USD 300,000 1.04 311,091.00 007903AS6 Corp USD (1,000,000) 1.03 (1,032,500.00)

Step by Step Solution

3.28 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total haircut in USD on the positions we need to follow these steps Step 1 Determin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started