Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Munificent Co. Ltd. (Muni) operates a defined benefit pension plan that offers its employees an annual retirement income based on years of service and

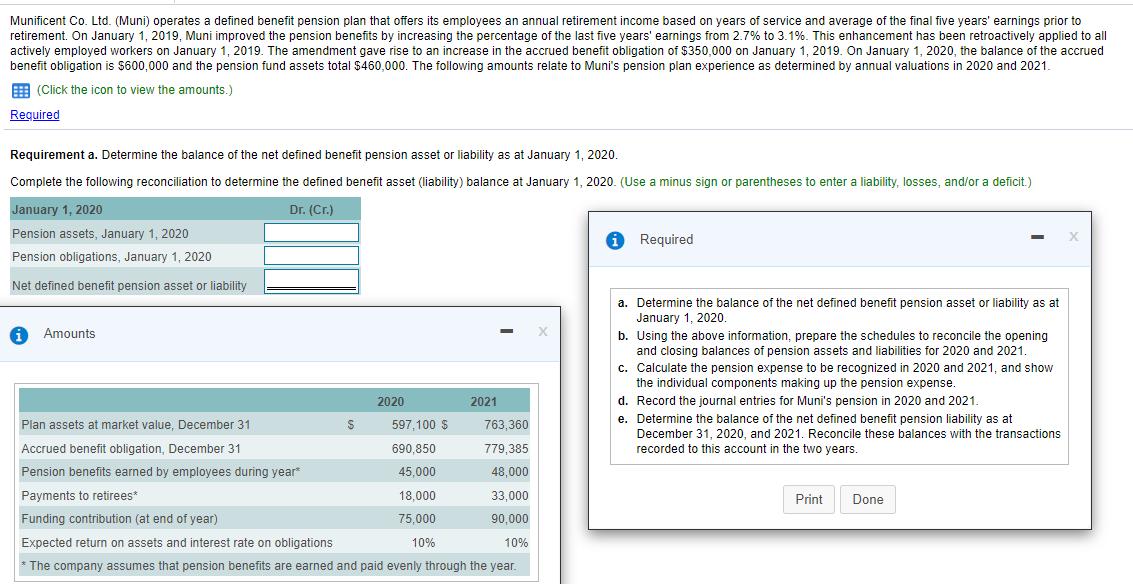

Munificent Co. Ltd. (Muni) operates a defined benefit pension plan that offers its employees an annual retirement income based on years of service and average of the final five years' earnings prior to retirement. On January 1, 2019, Muni improved the pension benefits by increasing the percentage of the last five years' earnings from 2.7% to 3.1%. This enhancement has been retroactively applied to all actively employed workers on January 1, 2019. The amendment gave rise to an increase in the accrued benefit obligation of $350,000 on January 1, 2019. On January 1, 2020, the balance of the accrued benefit obligation is $600,000 and the pension fund assets total $460,000. The following amounts relate to Muni's pension plan experience as determined by annual valuations in 2020 and 2021. E (Click the icon to view the amounts.) Required Requirement a. Determine the balance of the net defined benefit pension asset or liability as at January 1, 2020. Complete the following reconciliation to determine the defined benefit asset (liability) balance at January 1, 2020. (Use a minus sign or parentheses to enter a liability, losses, and/or a deficit.) January 1, 2020 Dr. (Cr.) Pension assets, January 1, 2020 1 Required Pension obligations, January 1, 2020 Net defined benefit pension asset or liability a. Determine the balance of the net defined benefit pension asset or liability as at January 1, 2020. 1 Amounts b. Using the above information, prepare the schedules to reconcile the opening and closing balances of pension assets and liabilities for 2020 and 2021. Cc. Calculate the pension expense to be recognized in 2020 and 2021, and show the individual components making up the pension expense. 2020 2021 d. Record the journal entries for Muni's pension in 2020 and 2021. e. Determine the balance of the net defined benefit pension liability as at December 31, 2020, and 2021. Reconcile these balances with the transactions recorded to this account in the two years. Plan assets at market value, December 31 597,100 $ 763,360 Accrued benefit obligation, December 31 690,850 779,385 Pension benefits earned by employees during year 45,000 48,000 Payments to retirees* 18,000 33,000 Print Done Funding contribution (at end of year) 75,000 90,000 Expected return on assets and interest rate on obligations 10% 10% * The company assumes that pension benefits are earned and paid evenly through the year.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 net benefit obligations at 1120 600000 460000 140000 2 statement of schedules of asset and liabili...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started