Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Munster Coffin Company was formed on January 1, 2019 by Herman, Lillie, and Vlad Munster. It builds coffins. Munster Coffin Company uses a calendar

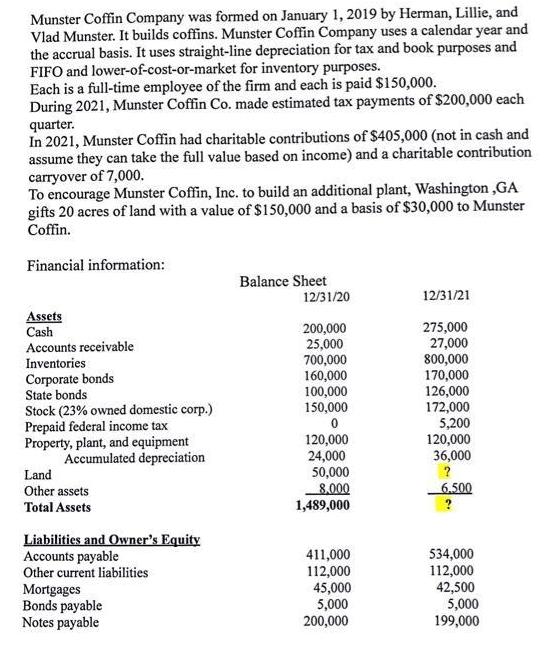

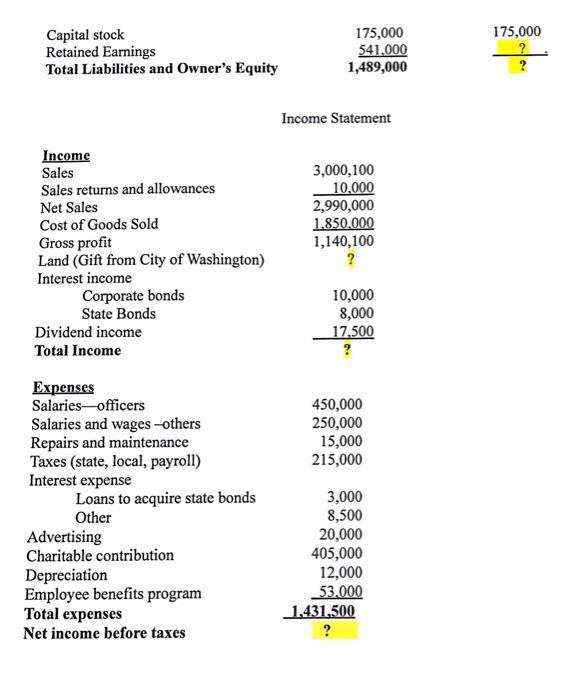

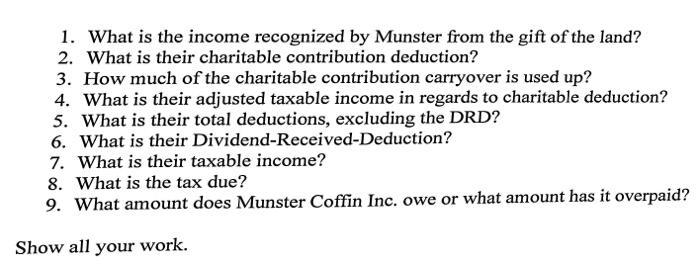

Munster Coffin Company was formed on January 1, 2019 by Herman, Lillie, and Vlad Munster. It builds coffins. Munster Coffin Company uses a calendar year and the accrual basis. It uses straight-line depreciation for tax and book purposes and FIFO and lower-of-cost-or-market for inventory purposes. Each is a full-time employee of the firm and each is paid $150,000. During 2021, Munster Coffin Co. made estimated tax payments of $200,000 each quarter. In 2021, Munster Coffin had charitable contributions of $405,000 (not in cash and assume they can take the full value based on income) and a charitable contribution carryover of 7,000. To encourage Munster Coffin, Inc. to build an additional plant, Washington ,GA gifts 20 acres of land with a value of $150,000 and a basis of $30,000 to Munster Coffin. Financial information: Balance Sheet 12/31/20 12/31/21 Assets Cash Accounts receivable Inventories 275,000 27,000 800,000 170,000 126,000 172,000 5,200 120,000 36,000 200,000 25,000 700,000 160,000 100,000 150,000 Corporate bonds State bonds Stock (23% owned domestic corp.) Prepaid federal income tax Property, plant, and equipment Accumulated depreciation Land 120,000 24,000 50,000 8,000 1,489,000 Other assets 6.500 Total Assets Liabilities and Owner's Equity Accounts payable Other current liabilities Mortgages Bonds payable Notes payable 411,000 112,000 45,000 5,000 200,000 534,000 112,000 42,500 5,000 199,000 175,000 Capital stock Retained Earnings Total Liabilities and Owner's Equity 175,000 541.000 1,489,000 Income Statement Income Sales 3,000,100 10.000 2,990,000 1.850.000 1,140,100 Sales returns and allowances Net Sales Cost of Goods Sold Gross profit Land (Gift from City of Washington) Interest income Corporate bonds State Bonds 10,000 8,000 17.500 Dividend income Total Income Expenses Salaries officers Salaries and wages -others Repairs and maintenance Taxes (state, local, payroll) Interest expense Loans to acquire state bonds Other 450,000 250,000 15,000 215,000 Advertising Charitable contribution Depreciation Employee benefits program Total expenses 3,000 8,500 20,000 405,000 12,000 53.000 1431,500 Net income before taxes 1. What is the income recognized by Munster from the gift of the land? 2. What is their charitable contribution deduction? 3. How much of the charitable contribution carryover is used up? 4. What is their adjusted taxable income in regards to charitable deduction? 5. What is their total deductions, excluding the DRD? 6. What is their Dividend-Received-Deduction? 7. What is their taxable income? 8. What is the tax due? 9. What amount does Munster Coffin Inc. owe or what amount has it overpaid? Show all your work.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answers What is their DividendReceivedDeduction In this case there is Sto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started