Question

Murray Company acquired $100,000 face value of the outstanding bonds of Campbell Company on January 1, 2013. The bonds pay interest semiannually on June 30

Murray Company acquired $100,000 face value of the outstanding bonds of Campbell Company on January 1, 2013. The bonds pay interest semiannually on June 30 and December 31 at an annual rate of 6% and mature on December 31, 2016. The market priced these bonds on January 1, 2013, to yield 8% compounded semiannually. Murray Company classifies these bonds as held-to-maturity securities.

a. Compute the amount that Murray Company paid for these bonds, excluding commissions and taxes.

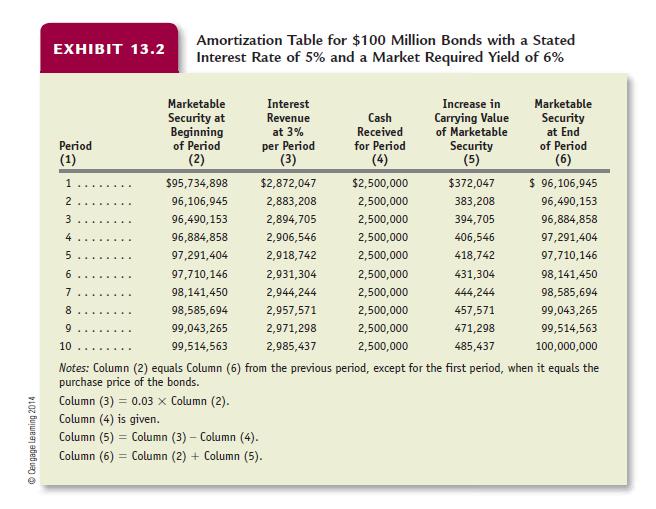

b. Prepare an amortization table for these bonds similar to that in Exhibit 13.2.

c. Give the journal entries that Murray Company would make to account for these bonds during 2013.

d. Give the journal entries that Murray Company would make to account for these bonds on December 31, 2016.

Amortization Table for $100 Million Bonds with a Stated EXHIBIT 13.2 Interest Rate of 5% and a Market Required Yield of 6% Marketable Security at Beginning of Period (2) Interest Increase in Carrying Value of Marketable Marketable Revenue Cash Received Security at End at 3% per Period (3) Period for Period (4) Security (5) of Period (6) (1) $95,734,898 $2,872,047 $2,500,000 $372,047 $ 96,106,945 2 96,106,945 2,883,208 2,500,000 383,208 96,490,153 3 96,490,153 2,894,705 2,500,000 394,705 96,884,858 4 96,884,858 2,906,546 2,500,000 406,546 97,291,404 5 97,291,404 2,918,742 2,500,000 418,742 97,710,146 97,710,146 2,931,304 2,500,000 431,304 98,141,450 7 98,141,450 2,944,244 2,500,000 444,244 98,585,694 8 98,585,694 2,957,571 2,500,000 457,571 99,043,265 9 99,043,265 2,971,298 2,500,000 471,298 99,514,563 10 99,514,563 2,985,437 2,500,000 485,437 100,000,000 .... Notes: Column (2) equals Column (6) from the previous period, except for the first period, when it equals the purchase price of the bonds. Column (3) = 0.03 x Column (2). Column (4) is given. Column (5) = Column (3) Column (4). Column (6) = Column (2) + Column (5). Cen gage Leaming 2014 O7 00

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Heldtomaturity investments Heldt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started