Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Murtagh Co. is operating at its target capital structure with market values of $110 million in equity and $175 million in debt outstanding. Murtagh

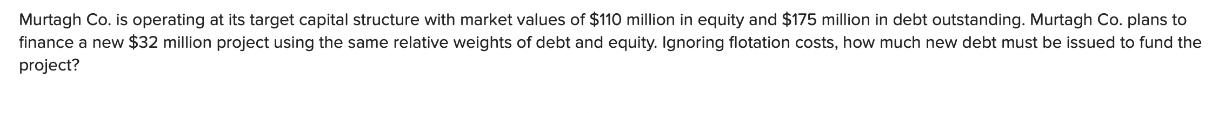

Murtagh Co. is operating at its target capital structure with market values of $110 million in equity and $175 million in debt outstanding. Murtagh Co. plans to finance a new $32 million project using the same relative weights of debt and equity. Ignoring flotation costs, how much new debt must be issued to fund the project?

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine how much new debt must be issued to fund the project we need to maintain the same relat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663360f37a05c_935836.pdf

180 KBs PDF File

663360f37a05c_935836.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started