Question

Muscat LLC is a company with a December 31 year end. On January 1, 2015, the company acquires 5,000 shares of Sohar LLC at

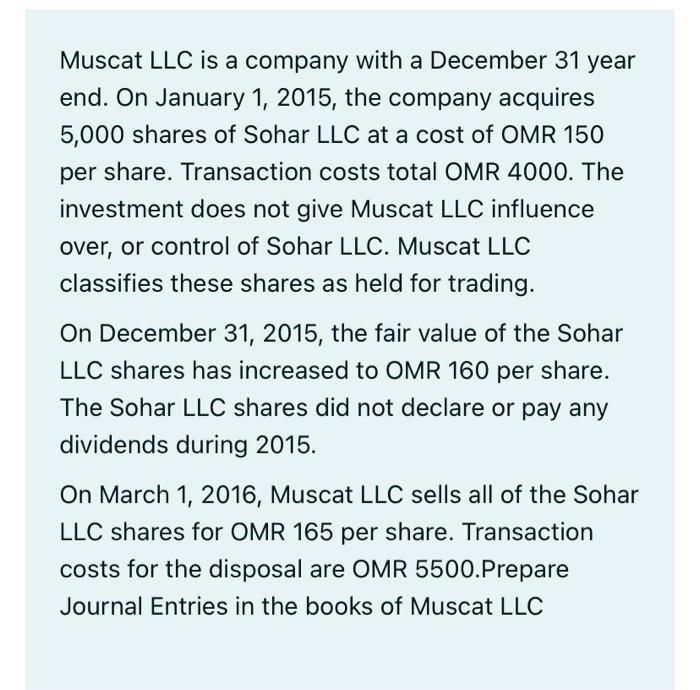

Muscat LLC is a company with a December 31 year end. On January 1, 2015, the company acquires 5,000 shares of Sohar LLC at a cost of OMR 150 per share. Transaction costs total OMR 4000. The investment does not give Muscat LLC influence over, or control of Sohar LLC. Muscat LLC classifies these shares as held for trading. On December 31, 2015, the fair value of the Sohar LLC shares has increased to OMR 160 per share. The Sohar LLC shares did not declare or pay any dividends during 2015. On March 1, 2016, Muscat LLC sells all of the Sohar LLC shares for OMR 165 per share. Transaction costs for the disposal are OMR 5500.Prepare Journal Entries in the books of Muscat LLC

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries in the books of Muscat LLC are as follows Date Particulars Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

1st edition

978-0133251579, 133251578, 013216230X, 978-0134102313, 134102312, 978-0132162302

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App