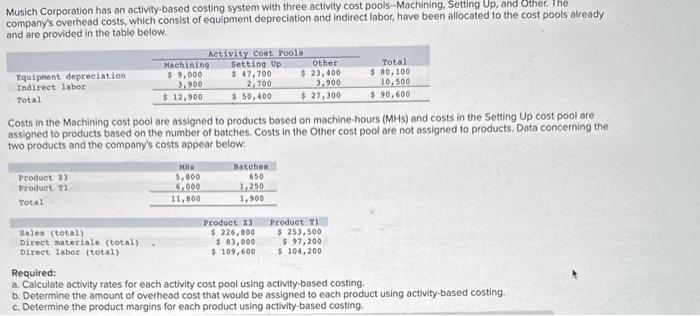

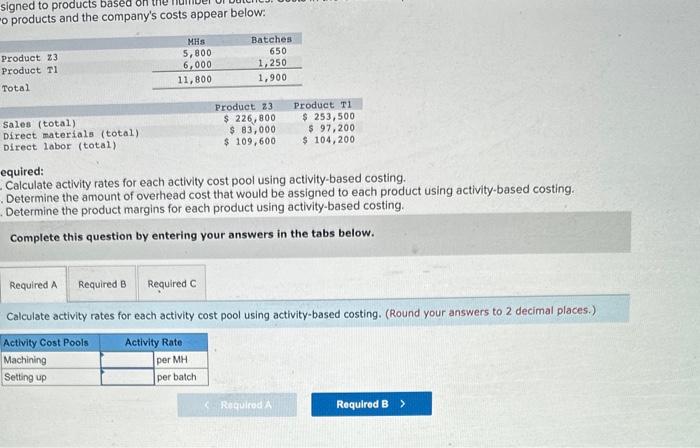

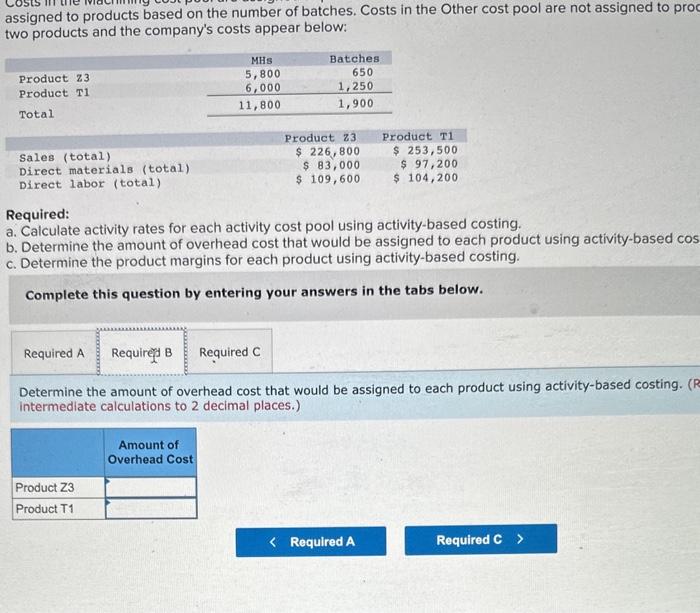

Musich Corporation has an activity-based costing system with three activity cost pools-Machining. Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below: Required: a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing. quired: Calculate activity rates for each activity cost pool using activity-based costing. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers to 2 decimal places.) assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to pros two products and the company's costs appear below: Required: a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based cos c. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. intermediate calculations to 2 decimal places.) Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost poo assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concer two products and the company's costs appear below: Required: a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Determine the product margins for each product using activity-based costing. (Round intermediate calculations to 2 decimal places.)