Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Musk Enterprises relies heavily on a copier machine to process its paperwork. Recently the copy clerk has not been able to process all the

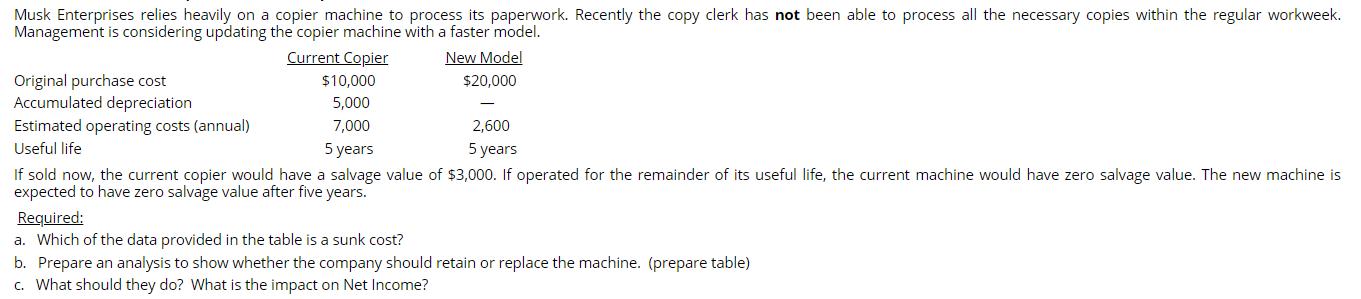

Musk Enterprises relies heavily on a copier machine to process its paperwork. Recently the copy clerk has not been able to process all the necessary copies within the regular workweek. Management is considering updating the copier machine with a faster model. Current Copier New Model $20,000 Original purchase cost Accumulated depreciation Estimated operating costs (annual) Useful life $10,000 5,000 7,000 2,600 5 years 5 years If sold now, the current copier would have a salvage value of $3,000. If operated for the remainder of its useful life, the current machine would have zero salvage value. The new machine is expected to have zero salvage value after five years. Required: a. Which of the data provided in the table is a sunk cost? b. Prepare an analysis to show whether the company should retain or replace the machine. (prepare table) c. What should they do? What is the impact on Net Income?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Original purchase cost of old machine accumulated depreciation and useful life is sunk cost in d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started