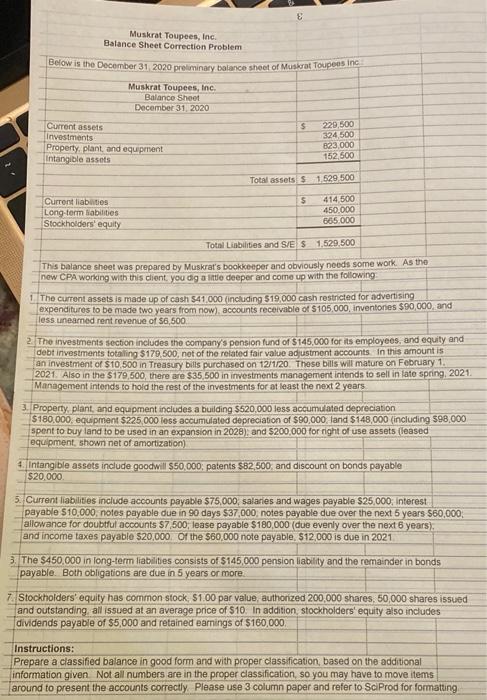

Muskrat Toupees, Inc Balance Sheet Correction Problem Below is the December 31 2020 preliminary balance sheet of Muskat Toupes in Muskrat Toupees, Inc. Balance Sheet December 31, 2020 Current assets $ 229,500 investments Property, plant and equipment Intangible assets Total assets 1.529,500 324 500 823 000 152 500 $ Current liabutis Long-term liabilities Stockholders' equity 414,500 450.000 665.000 Total Liabilities and S/ES 1.529,500 This balance sheet was prepared by Muskrat's bookkeeper and obviously needs some work. As the new CPA working with this client, you dg a little deeper and come up with the following The current assets is made up of cash $41.000 (including $19.000 cash restricted for advertising expenditures to be made two years from now) accounts receivable of $105.000, inventories $90,000, and lessuneamed rent revenue of $6,500 2. The investments section includes the company's pension fund of $145,000 for its employees, and equity and debt investments totaling $170.500, not of the related fair value adjustment accounts in this amount is an investment of $10.500 in Treasury bills purchased on 12/1/20. Those bills will mature on February 1 2021. Also in the $179,500 there are $35,500 in investments management intends to sell in late spring 2021 Management intends to hold the rest of the investments for at least the next 2 years 3. Property, plant, and equipment includes a building $520,000 less accumulated depreciation S180.000, equipment S225 000 less accumulated depreciation of $90,000, land $148,000 (including 598.000 spent to buy land to be used in an expansion in 2028), and S200,000 for right of use assets (leased equipment, shown net of amortization) 4. Intangible assets include goodwill $50,000. patents $82,500, and discount on bonds payable $20.000 5. Current liabilities include accounts payable $75,000 salaries and wages payable $25,000, Interest payable 510,000, notes payable due in 90 days 537,000 notes payable due over the next 5 years 560,000, allowance for doubtful accounts $7,500, lease payable $180,000 (duo evenly over the next 6 years). and income taxes payable $20,000 of the 560 000 note payable 512,000 is due in 2021 3. The $450,000 in long-term liabilities consists of $145,000 pension liability and the remainder in bonds payable. Both obligations are due in 5 years or more 7. Stockholders' equity has common stock, 51.00 par value, authorized 200,000 shares 50,000 shares issued and outstanding all issued at an average price of $10. In addition stockholders' equity also includes dividends payable of $5,000 and retained earnings of $160,000 Instructions: Prepare a classified balance in good form and with proper classification, based on the additional information given Not all numbers are in the proper classification, so you may have to move items around to present the accounts correctly. Please use 3 column paper and refer to Sc Prod for formatting Muskrat Toupees, Inc Balance Sheet Correction Problem Below is the December 31 2020 preliminary balance sheet of Muskat Toupes in Muskrat Toupees, Inc. Balance Sheet December 31, 2020 Current assets $ 229,500 investments Property, plant and equipment Intangible assets Total assets 1.529,500 324 500 823 000 152 500 $ Current liabutis Long-term liabilities Stockholders' equity 414,500 450.000 665.000 Total Liabilities and S/ES 1.529,500 This balance sheet was prepared by Muskrat's bookkeeper and obviously needs some work. As the new CPA working with this client, you dg a little deeper and come up with the following The current assets is made up of cash $41.000 (including $19.000 cash restricted for advertising expenditures to be made two years from now) accounts receivable of $105.000, inventories $90,000, and lessuneamed rent revenue of $6,500 2. The investments section includes the company's pension fund of $145,000 for its employees, and equity and debt investments totaling $170.500, not of the related fair value adjustment accounts in this amount is an investment of $10.500 in Treasury bills purchased on 12/1/20. Those bills will mature on February 1 2021. Also in the $179,500 there are $35,500 in investments management intends to sell in late spring 2021 Management intends to hold the rest of the investments for at least the next 2 years 3. Property, plant, and equipment includes a building $520,000 less accumulated depreciation S180.000, equipment S225 000 less accumulated depreciation of $90,000, land $148,000 (including 598.000 spent to buy land to be used in an expansion in 2028), and S200,000 for right of use assets (leased equipment, shown net of amortization) 4. Intangible assets include goodwill $50,000. patents $82,500, and discount on bonds payable $20.000 5. Current liabilities include accounts payable $75,000 salaries and wages payable $25,000, Interest payable 510,000, notes payable due in 90 days 537,000 notes payable due over the next 5 years 560,000, allowance for doubtful accounts $7,500, lease payable $180,000 (duo evenly over the next 6 years). and income taxes payable $20,000 of the 560 000 note payable 512,000 is due in 2021 3. The $450,000 in long-term liabilities consists of $145,000 pension liability and the remainder in bonds payable. Both obligations are due in 5 years or more 7. Stockholders' equity has common stock, 51.00 par value, authorized 200,000 shares 50,000 shares issued and outstanding all issued at an average price of $10. In addition stockholders' equity also includes dividends payable of $5,000 and retained earnings of $160,000 Instructions: Prepare a classified balance in good form and with proper classification, based on the additional information given Not all numbers are in the proper classification, so you may have to move items around to present the accounts correctly. Please use 3 column paper and refer to Sc Prod for formatting