Question

**Must Be Able to Answer Each Question** A) In March, Stinson Company completes Jobs 10 and 11. Job 10 cost $27,700 and Job 11 $32,700.

**Must Be Able to Answer Each Question**

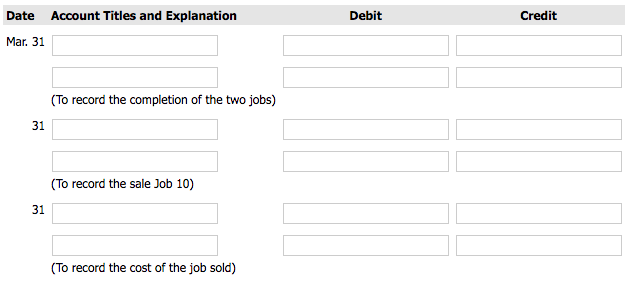

A) In March, Stinson Company completes Jobs 10 and 11. Job 10 cost $27,700 and Job 11 $32,700. On March 31, Job 10 is sold to the customer for $44,900 in cash. Journalize the entries for the completion of the two jobs and the sale of Job 10.

**********************************************************************************************************

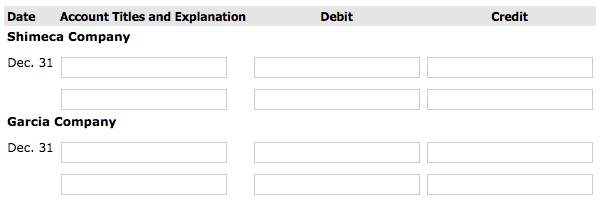

B) At December 31, balances in Manufacturing Overhead are Shimeca Companydebit $2,100, Garcia Companycredit $1,067. Prepare the adjusting entry for each company at December 31, assuming the adjustment is made to cost of goods sold.

**********************************************************************************************

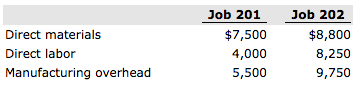

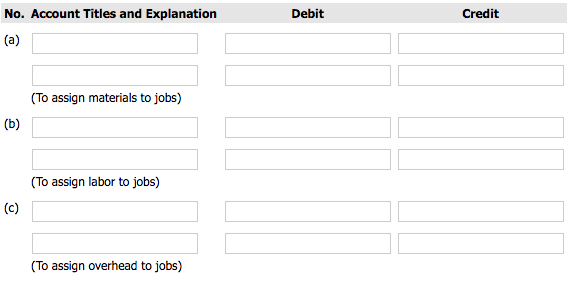

C) Milner Company is working on two job orders. The job cost sheets show the following.

Prepare the three summary entries to record the assignment of costs to Work in Process from the data on the job cost sheets.

**********************************************************************************************

D) Washburn Company produces earbuds. During the year, manufacturing overhead costs were $222,000. Machine usage was 2,500 hours. The company assigns overhead based on machine hours. Job No. 551 used 90 machine hours. Determine the amount of overhead to allocate to Job No. 551.

**********************************************************************************************

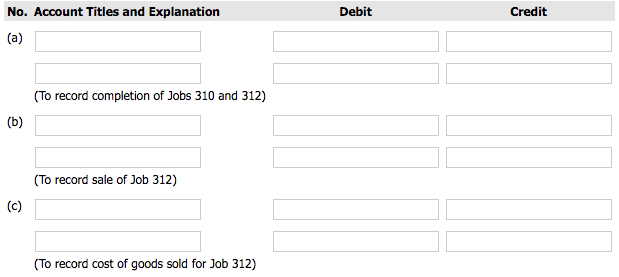

E) During the current month, Standard Corporation completed Job 310 and Job 312. Job 310 cost $75,000 and Job 312 cost $51,500. Job 312 was sold on account for $90,000. Journalize the entries for the completion of the two jobs and the sale of Job 312.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started