Answered step by step

Verified Expert Solution

Question

1 Approved Answer

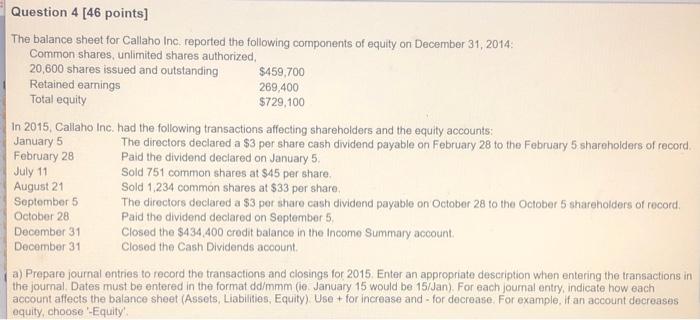

must use headings in the list provided. thanks! no theyre not Question 4 [46 points) The balance sheet for Callaho Inc. reported the following components

must use headings in the list provided. thanks!

must use headings in the list provided. thanks!no theyre not

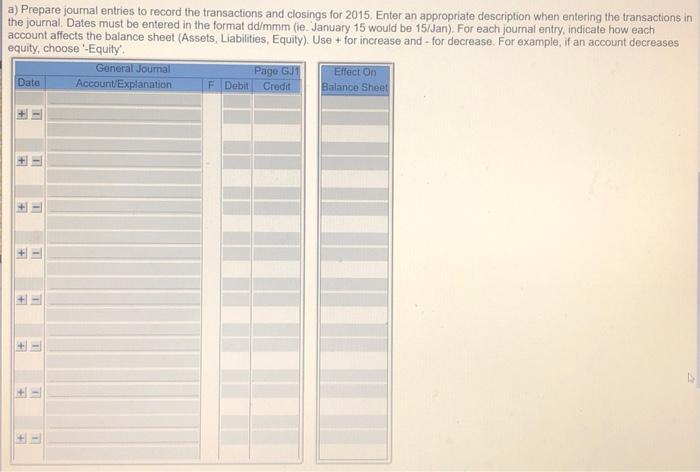

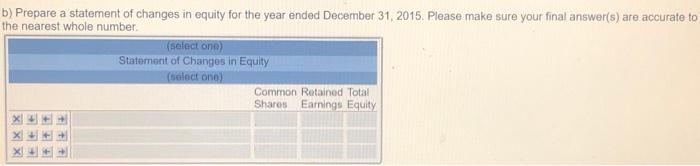

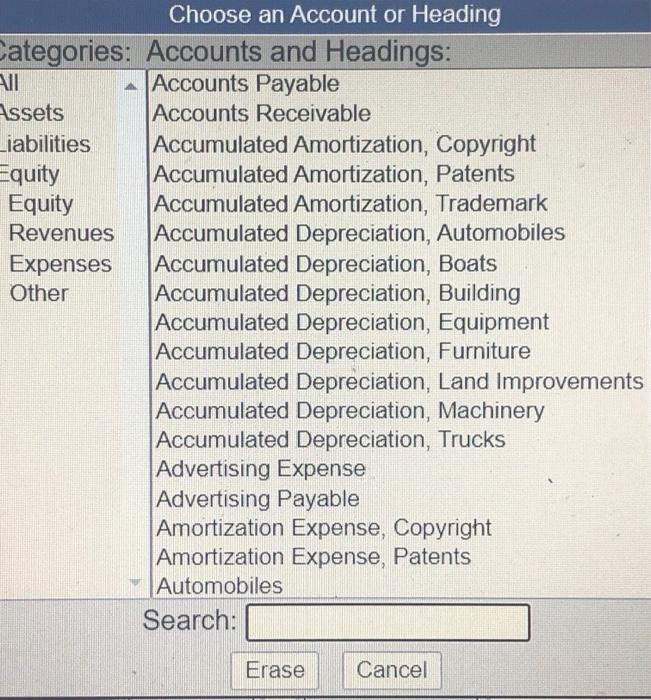

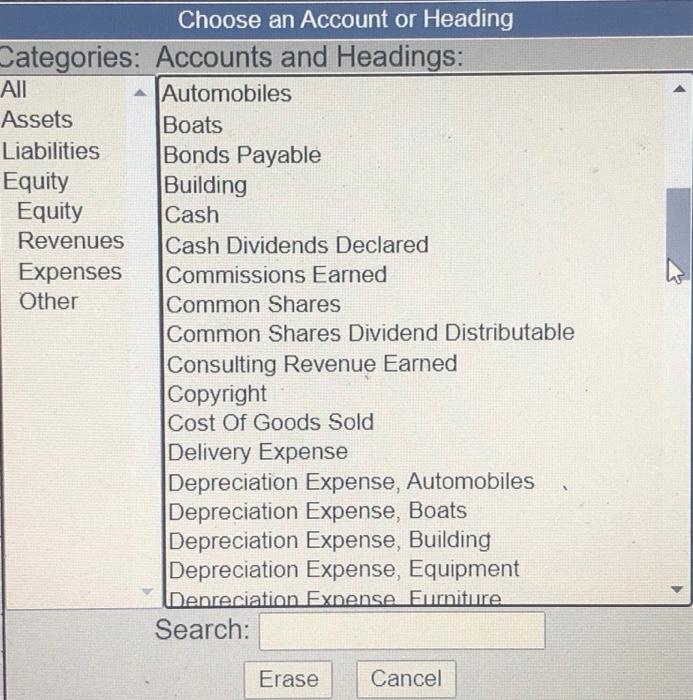

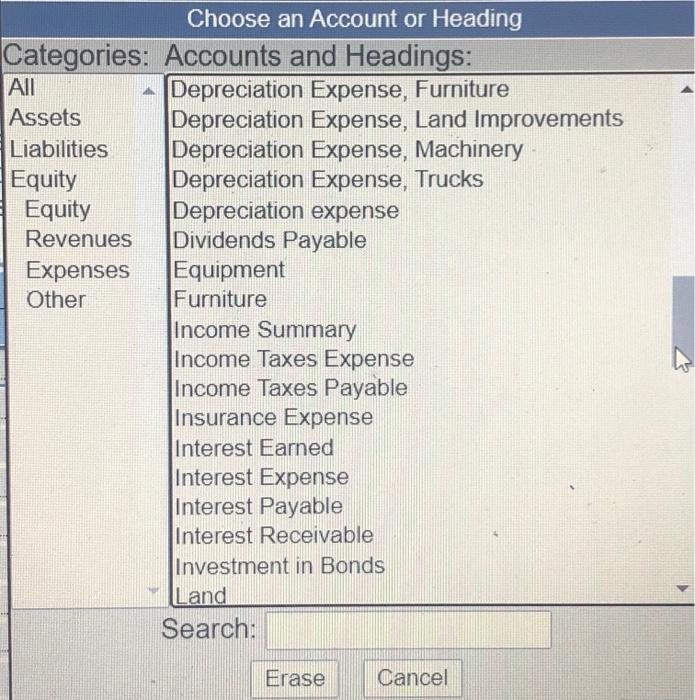

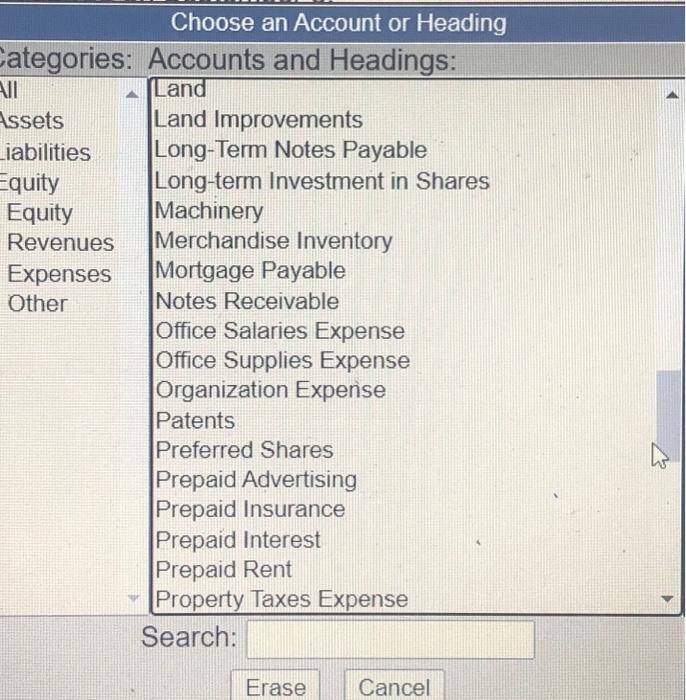

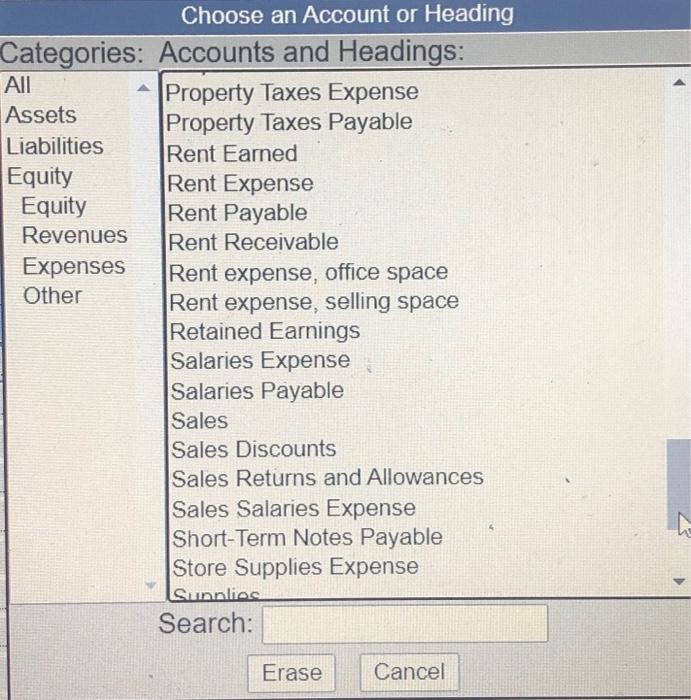

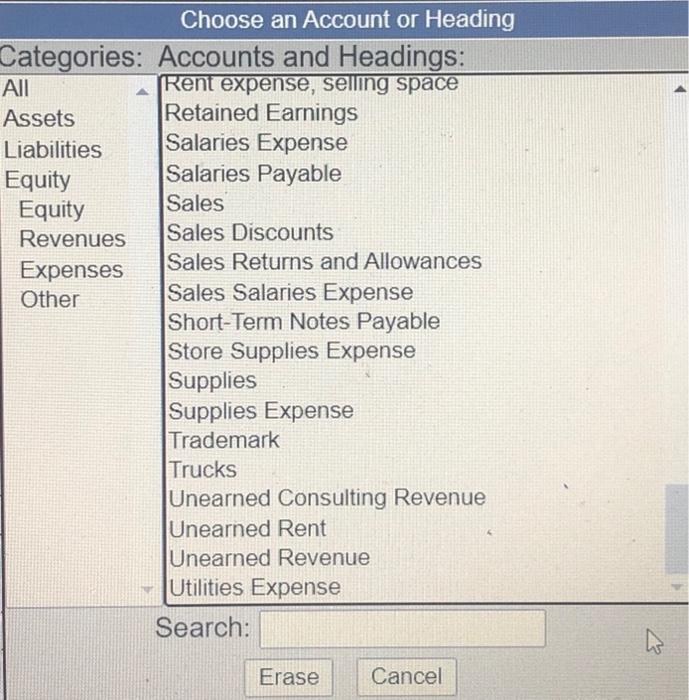

Question 4 [46 points) The balance sheet for Callaho Inc. reported the following components of equity on December 31, 2014 Common shares, unlimited shares authorized 20,600 shares issued and outstanding $459,700 Retained earnings 269,400 Total equity $729,100 In 2015, Callaho Inc. had the following transactions affecting shareholders and the equity accounts: January 5 The directors declared a $3 per share cash dividend payable on February 28 to the February 5 shareholders of record February 28 Paid the dividend declared on January 5 July 11 Sold 751 common shares at $45 per share August 21 Sold 1.234 common shares at $33 per share, September 5 The directors declared a $3 por share cash dividend payable on October 28 to the October 5 shareholders of record, October 28 Paid the dividend declared on September 5, December 31 Closed the $434 400 credit balance in the Income Summary account December 31 Closed the Cash Dividends account a) Prepare journal entries to record the transactions and closings for 2015. Enter an appropriate description when entering the transactions in the journal Dates must be entered in the format dd/mmm (ie January 15 would be 15/Jan) . For each journal entry, indicate how each account affects the balance sheet (Assets, Liabilities, Equity) Use + for increase and - for decrease. For example, if an account decreases equity, choose 'Equity a) Prepare journal entries to record the transactions and closings for 2015. Enter an appropriate description when entering the transactions in the journal Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). For each journal entry, indicate how each account affects the balance sheet (Assets, Liabilities, Equity) Use + for increase and - for decrease. For example, if an account decreases equity, choose '-Equity General Journal Page 1 Effect on Date Account/Explanation Credit Balance Sheet F Debit + 1 + T + TI + TI + TI + T + - + b) Prepare a statement of changes in equity for the year ended December 31, 2015. Please make sure your final answer(s) are accurate to the nearest whole number (select one) Statement of Changes in Equity (wolectone) Common Retained Total Shares Earnings Equity X X X X ttt E + + + Choose an Account or Heading Categories: Accounts and Headings: All Accounts Payable Assets Accounts Receivable Liabilities Accumulated Amortization, Copyright Equity Accumulated Amortization, Patents Equity Accumulated Amortization, Trademark Revenues Accumulated Depreciation, Automobiles Expenses Accumulated Depreciation, Boats Other Accumulated Depreciation, Building Accumulated Depreciation, Equipment Accumulated Depreciation, Furniture Accumulated Depreciation, Land Improvements Accumulated Depreciation, Machinery Accumulated Depreciation, Trucks Advertising Expense Advertising Payable Amortization Expense, Copyright Amortization Expense, Patents Automobiles Search: Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: All Automobiles Assets Boats Liabilities Bonds Payable Equity Building Equity Cash Revenues Cash Dividends Declared Expenses Commissions Earned Other Common Shares Common Shares Dividend Distributable Consulting Revenue Earned Copyright Cost Of Goods Sold Delivery Expense Depreciation Expense, Automobiles Depreciation Expense, Boats Depreciation Expense, Building Depreciation Expense, Equipment Depreciation Expense. Furniture Search: Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: All Depreciation Expense, Furniture Assets Depreciation Expense, Land Improvements Liabilities Depreciation Expense, Machinery Equity Depreciation Expense, Trucks Equity Depreciation expense Revenues Dividends Payable Expenses Equipment Other Furniture Income Summary Income Taxes Expense Income Taxes Payable Insurance Expense Interest Eamed Interest Expense Interest Payable Interest Receivable Investment in Bonds Land Search: Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: All Land Assets Land Improvements Liabilities Long-Term Notes Payable Equity Long-term Investment in Shares Equity Machinery Revenues Merchandise Inventory Expenses Mortgage Payable Other Notes Receivable Office Salaries Expense Office Supplies Expense Organization Expense Patents Preferred Shares Prepaid Advertising Prepaid Insurance Prepaid Interest Prepaid Rent Property Taxes Expense Search: a Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: All Property Taxes Expense Assets Property Taxes Payable Liabilities Rent Earned Equity Rent Expense Equity Rent Payable Revenues Rent Receivable Expenses Rent expense, office space Other Rent expense, selling space Retained Earnings Salaries Expense Salaries Payable Sales Sales Discounts Sales Returns and Allowances Sales Salaries Expense Short-Term Notes Payable Store Supplies Expense Sunnlies Search: Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: All Rent expense, selling space Assets Retained Earnings Liabilities Salaries Expense Equity Salaries Payable Equity Sales Revenues Sales Discounts Expenses Sales Returns and Allowances Other Sales Salaries Expense Short-Term Notes Payable Store Supplies Expense Supplies Supplies Expense Trademark Trucks Unearned Consulting Revenue Unearned Rent Unearned Revenue Utilities Expense Search: Erase Cancel Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started