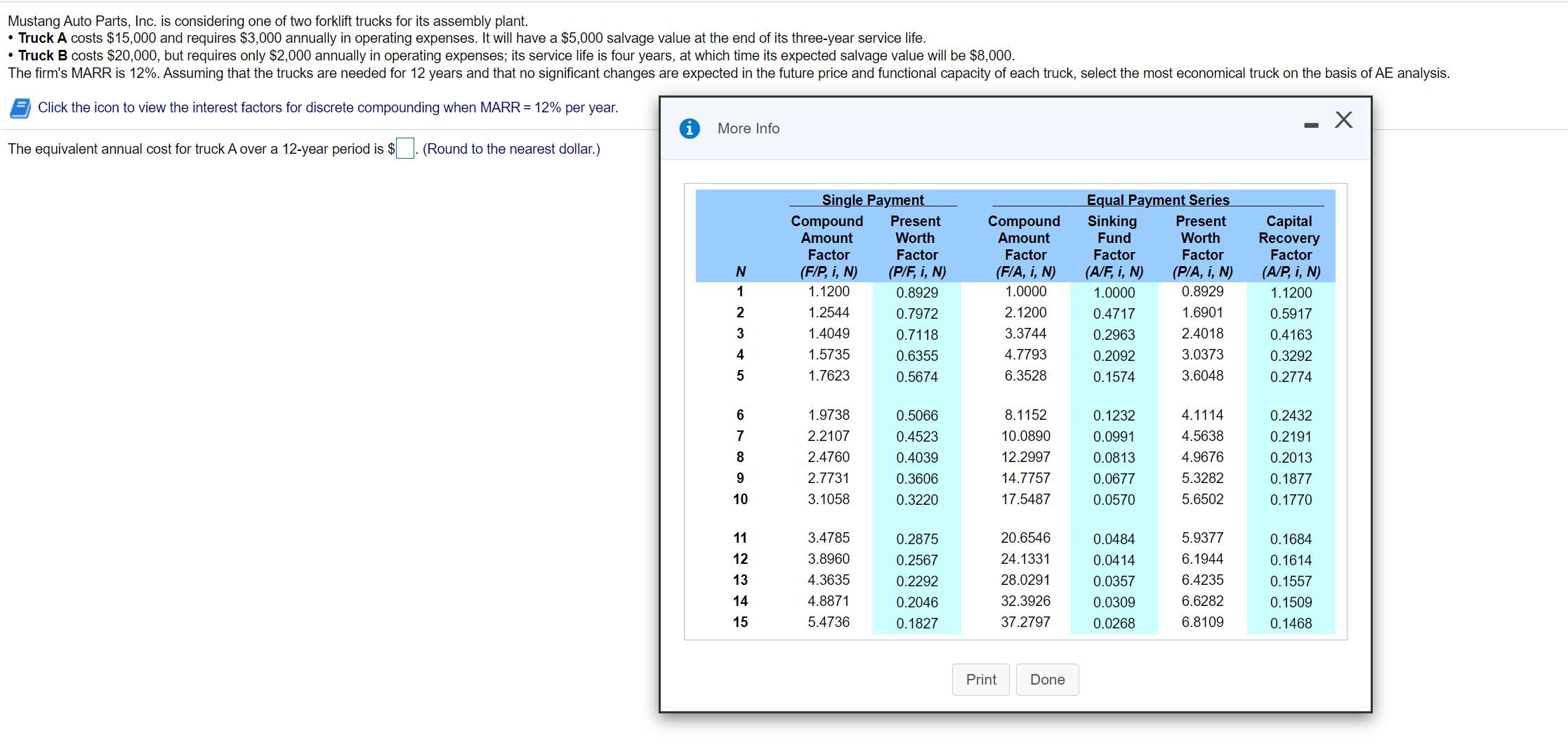

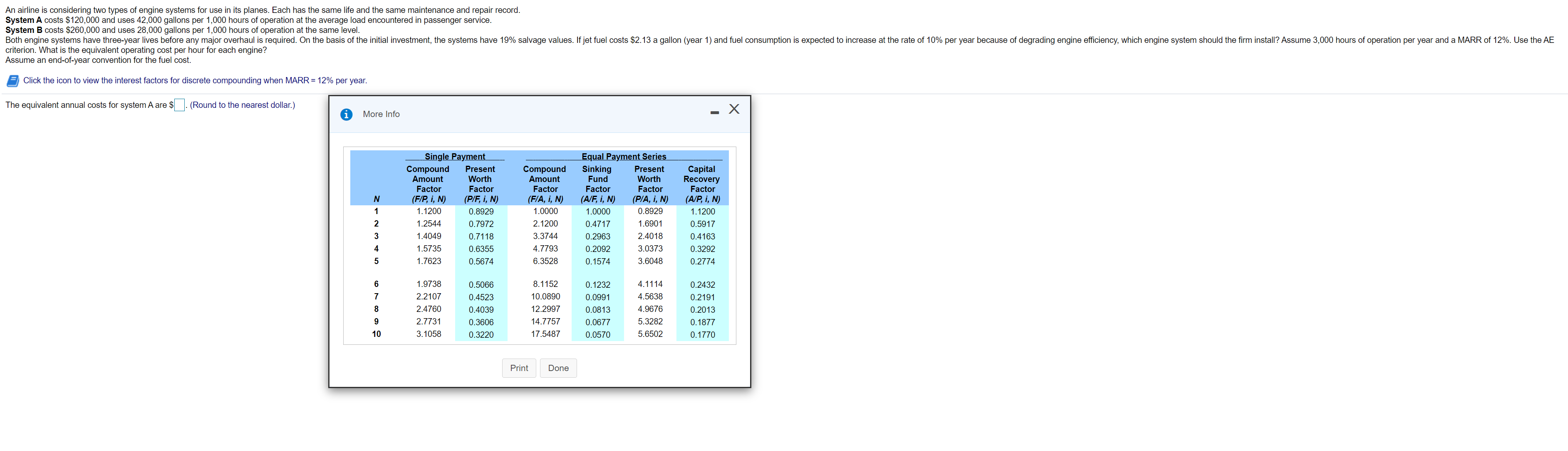

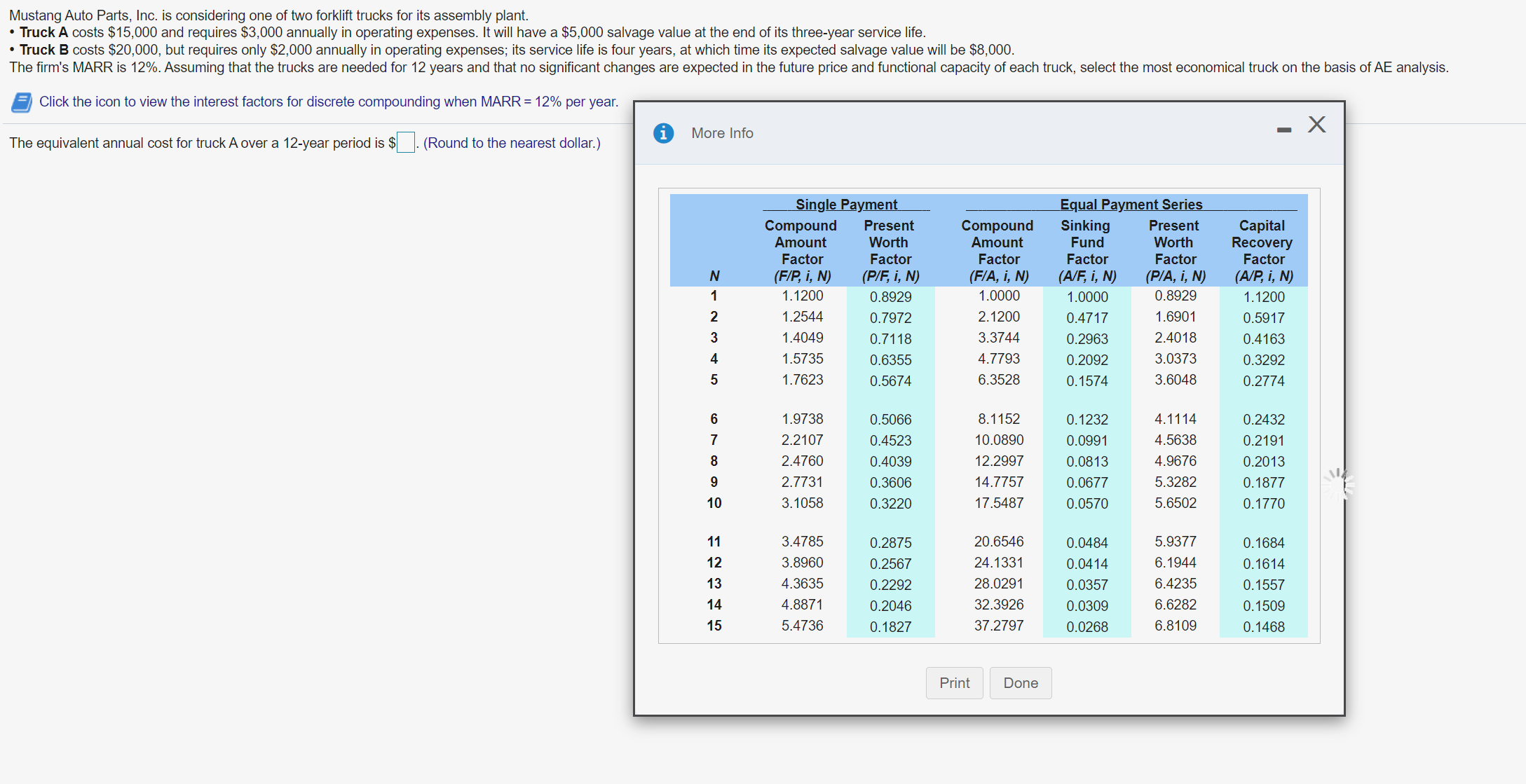

Mustang Auto Parts, Inc. is considering one of two forklift trucks for its assembly plant. - TruckA costs $15,000 and requires $3,000 annually in operating expenses. It will have a $5,000 salvage value at the end of its three-year service life. - Truck B costs $20,000, but requires only $2,000 annually in operating expenses; its service life is four years, at which time its expected salvage value will be $8,000. The rm's MARR is 12%. Assuming that the trucks are needed for 12 years and that no signicant changes are expected in the future price and functional capacity of each truck, select the most economical truck on the basis of AE analysis. a Click the icon to view the interest factors for discrete compounding when MARR = 12% per year. The equivalent annual cost for truck A over a 12-year period is $ . (Round to the nearest dollar.) 1 .0000 2.1200 3.3744 4.7793 6.3528 8.1 1 52 1 0.0890 1 2.2997 14.7757 1 7.5487 20.6546 24.1 331 28.0291 32.3926 37.2797 ' Print H Done ' An airline is considering two types of engine systems for use in its planes. Each has the same life and the same maintenance and repair record. System A costs $120,000 and uses 42,000 gallons per 1,000 hours of operation at the average load encountered in passenger service. System B costs $260,000 and uses 28,000 gallons per 1,000 hours of operation at the same level. Both engine systems have three-year lives before any major overhaul is required. On the basis of the initial investment, the systems have 19% salvage values. If jet fuel costs $2.13 a gallon (year 1) and fuel consumption is expected to increase at the rate of 10% per year because of degrading engine efficiency, which engine system should the firm install? Assume 3,000 hours of operation per year and a MARR of 12%. Use the AE criterion. What is the equivalent operating cost per hour for each engine? Assume an end-of-year convention for the fuel cost. Click the icon to view the interest factors for discrete compounding when MARR = 12% per year. The equivalent annual costs for system A are $ . (Round to the nearest dollar.) i More Info X Single Payment Equal Payment Series Compound Present Compound Sinking Present Capital Amount Worth Amount Fund Worth Recovery Factor Facto Factor Factor Factor Factor (F/P, i, N) (P/F, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) (A/P, i, N) 1.1200 0.8929 1.0000 1.0000 0.8929 1.1200 1.2544 0.7972 2.1200 0.4717 1.6901 0.5917 UAW N- Z 1.4049 0.711 3.374 .296 2.4018 0.416 1.5735 0.6355 4.7793 0.2092 3.0373 0.3292 1.7623 0.5674 6.3528 0.1574 3.6048 0.2774 1.9738 0.5066 8.1152 0.1232 4.1114 0.2432 2.2107 0.4523 10.0890 0.0991 4.5638 0.219 2.4760 0.4039 12.299 0.0813 4.9676 0.2013 2.7731 0.360 14.7757 0.0677 5.3282 0.187 3.1058 0.3220 17.5487 0.0570 0.1770 Print DoneMustang Auto Parts, Inc. is considering one of two forklift trucks for its assembly plant. . Truck A costs $15,000 and requires $3,000 annually in operating expenses. It will have a $5,000 salvage value at the end of its three-year service life. . Truck B costs $20,000, but requires only $2,000 annually in operating expenses; its service life is four years, at which time its expected salvage value will be $8,000. The firm's MARR is 12%. Assuming that the trucks are needed for 12 years and that no significant changes are expected in the future price and functional capacity of each truck, select the most economical truck on the basis of AE analysis. Click the icon to view the interest factors for discrete compounding when MARR = 12% per year. The equivalent annual cost for truck A over a 12-year period is $ . (Round to the nearest dollar.) i More Info - X Single Payment Equal Payment Series Compound Present Compound Sinking Present Capital Amount Worth Amount Fund Worth Recovery Factor Factor Factor Factor Factor Factor (F/P, i, N) (P/F, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) (A/P, i, N) 1.1200 0.8929 1.0000 1.0000 0.8929 1.1200 1.2544 0.7972 2.1200 0.4717 1.6901 0.5917 U A W N - Z 1.4049 0.7118 3.3744 0.2963 2.4018 0.4163 1.5735 0.6355 4.7793 0.2092 3.0373 0.3292 1.7623 0.5674 6.3528 0.1574 3.6048 0.2774 1.9738 0.5066 8.1152 0.1232 4.1114 0.2432 2.2107 0.4523 10.0890 0.0991 4.5638 0.2191 2.4760 0.4039 12.2997 0.0813 4.9676 0.2013 2.7731 0.3606 14.7757 0.0677 5.3282 0. 1877 3.1058 0.3220 17.5487 0.0570 5.6502 0. 1770 11 3.4785 0.2875 20.6546 0.0484 5.9377 0. 1684 12 3.8960 0.2567 24.1331 0.0414 6. 1944 0. 1614 13 4.3635 0.2292 28.0291 0.0357 6.4235 0. 1557 14 4.8871 0.2046 32.3926 0.0309 6.6282 0. 1509 15 5.4736 0.1827 37.2797 0.0268 6.8109 0. 1468 Print Done