You are a compliance officer in an offshore investment bank dealing with Ultra High Net Worth Individuals and one client, as a token of

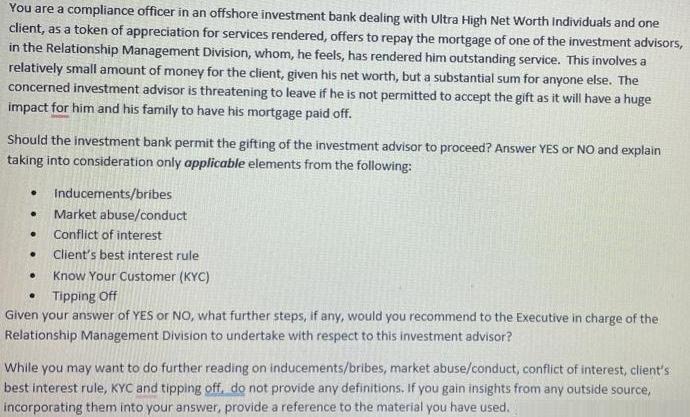

You are a compliance officer in an offshore investment bank dealing with Ultra High Net Worth Individuals and one client, as a token of appreciation for services rendered, offers to repay the mortgage of one of the investment advisors, in the Relationship Management Division, whom, he feels, has rendered him outstanding service. This involves a relatively small amount of money for the client, given his net worth, but a substantial sum for anyone else. The concerned investment advisor is threatening to leave if he is not permitted to accept the gift as it will have a huge impact for him and his family to have his mortgage paid off. Should the investment bank permit the gifting of the investment advisor to proceed? Answer YES or NO and explain taking into consideration only applicable elements from the following: Inducements/bribes . . . Conflict of interest . . Market abuse/conduct . Client's best interest rule Know Your Customer (KYC) Tipping Off Given your answer of YES or NO, what further steps, if any, would you recommend to the Executive in charge of the Relationship Management Division to undertake with respect to this investment advisor? While you may want to do further reading on inducements/bribes, market abuse/conduct, conflict of interest, client's best interest rule, KYC and tipping off, do not provide any definitions. If you gain insights from any outside source, incorporating them into your answer, provide a reference to the material you have used.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Inducement and bribery Inducement is background incentive that helps bring about 09 While ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started