Question

Mutant Company purchased 20,000 shares of Twister Company ordinary shares on February 29, 2011, for P924,000. Mutant received a P40,000 cash dividend on Twister

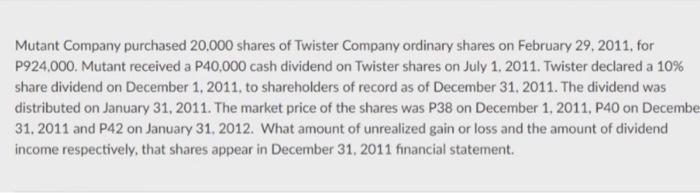

Mutant Company purchased 20,000 shares of Twister Company ordinary shares on February 29, 2011, for P924,000. Mutant received a P40,000 cash dividend on Twister shares on July 1, 2011. Twister declared a 10% share dividend on December 1, 2011, to shareholders of record as of December 31, 2011. The dividend was distributed on January 31, 2011. The market price of the shares was P38 on December 1, 2011, P40 on Decembe 31, 2011 and P42 on January 31, 2012. What amount of unrealized gain or loss and the amount of dividend income respectively, that shares appear in December 31, 2011 financial statement.

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Share Purchase priceP924000 Shares at 31 dec ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short

8th edition

78025559, 978-0078025556

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App