Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MV Corporation has debt with market value of $95 million, common equity with a book value of $95 million, and preferred stock worth $20

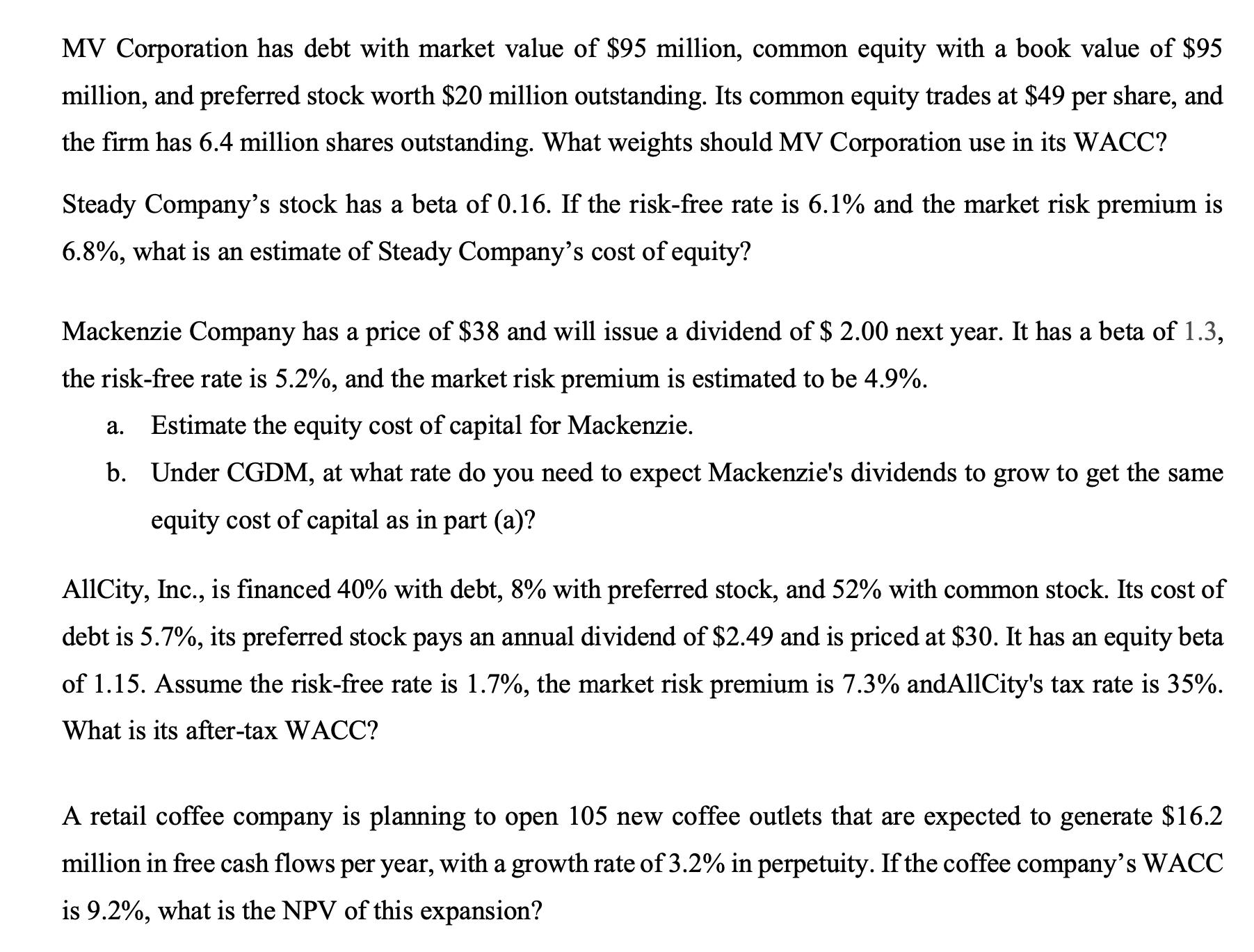

MV Corporation has debt with market value of $95 million, common equity with a book value of $95 million, and preferred stock worth $20 million outstanding. Its common equity trades at $49 per share, and the firm has 6.4 million shares outstanding. What weights should MV Corporation use in its WACC? Steady Company's stock has a beta of 0.16. If the risk-free rate is 6.1% and the market risk premium is 6.8%, what is an estimate of Steady Company's cost of equity? Mackenzie Company has a price of $38 and will issue a dividend of $ 2.00 next year. It has a beta of 1.3, the risk-free rate is 5.2%, and the market risk premium is estimated to be 4.9%. a. Estimate the equity cost of capital for Mackenzie. b. Under CGDM, at what rate do you need to expect Mackenzie's dividends to grow to get the same equity cost of capital as in part (a)? AllCity, Inc., is financed 40% with debt, 8% with preferred stock, and 52% with common stock. Its cost of debt is 5.7%, its preferred stock pays an annual dividend of $2.49 and is priced at $30. It has an equity beta of 1.15. Assume the risk-free rate is 1.7%, the market risk premium is 7.3% andAllCity's tax rate is 35%. What is its after-tax WACC? A retail coffee company is planning to open 105 new coffee outlets that are expected to generate $16.2 million in free cash flows per year, with a growth rate of 3.2% in perpetuity. If the coffee company's WACC is 9.2%, what is the NPV of this expansion?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 MV Corporation should use the following weights in its WACC calculation Debt 95 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started