Question

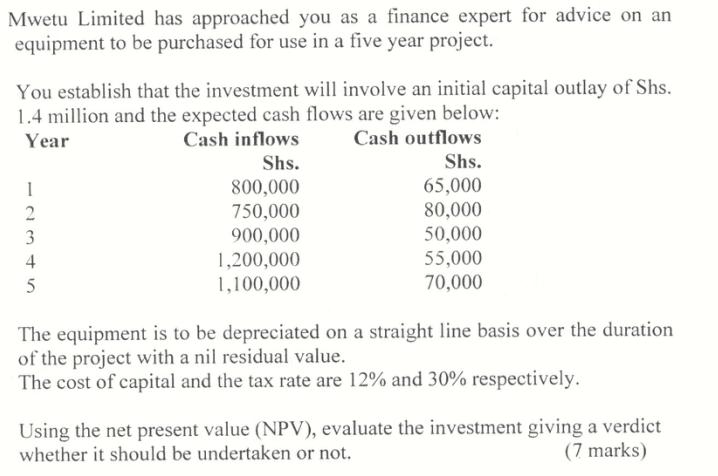

Mwetu Limited has approached you as a finance expert for advice on an equipment to be purchased for use in a five year project.

Mwetu Limited has approached you as a finance expert for advice on an equipment to be purchased for use in a five year project. You establish that the investment will involve an initial capital outlay of Shs. 1.4 million and the expected cash flows are given below: Year Cash inflows Cash outflows Shs. 800,000 750,000 900,000 12345 2 1,200,000 1,100,000 Shs. 65,000 80,000 50,000 55,000 70,000 The equipment is to be depreciated on a straight line basis over the duration of the project with a nil residual value. The cost of capital and the tax rate are 12% and 30% respectively. Using the net present value (NPV), evaluate the investment giving a verdict whether it should be undertaken or not. (7 marks)

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting What the Numbers Mean

Authors: David H. Marshall, Wayne W. McManus, Daniel F. Viele,

9th Edition

978-0-07-76261, 0-07-762611-7, 9780078025297, 978-0073527062

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App