Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My answer is 1. DT Selling cost 7000 CT Cash 7000 2. DT Manufacture cost 600 CT Cash 600 3. This is not a transaction

My answer is

1. DT Selling cost 7000 CT Cash 7000 2. DT Manufacture cost 600 CT Cash 600 3. This is not a transaction 4. DT Other operating cost 1000 CT Cash in bank 1000 5. DT Administrative cost 2000 CT Cash in bank 2000 6. DT External services 12 CT Cash in bank 12 7. DT Administrative cost CT Cash 8. Dt Manufactural cost 7650 Ct Inventory 7650 9. DT Depreciation 1600 CT Accumulated depreciation 1600

3.5.6.8.9 are wrong, I'd like to know what the correct answer to these is?

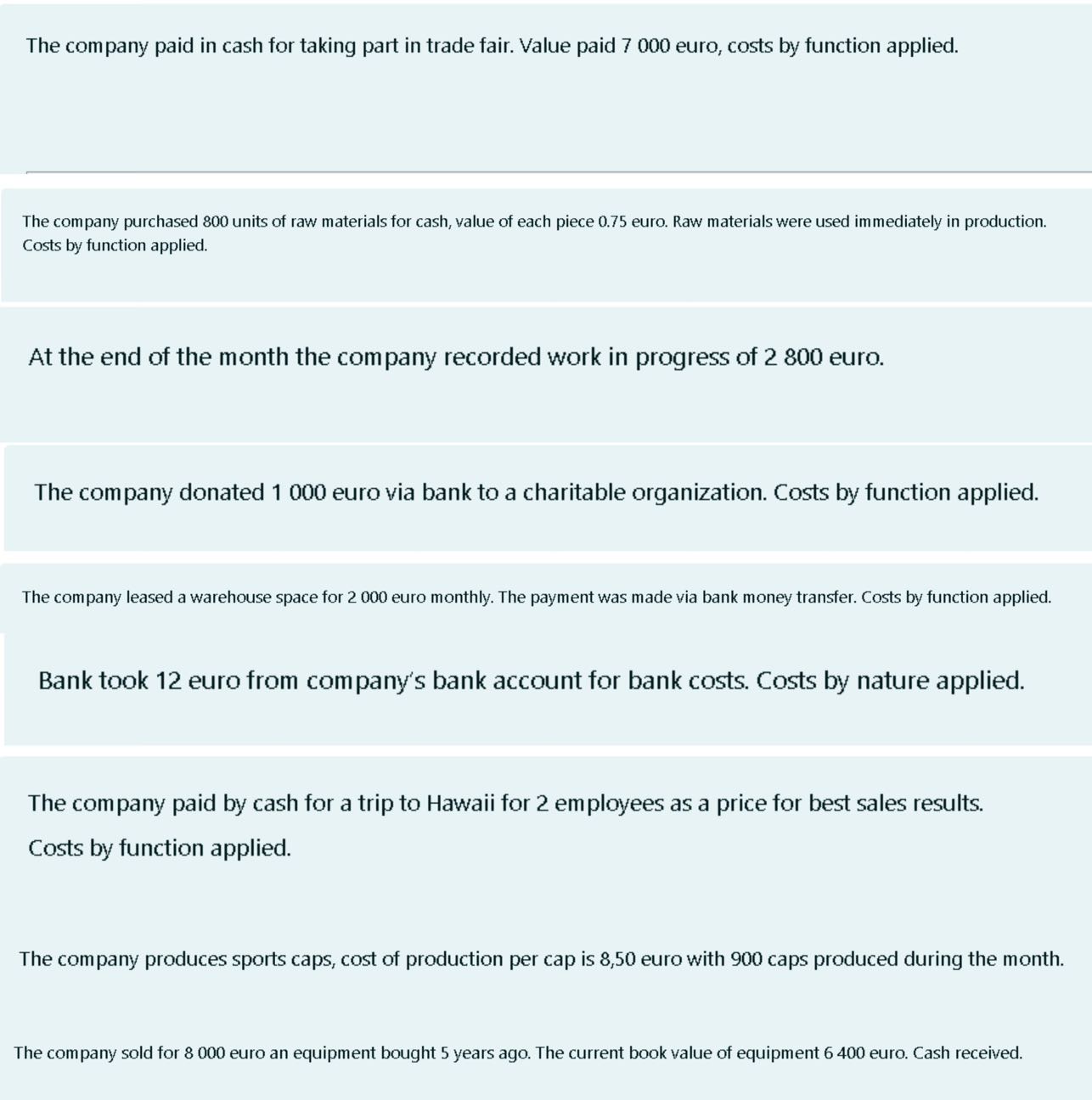

The company paid in cash for taking part in trade fair. Value paid 7000 euro, costs by function applied. The company purchased 800 units of raw materials for cash, value of each piece 0.75 euro. Raw materials were used immediately in production. Costs by function applied. At the end of the month the company recorded work in progress of 2800 euro. The company donated 1000 euro via bank to a charitable organization. Costs by function applied. The company leased a warehouse space for 2000 euro monthly. The payment was made via bank money transfer. Costs by function applied. Bank took 12 euro from company's bank account for bank costs. Costs by nature applied. The company paid by cash for a trip to Hawaii for 2 employees as a price for best sales results. Costs by function applied. The company produces sports caps, cost of production per cap is 8,50 euro with 900 caps produced during the monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started