My answer is not all correct. So need to check what's missing.

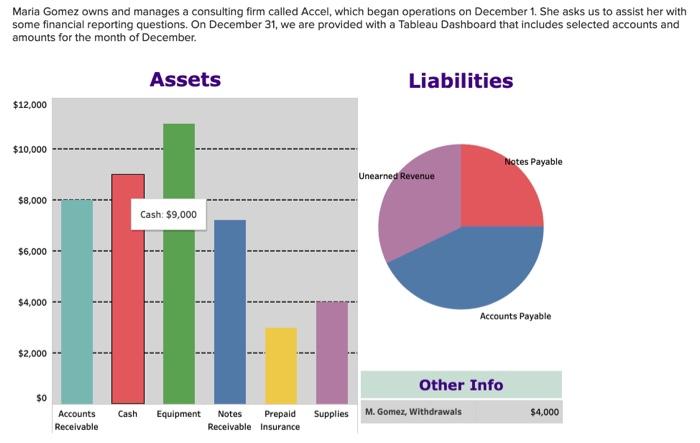

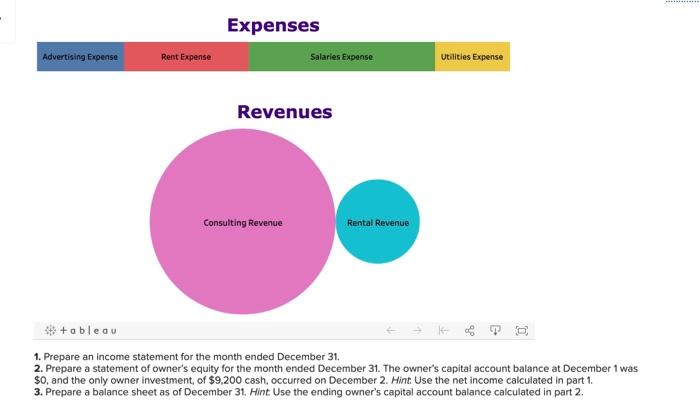

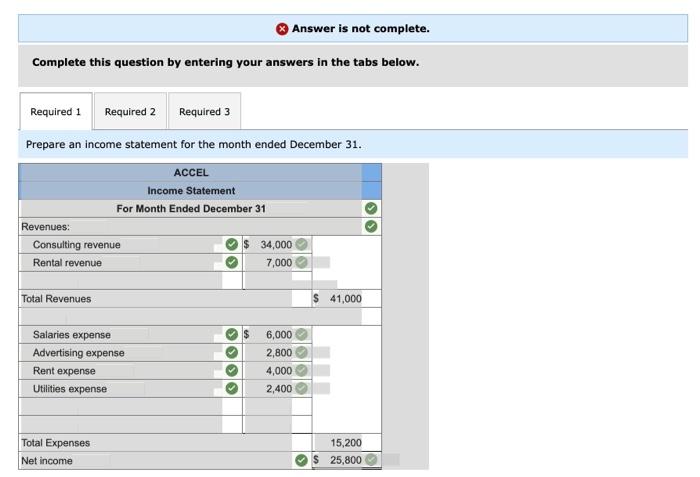

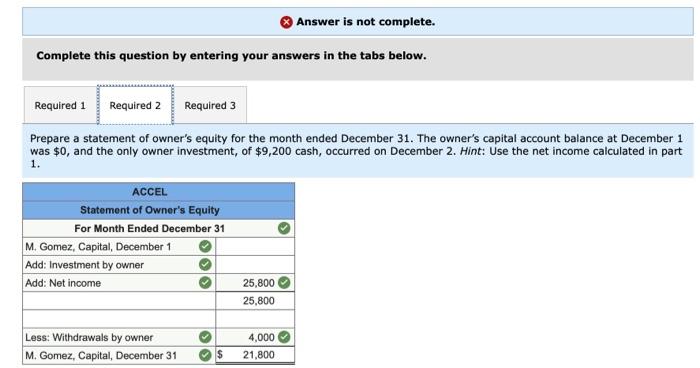

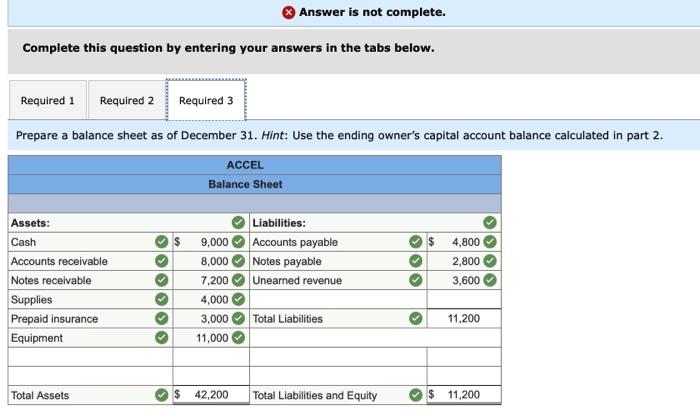

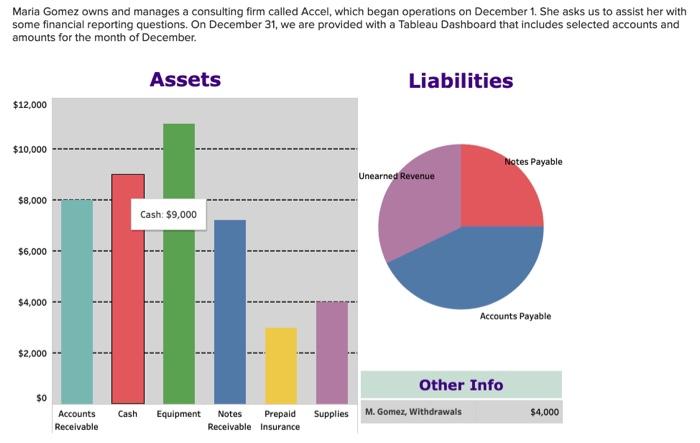

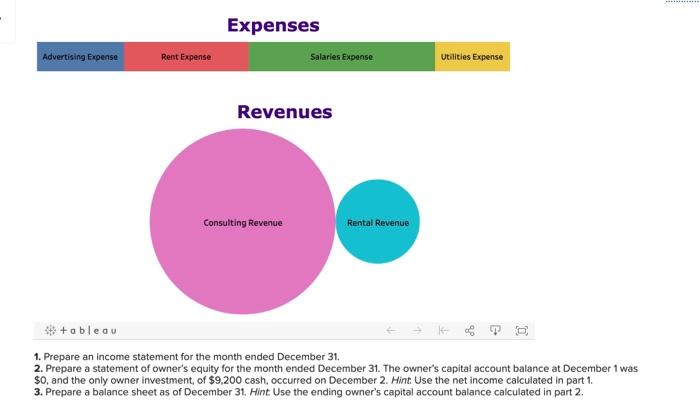

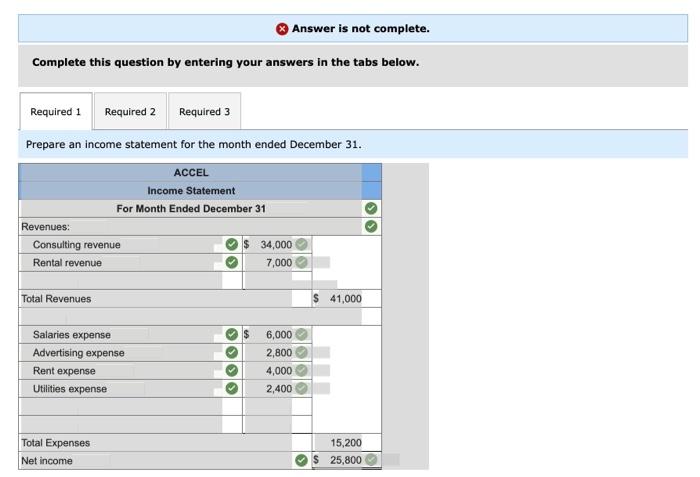

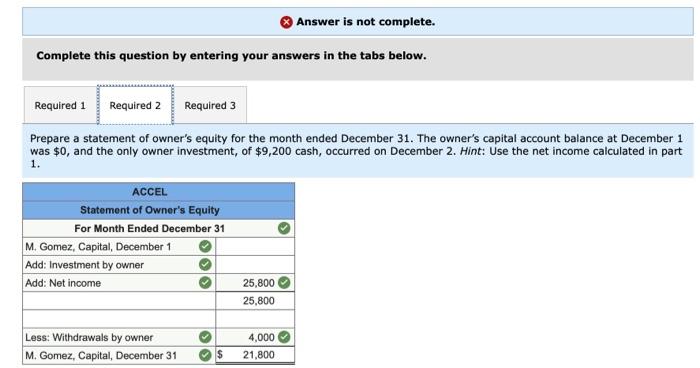

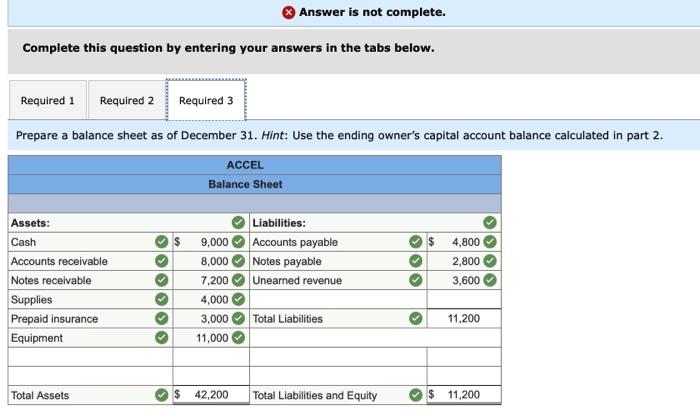

Maria Gomez owns and manages a consulting firm called Accel, which began operations on December 1. She asks us to assist her with some financial reporting questions. On December 31, we are provided with a Tableau Dashboard that includes selected accounts and amounts for the month of December Assets Liabilities $12,000 $10,000 Notes Payable Unearned Revenue $8,000 Cash: $9,000 $6,000 $4,000 Accounts Payable $2,000 SO Other Info M. Gomez, Withdrawals Cash Equipment Accounts Receivable Supplies $4,000 Notes Prepaid Receivable Insurance Expenses Salaries Expense Advertising Expense Rent Expense Utilities Expense Revenues Consulting Revenue Rental Revenue *+ableau 1. Prepare an income statement for the month ended December 31. 2. Prepare a statement of owner's equity for the month ended December 31. The owner's capital account balance at December 1 was $0, and the only owner investment, of $9.200 cash, occurred on December 2. Hint. Use the net income calculated in part 1 3. Prepare a balance sheet as of December 31. Hint. Use the ending owner's capital account balance calculated in part 2 Accounts receivable: 8000 Cash: 9000 Equipment: 11000 Notes receivable: 7200 Prepaid insurance: 3000 TF3:11 Supplies: 4000 Unearned revenue: 3600 Notes payable: 2800 Supplies: 4000 Unearned revenue: 3600 Notes payable: 2800 Accounts payable: 4800 Advertising expense: 2800 Rent expense: 4000 Salaries expense: 6000 Utilities expense: 2400 Consulting revenue: 34000 Rental revenue: 7000 Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement for the month ended December 31. ACCEL Income Statement For Month Ended December 31 Revenues: Consulting revenue $ 34,000 Rental revenue 7,000 lo Total Revenues 41,000 Salaries expense Advertising expense Rent expense Utilities expense 6,000 2,800 4,000 2,400 Total Expenses Net income 15,200 $ 25,800 Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a statement of owner's equity for the month ended December 31. The owner's capital account balance at December 1 was $0, and the only owner investment, of $9,200 cash, occurred on December 2. Hint: Use the net income calculated in part 1. ACCEL Statement of Owner's Equity For Month Ended December 31 M. Gomez, Capital, December 1 Add: Investment by owner Add: Net income 25,800 25,800 Less: Withdrawals by owner M. Gomez, Capital, December 31 4,000 21,800 Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a balance sheet as of December 31. Hint: Use the ending owner's capital account balance calculated in part 2. ACCEL Balance Sheet Assets: $ Liabilities: Accounts payable Notes payable Unearned revenue 4,800 2,800 3,600 Cash Accounts receivable Notes receivable Supplies Prepaid insurance Equipment 9,000 8,000 7,200 4,000 3,000 11,000 Total Liabilities 11.200 Total Assets 42,200 Total Liabilities and Equity $ 11,200