Answered step by step

Verified Expert Solution

Question

1 Approved Answer

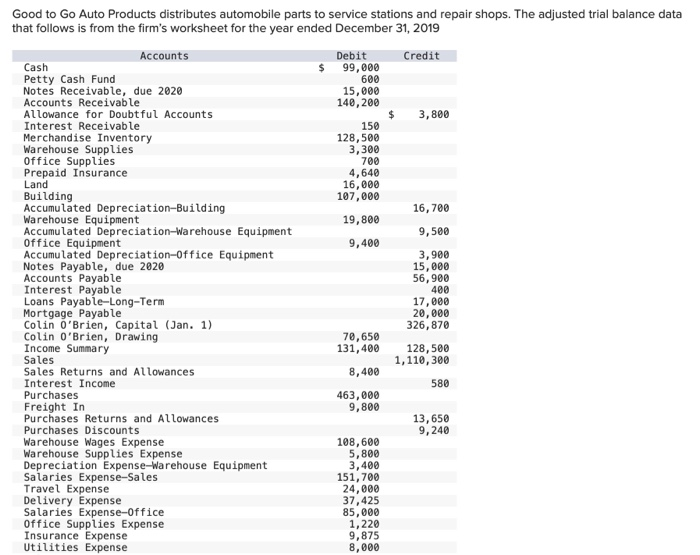

My answer is not complete. Please help me fix this. Good to Go Auto Products distributes automobile parts to service stations and repair shops. The

My answer is not complete. Please help me fix this.

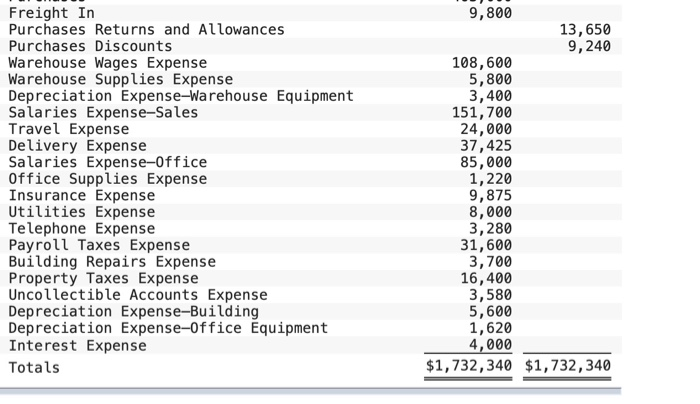

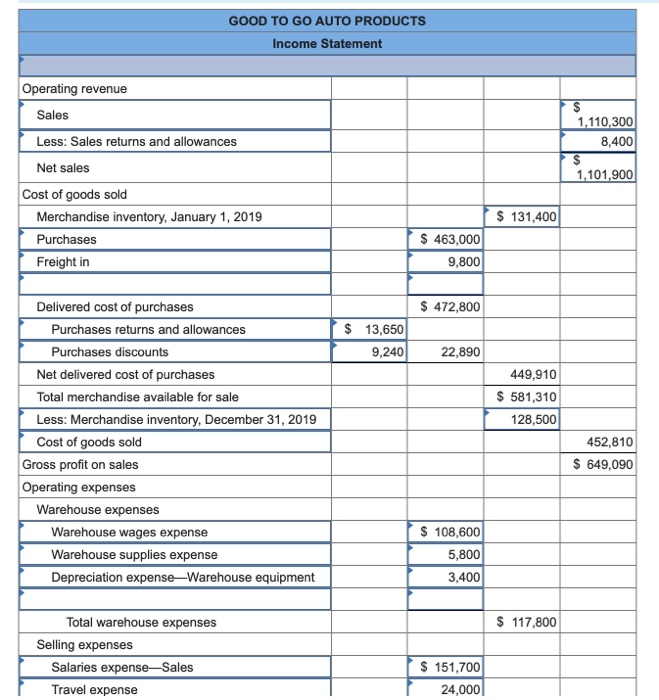

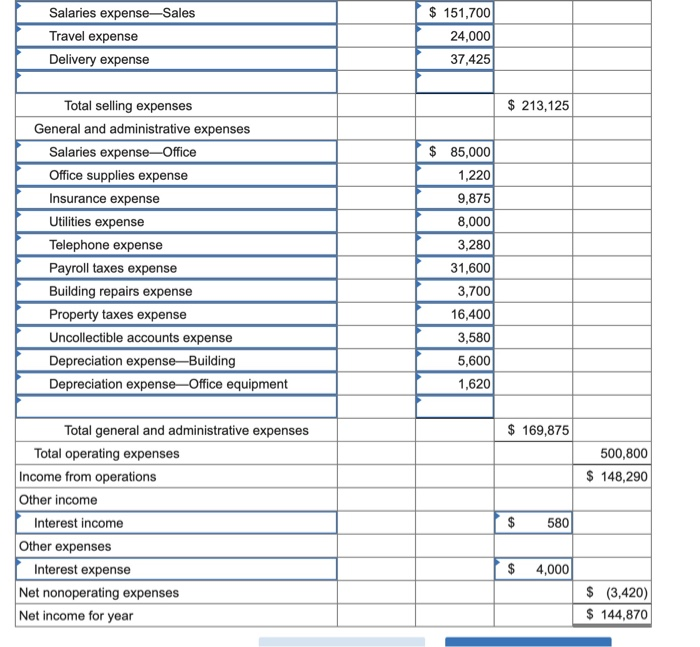

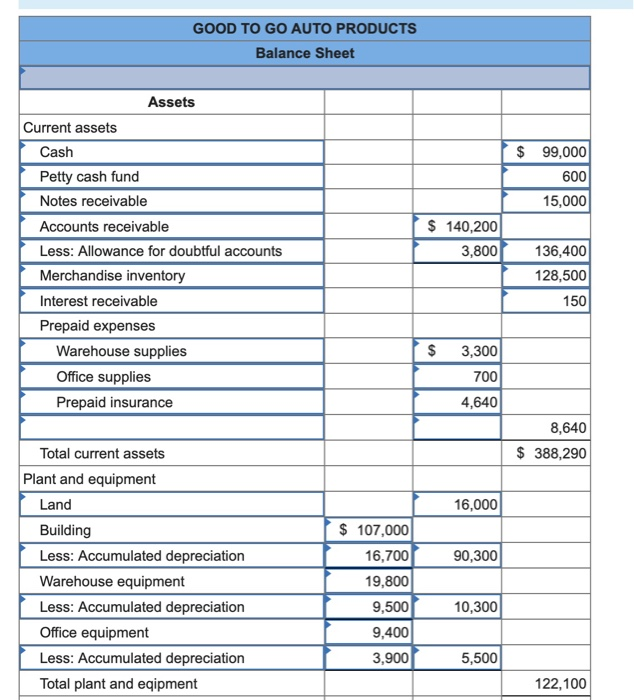

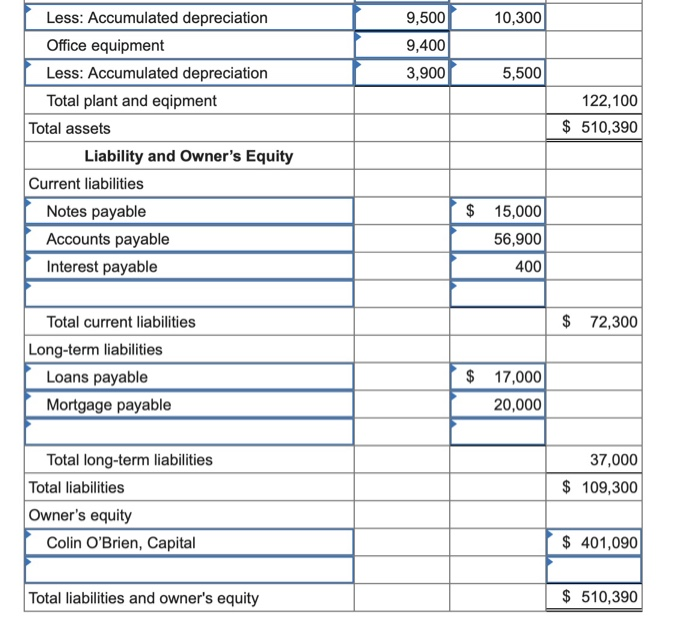

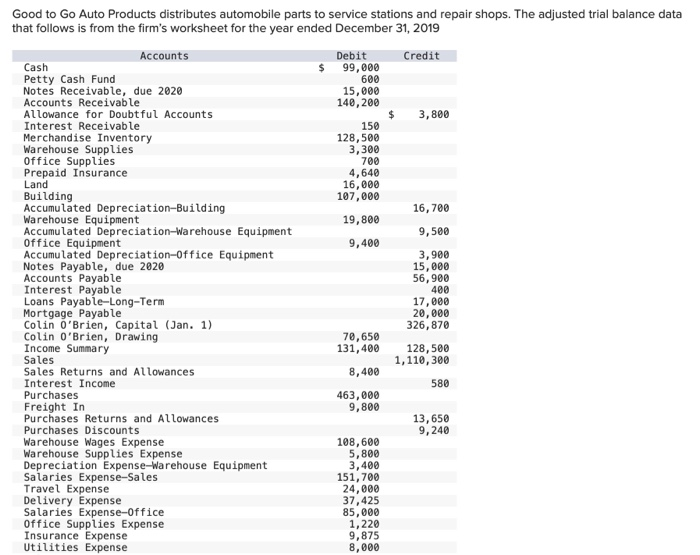

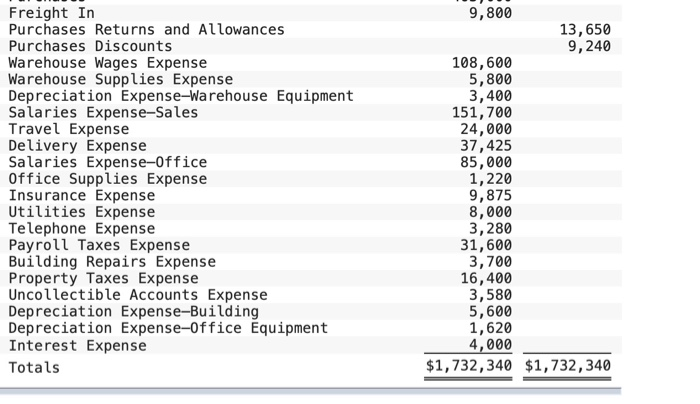

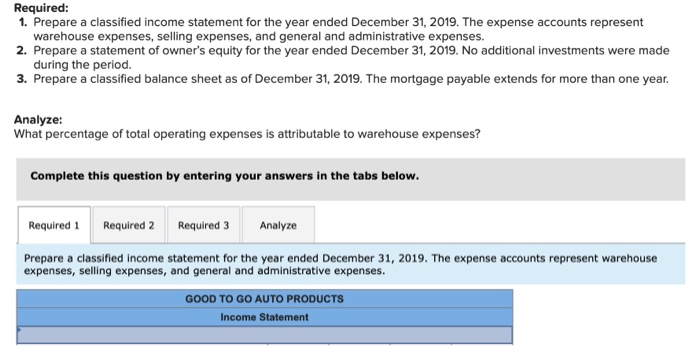

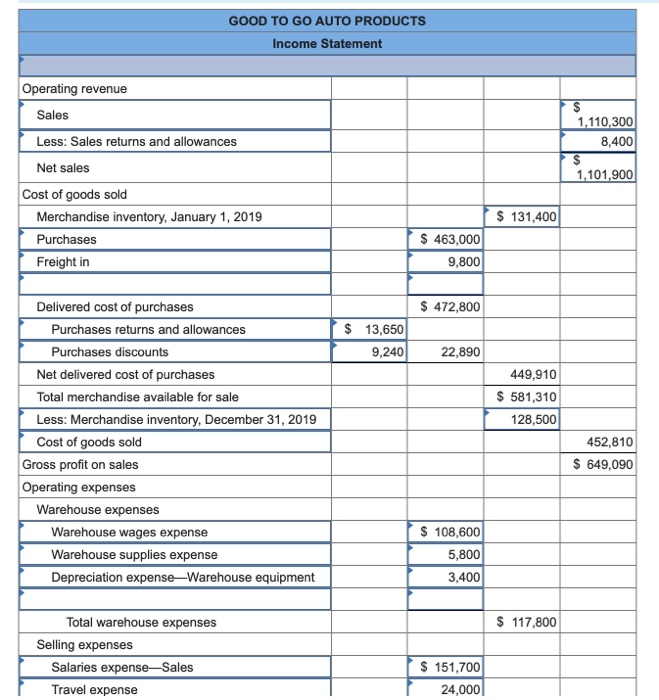

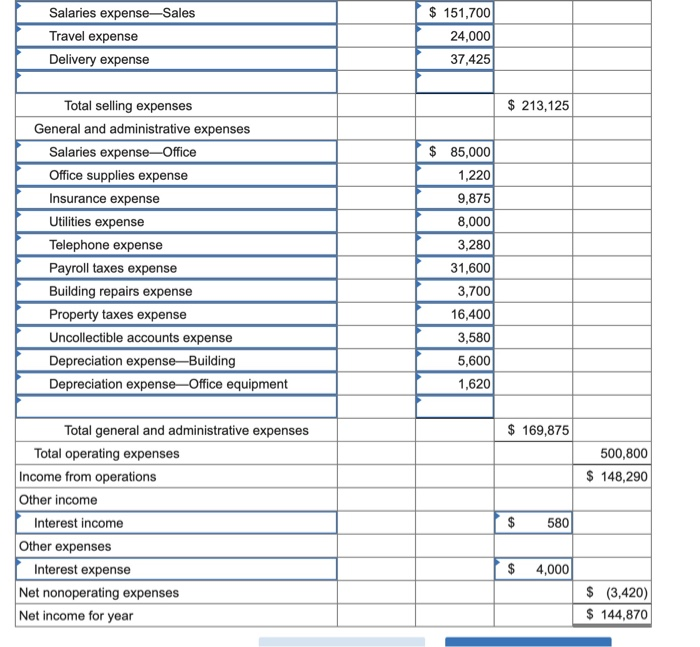

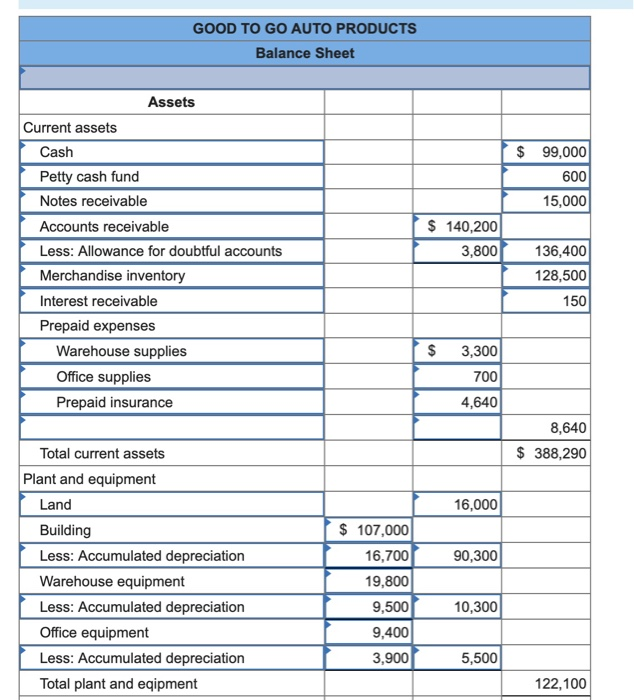

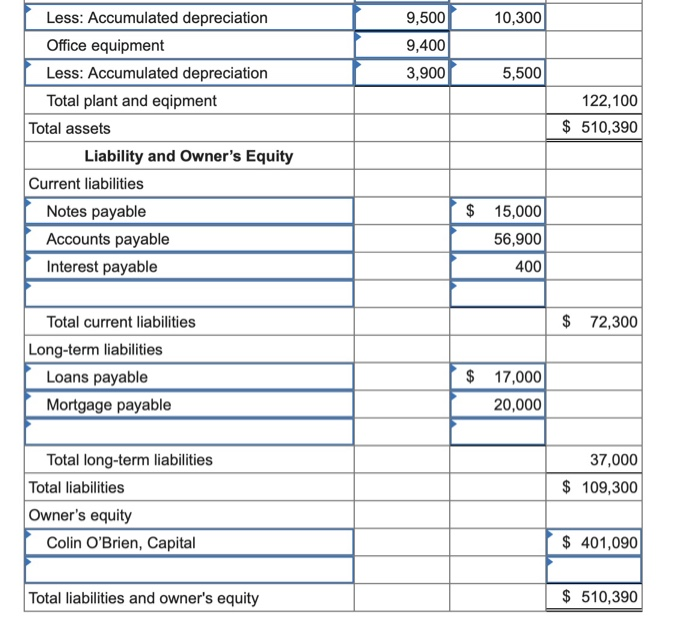

Good to Go Auto Products distributes automobile parts to service stations and repair shops. The adjusted trial balance data that follows is from the firm's worksheet for the year ended December 31, 2019 Accounts Debit Credit Cash 99,000 Petty Cash Fund 600 Notes Receivable, due 2020 15,000 Accounts Receivable 140,200 Allowance for Doubtful Accounts $ 3,800 Interest Receivable 150 Merchandise Inventory 128,500 Warehouse Supplies 3,300 Office Supplies 700 Prepaid Insurance 4,640 Land 16,000 Building 107,000 Accumulated Depreciation-Building 16,700 Warehouse Equipment 19,800 Ac ated Depreciation-Warehouse Equipment 9,500 Office Equipment 9,400 Accumulated Depreciation-office Equipment 3,900 Notes Payable, due 2020 15,000 Accounts Payable 56,900 Interest Payable Loans Payable-Long-Term 17,000 Mortgage Payable 20,000 Colin O'Brien, Capital (Jan. 1) 326, 870 Colin O'Brien, Drawing 70,650 Income Summary 131,400 128,500 Sales 1,110,300 Sales Returns and Allowances 8,400 Interest Income 580 Purchases 463,000 Freight In 9,800 Purchases Returns and Allowances 13,650 Purchases Discounts 9, 240 Warehouse Wages Expense 108,600 Warehouse Supplies Expense 5,800 Depreciation Expense-Warehouse Equipment 3,400 Salaries Expense-Sales 151,700 Travel Expense 24,000 Delivery Expense 37,425 Salaries Expense-Office 85,000 Office Supplies Expense 1,220 Insurance Expense 9,875 Utilities Expense 8,000 400 Freight In Purchases Returns and Allowances Purchases Discounts Warehouse Wages Expense Warehouse Supplies Expense Depreciation Expense-Warehouse Equipment Salaries Expense-Sales Travel Expense Delivery Expense Salaries Expense-Office Office Supplies Expense Insurance Expense Utilities Expense Telephone Expense Payroll Taxes Expense Building Repairs Expense Property Taxes Expense Uncollectible Accounts Expense Depreciation Expense-Building Depreciation Expense-Office Equipment Interest Expense Totals 9,800 13,650 9,240 108,600 5,800 3,400 151,700 24,000 37,425 85,000 1,220 9,875 8,000 3,280 31,600 3,700 16,400 3,580 5,600 1,620 4,000 $1,732,340 $1,732, 340 Required: 1. Prepare a classified income statement for the year ended December 31, 2019. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses. 2. Prepare a statement of owner's equity for the year ended December 31, 2019. No additional investments were made during the period. 3. Prepare a classified balance sheet as of December 31, 2019. The mortgage payable extends for more than one year. Analyze: What percentage of total operating expenses is attributable to warehouse expenses? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Analyze Prepare a classified income statement for the year ended December 31, 2019. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses. GOOD TO GO AUTO PRODUCTS Income Statement GOOD TO GO AUTO PRODUCTS Income Statement Operating revenue Sales Less: Sales returns and allowances Net sales Cost of goods sold Merchandise inventory, January 1, 2019 Purchases Freight in $ 1,110,300 8,400 $ 1,101,900 $ 131,400 $ 463,000 9,800 $ 472,800 $ 13,650 9,240 22,890 449,910 $ 581,310 128,500 Delivered cost of purchases Purchases returns and allowances Purchases discounts Net delivered cost of purchases Total merchandise available for sale Less: Merchandise inventory, December 31, 2019 Cost of goods sold Gross profit on sales Operating expenses Warehouse expenses Warehouse wages expense Warehouse supplies expense Depreciation expense-Warehouse equipment 452,810 $ 649,090 $ 108,600 5,800 3,400 $ 117,800 Total warehouse expenses Selling expenses Salaries expenseSales Travel expense $ 151,700 24,000 $ 151,700 Salaries expense-Sales Travel expense Delivery expense 24,000 37,425 $ 213,125 Total selling expenses General and administrative expenses Salaries expense-Office Office supplies expense Insurance expense Utilities expense Telephone expense Payroll taxes expense Building repairs expense Property taxes expense Uncollectible accounts expense Depreciation expense-Building Depreciation expense-Office equipment $ 85,000 1,220 9,875 8,000 3,280 31,600 3,700 16,400 3,580 5,600 1,620 $ 169,875 500,800 $ 148,290 Total general and administrative expenses Total operating expenses Income from operations Other income Interest income Other expenses Interest expense Net nonoperating expenses Net income for year $ 580 $ 4,000 $ (3,420) $ 144,870 GOOD TO GO AUTO PRODUCTS Balance Sheet $ 99,000 600 15,000 Assets Current assets Cash Petty cash fund Notes receivable Accounts receivable Less: Allowance for doubtful accounts Merchandise inventory Interest receivable Prepaid expenses Warehouse supplies Office supplies Prepaid insurance $ 140,200 3,800 136,400 128,500 150 $ 3,300 700 4,640 8,640 $ 388,290 16,000 90,300 Total current assets Plant and equipment Land Building Less: Accumulated depreciation Warehouse equipment Less: Accumulated depreciation Office equipment Less: Accumulated depreciation Total plant and eqipment $ 107,000 16,700 19,800 9,500 9,400 3,900 10,300 5,500 122, 100 9,500 10,300 9,400 3,900 5,500 122, 100 $ 510,390 Less: Accumulated depreciation Office equipment Less: Accumulated depreciation Total plant and eqipment Total assets Liability and Owner's Equity Current liabilities Notes payable Accounts payable Interest payable $ 15,000 56,900 400 $ 72,300 Total current liabilities Long-term liabilities Loans payable Mortgage payable $ 17,000 20,000 37,000 $ 109,300 Total long-term liabilities Total liabilities Owner's equity Colin O'Brien, Capital $ 401,090 Total liabilities and owner's equity $ 510,390

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started