Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My answers correct? My answers correct? My answers correct? My answers correct? Question 1 10 pts Eric is purchasing a put option to hedge his

My answers correct?

My answers correct?

My answers correct?

My answers correct?

My answers correct?

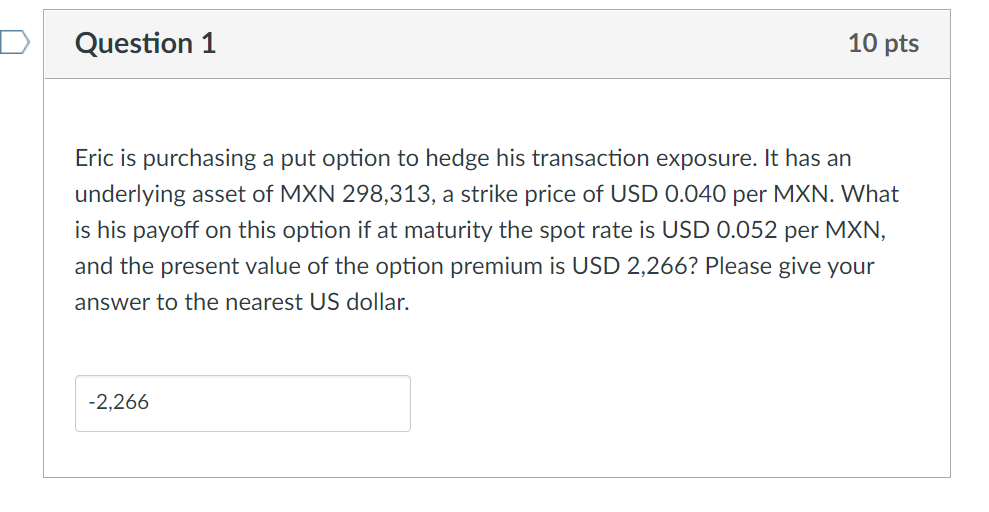

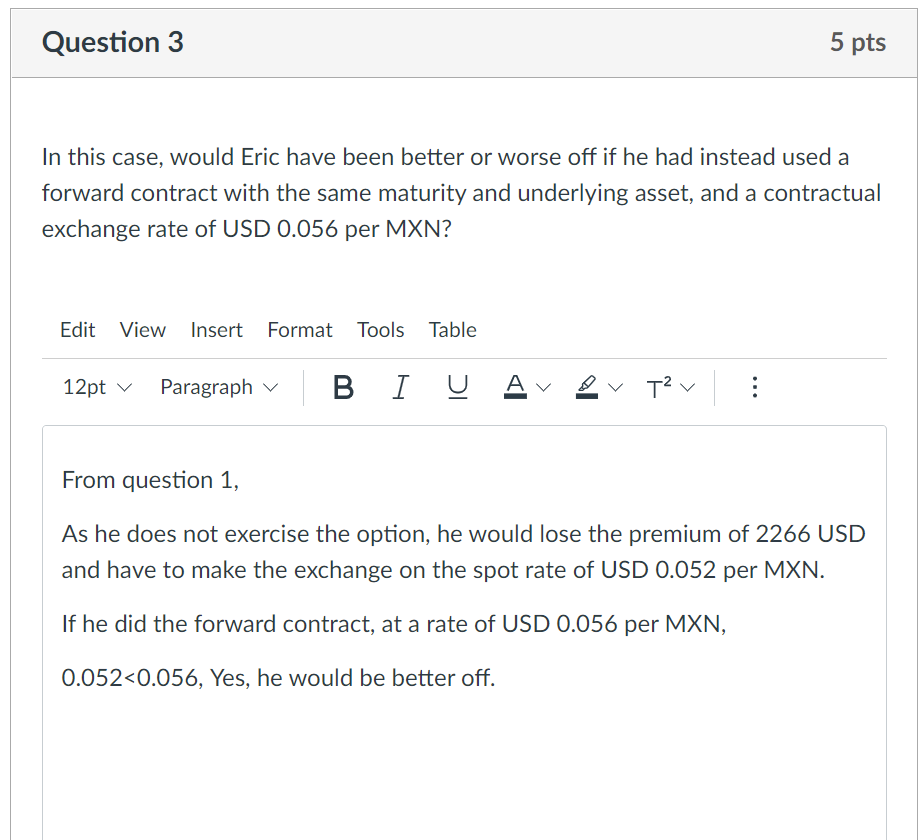

Question 1 10 pts Eric is purchasing a put option to hedge his transaction exposure. It has an underlying asset of MXN 298,313, a strike price of USD 0.040 per MXN. What is his payoff on this option if at maturity the spot rate is USD 0.052 per MXN, and the present value of the option premium is USD 2,266? Please give your answer to the nearest US dollar. -2,266 Question 3 5 pts In this case, would Eric have been better or worse off if he had instead used a forward contract with the same maturity and underlying asset, and a contractual exchange rate of USD 0.056 per MXN? Edit View Insert Format Tools Table 12pt v Paragraph B I I U Avor T v From question 1, As he does not exercise the option, he would lose the premium of 2266 USD and have to make the exchange on the spot rate of USD 0.052 per MXN. If he did the forward contract, at a rate of USD 0.056 per MXN, 0.052Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started