Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My answers correct? My answers correct? My answers correct? Question 7 10 pts You own a Mexican firm that manufactures truck transmissions. One year from

My answers correct?

My answers correct?

My answers correct?

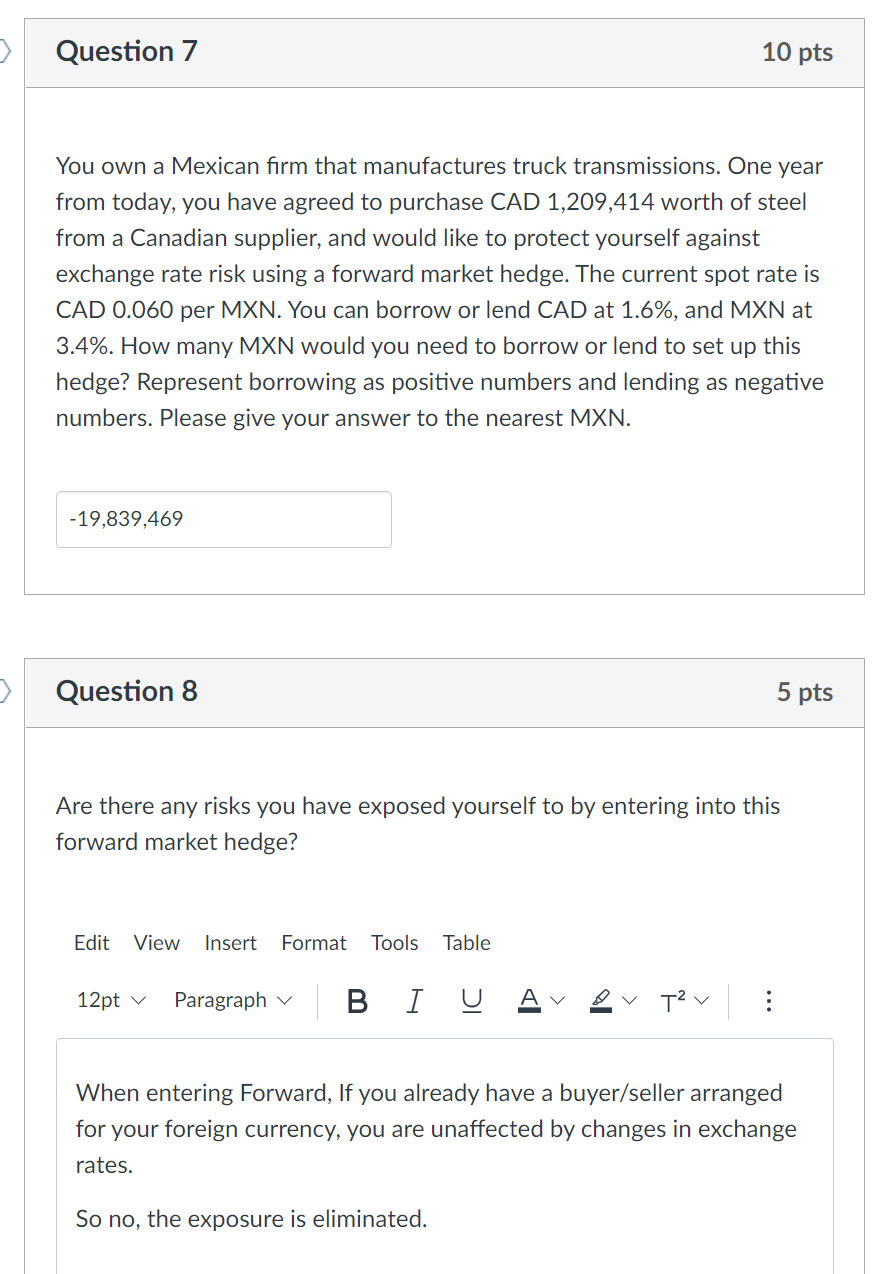

Question 7 10 pts You own a Mexican firm that manufactures truck transmissions. One year from today, you have agreed to purchase CAD 1,209,414 worth of steel from a Canadian supplier, and would like to protect yourself against exchange rate risk using a forward market hedge. The current spot rate is CAD 0.060 per MXN. You can borrow or lend CAD at 1.6%, and MXN at 3.4%. How many MXN would you need to borrow or lend to set up this hedge? Represent borrowing as positive numbers and lending as negative numbers. Please give your answer to the nearest MXN. -19,839,469 3 Question 8 5 pts Are there any risks you have exposed yourself to by entering into this forward market hedge? Edit View Insert Format Tools Table 12pt v Paragraph v Tv When entering Forward, If you already have a buyer/seller arranged for your foreign currency, you are unaffected by changes in exchange rates. So no, the exposure is eliminatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started