Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My company is Tesla and Ford Motor and General Motors are my competitors. Assuming all companies published their 2022 annual reports, your three-year trend should

My company is Tesla and Ford Motor and General Motors are my competitors.

Assuming all companies published their 2022 annual reports, your three-year trend should include

the following years 2022, 2021, and 2020. At the bottom of each table, provide a short

paragraph explaining the table information.

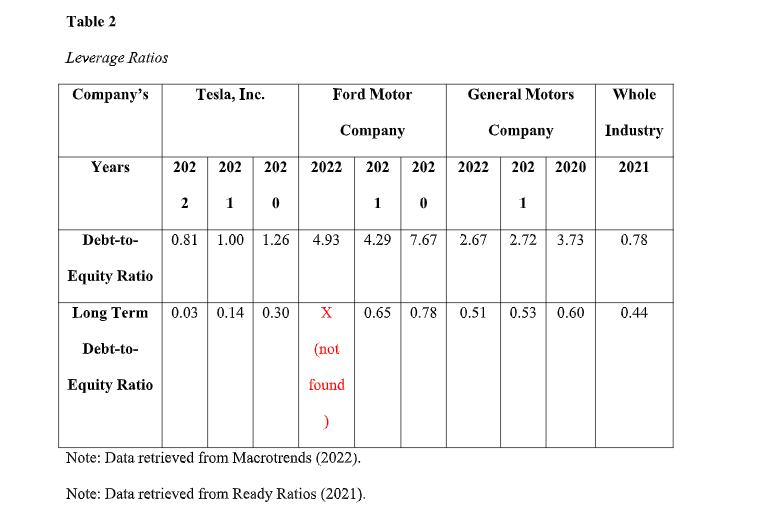

Table 2 Leverage Ratios Company's Years Debt-to- Debt-to- Tesla, Inc. Equity Ratio 2 1 0 Equity Ratio Long Term 0.03 0.14 0.30 Ford Motor 202 202 202 2022 Company 202 0.81 1.00 1.26 4.93 X 1 (not found ) Note: Data retrieved from Macrotrends (2022). Note: Data retrieved from Ready Ratios (2021). 202 0 4.29 7.67 General Motors Company Industry 2022 202 2020 2021 1 2.67 2.72 3.73 0.65 0.78 0.51 0.53 0.60 Whole 0.78 0.44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Explanation Teslas debttoequity ratio has been increasing consistently over the past three years fro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started