my company is the clorox company. The first pic are instructions, and the other pics are the pics of the spreadsheet we have to fill

what data is missing?

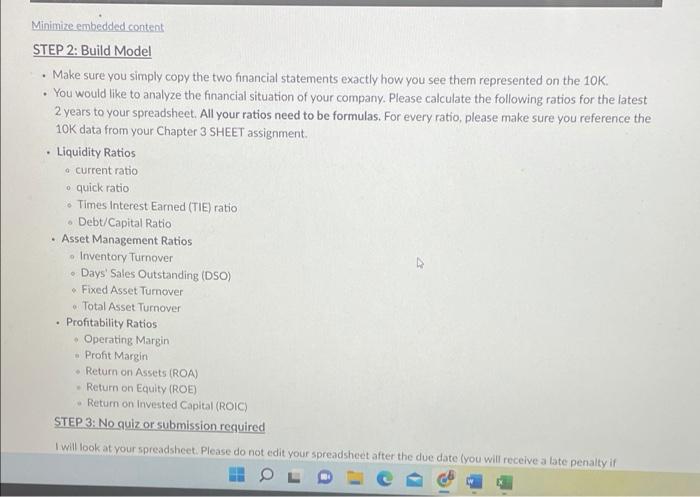

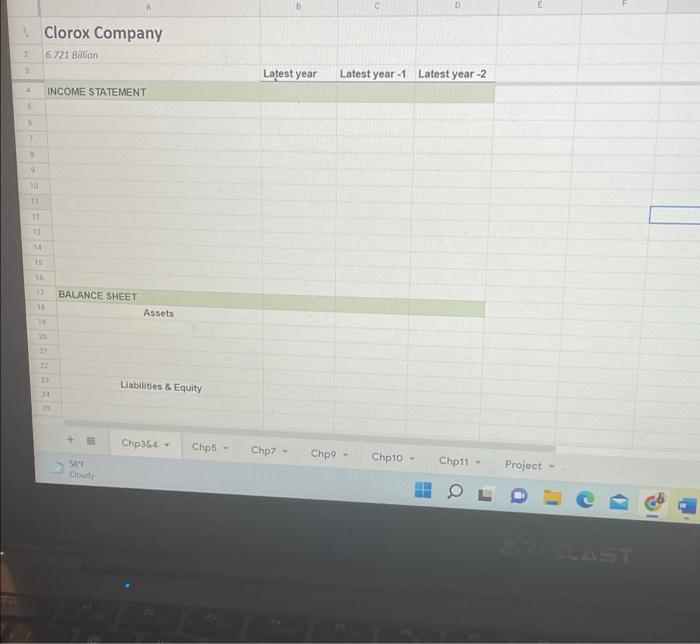

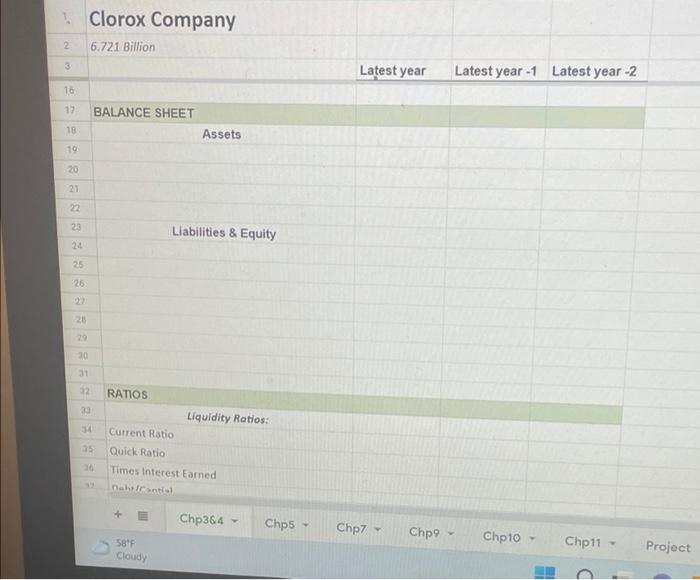

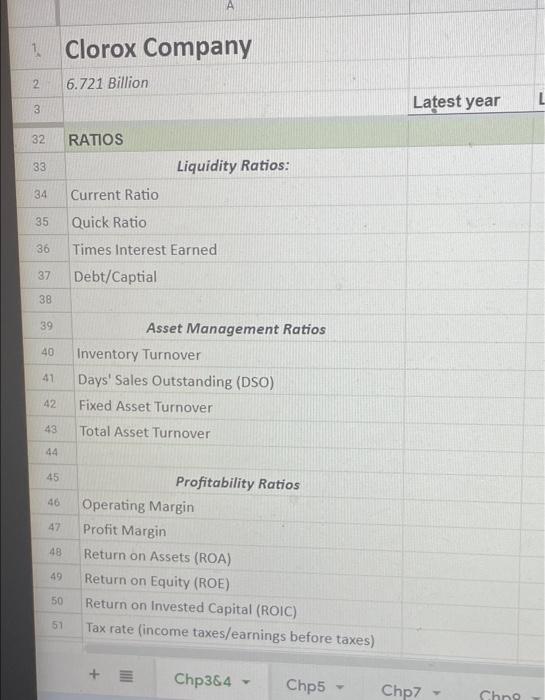

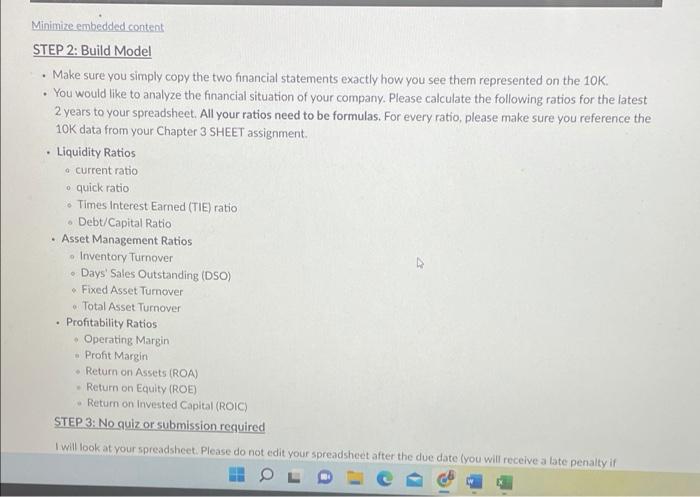

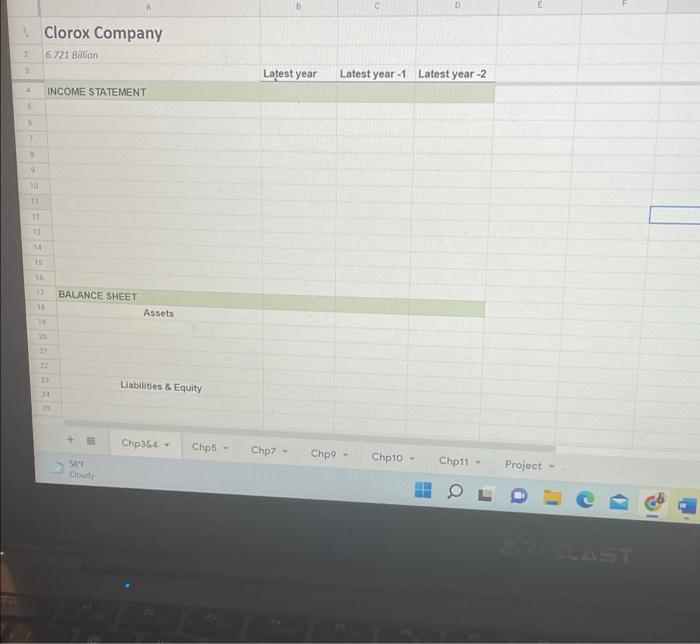

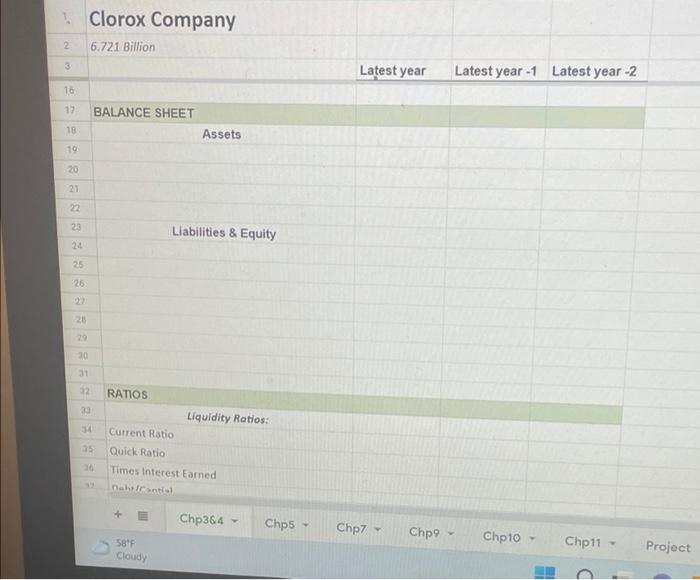

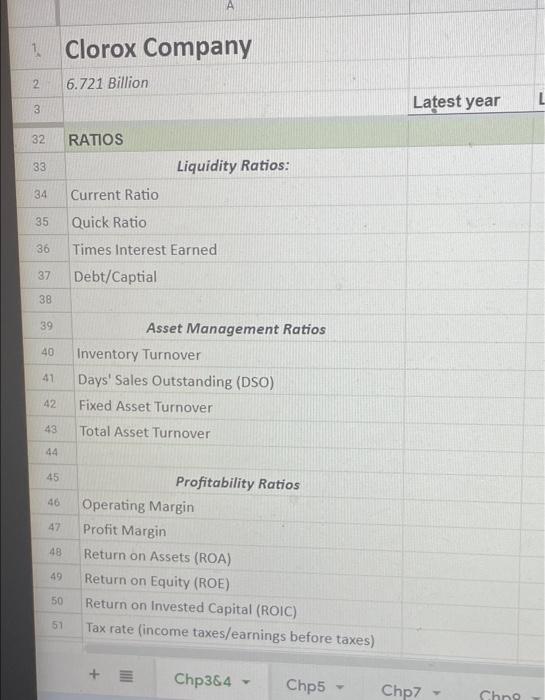

Minimize embedded content STEP 2: Build Model . Make sure you simply copy the two financial statements exactly how you see them represented on the 10K. You would like to analyze the financial situation of your company. Please calculate the following ratios for the latest 2 years to your spreadsheet. All your ratios need to be formulas. For every ratio, please make sure you reference the 10K data from your Chapter 3 SHEET assignment. Liquidity Ratios current ratio o quick ratio Times Interest Earned (TIE) ratio Debt/Capital Ratio . Asset Management Ratios Inventory Turnover Days' Sales Outstanding (DSO) Fixed Asset Turnover Total Asset Turnover Profitability Ratios Operating Margin Profit Margin Return on Assets (ROA) Return on Equity (ROE) Return on invested Capital (ROIC) STEP 3: No quiz or submission required I will look at your spreadsheet. Please do not edit your spreadsheet after the due date (you will receive a late penalty if . Clorox Company 2 6.721 Billion 3 4 INCOME STATEMENT 5 BALANCE SHEET 16 7 $ 9 10 11 12 13 14 15 16 37 18 19 20 21 20 3A 25 + E 58F Cloudy Assets Liabilities & Equity Chp3&4 Chp5 Latest year Chp7 Chp C D Latest year -1 Latest year-2 Chp10- Chp11 = Project &TECLAST 1. Clorox Company 2 6.721 Billion BALANCE SHEET Assets Liabilities & Equity Liquidity Ratios: 3 16 17 18 19 20 21 22 23 24 25 26 22 28 2858 29 30 31 32 RATIOS 33 34 35 36 32 Current Ratio Quick Ratio Times Interest Earned Dahs/Cantial 58F Cloudy Chp3&4 Y Chp5 Latest year Chp7 T Chp T Latest year -1 Latest year-2 Chp11 Chp10 Y Project 2 3 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 A Clorox Company 6.721 Billion RATIOS Current Ratio Quick Ratio Times Interest Earned Debt/Captial Inventory Turnover Days' Sales Outstanding (DSO) Fixed Asset Turnover Total Asset Turnover Profitability Ratios Operating Margin Profit Margin Return on Assets (ROA) Return on Equity (ROE) Return on Invested Capital (ROIC) Tax rate (income taxes/earnings before taxes) Chp3&4 Chp5 Liquidity Ratios: Asset Management Ratios Latest year Chp7 Chng Minimize embedded content STEP 2: Build Model . Make sure you simply copy the two financial statements exactly how you see them represented on the 10K. You would like to analyze the financial situation of your company. Please calculate the following ratios for the latest 2 years to your spreadsheet. All your ratios need to be formulas. For every ratio, please make sure you reference the 10K data from your Chapter 3 SHEET assignment. Liquidity Ratios current ratio o quick ratio Times Interest Earned (TIE) ratio Debt/Capital Ratio . Asset Management Ratios Inventory Turnover Days' Sales Outstanding (DSO) Fixed Asset Turnover Total Asset Turnover Profitability Ratios Operating Margin Profit Margin Return on Assets (ROA) Return on Equity (ROE) Return on invested Capital (ROIC) STEP 3: No quiz or submission required I will look at your spreadsheet. Please do not edit your spreadsheet after the due date (you will receive a late penalty if . Clorox Company 2 6.721 Billion 3 4 INCOME STATEMENT 5 BALANCE SHEET 16 7 $ 9 10 11 12 13 14 15 16 37 18 19 20 21 20 3A 25 + E 58F Cloudy Assets Liabilities & Equity Chp3&4 Chp5 Latest year Chp7 Chp C D Latest year -1 Latest year-2 Chp10- Chp11 = Project &TECLAST 1. Clorox Company 2 6.721 Billion BALANCE SHEET Assets Liabilities & Equity Liquidity Ratios: 3 16 17 18 19 20 21 22 23 24 25 26 22 28 2858 29 30 31 32 RATIOS 33 34 35 36 32 Current Ratio Quick Ratio Times Interest Earned Dahs/Cantial 58F Cloudy Chp3&4 Y Chp5 Latest year Chp7 T Chp T Latest year -1 Latest year-2 Chp11 Chp10 Y Project 2 3 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 A Clorox Company 6.721 Billion RATIOS Current Ratio Quick Ratio Times Interest Earned Debt/Captial Inventory Turnover Days' Sales Outstanding (DSO) Fixed Asset Turnover Total Asset Turnover Profitability Ratios Operating Margin Profit Margin Return on Assets (ROA) Return on Equity (ROE) Return on Invested Capital (ROIC) Tax rate (income taxes/earnings before taxes) Chp3&4 Chp5 Liquidity Ratios: Asset Management Ratios Latest year Chp7 Chng