Answered step by step

Verified Expert Solution

Question

1 Approved Answer

My Corporation is PEP- PepsiCo, INC What financial market, NYSE or NASDAQ, is your assigned corporation listed on? Why does it matter? Current Market Capitalization:

My Corporation is PEP- PepsiCo, INC

- What financial market, NYSE or NASDAQ, is your assigned corporation listed on? Why does it matter?

- Current Market Capitalization:

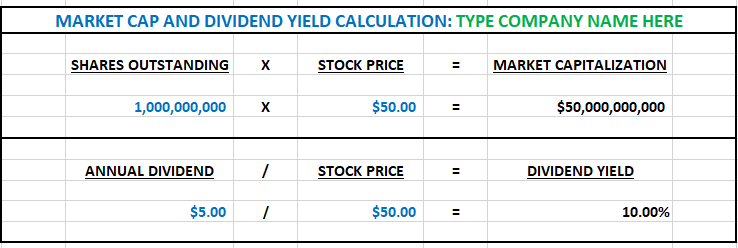

- Using the provided Excel template (Please see below)

- Download Excel template (Please see below), show the calculation: Market Cap = Shares Outstanding times Stock Price

- Define Mid-Cap and Large-Cap. Which designation is your corporation?

- Current Dividend Yield:

- Using the provided excel template, show the calculation: Dividend Yield = Annual Dividend divided by Stock Price

- Provide an example of the current savings rate at a bank. Does your corporation pay a higher rate for their dividend yield? Knowing that stocks are riskier than savings accounts, defend or support the current dividend yield. Provide at least page.

- CEO Pay Trend

- Provide a five-year trend of the CEO pay for your corporation. In your opinion, in your own words, provide at least one full page that defends or criticizes the trend in CEO pay.

- Debt to Equity Ratio:

- What is the debt (bonds) to equity (stocks) ratio of your assigned corporation for the past 5 years (no calculation needed just cite a reliable source)?

- Using the five-year trend above, what is your assigned corporation's current condition of the right-hand' side of the balance sheet in terms of total debt to total equity of the firm? In other words, provide and analyze the debt to equity ratio. Provide at least page.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started