My midterm is going on pls help

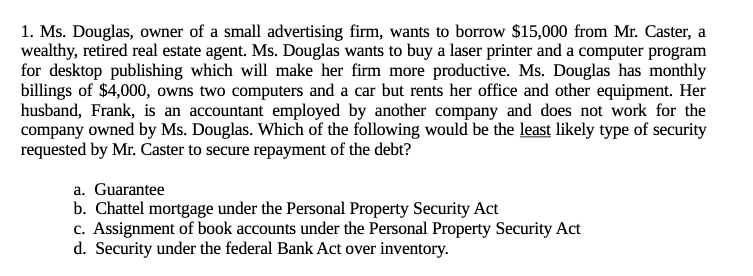

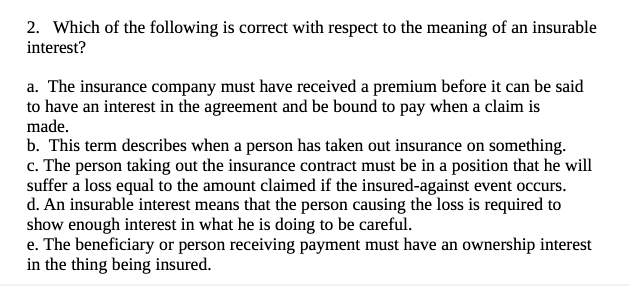

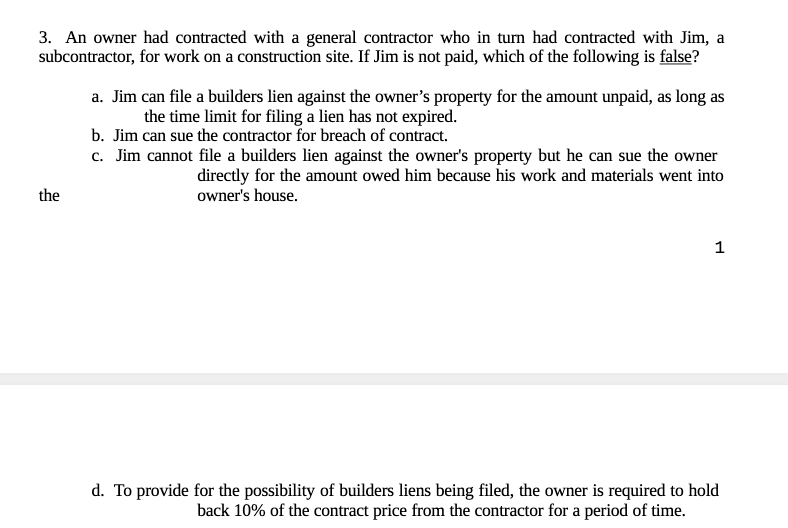

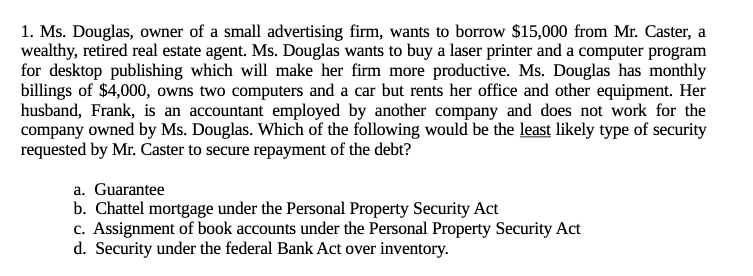

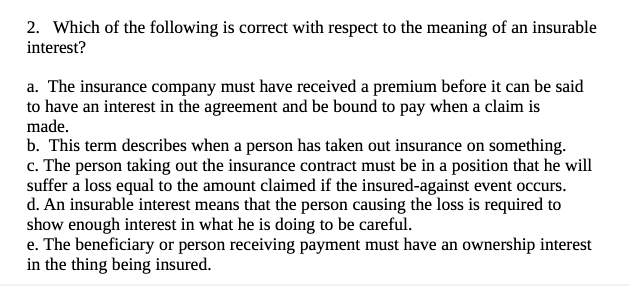

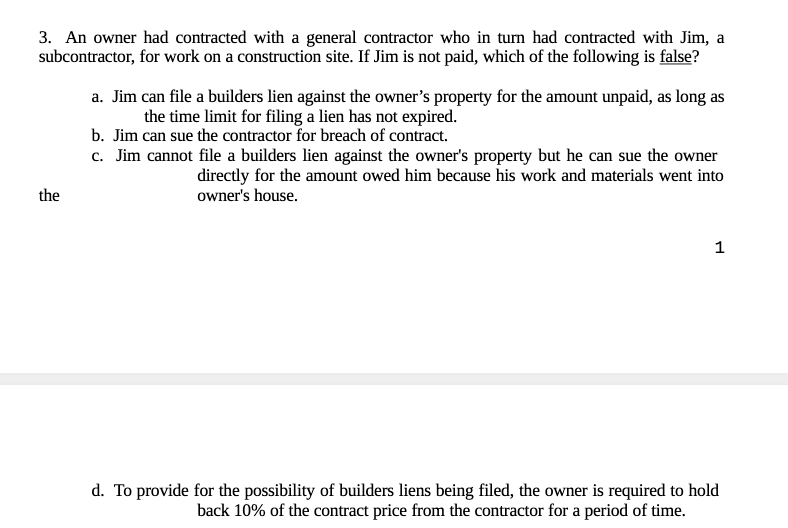

1. Ms. Douglas, owner of a small advertising firm, wants to borrow $15,000 from Mr. Caster, a wealthy, retired real estate agent. Ms. Douglas wants to buy a laser printer and a computer program for desktop publishing which will make her firm more productive. Ms. Douglas has monthly billings of $4,000, owns two computers and a car but rents her office and other equipment. Her husband, Frank, is an accountant employed by another company and does not work for the company owned by Ms. Douglas. Which of the following would be the least likely type of security requested by Mr. Caster to secure repayment of the debt? a. Guarantee b. Chattel mortgage under the Personal Property Security Act c. Assignment of book accounts under the Personal Property Security Act d. Security under the federal Bank Act over inventory.2. Which of the following is correct with respect to the meaning of an insurable interest? a. The insurance company must have received a premium before it can be said to have an interest in the agreement and he bound to pay when a claim is made. h. This term describes when a person has taken out insurance on something. c. The person taking out the insurance contract must be in a position that he will suffer a loss equal to the amount claimed if the insured-against event occm's. d. An insurable interest means that the person causing the loss is required to show enough interest in what he is doing to be careful. e. The beneciary or person receiving payment must have an ownership interest in the thing being insured. 3. An owner had contracted with a general contractor who in tmn had contracted with Jim, a subcontractor, for work on a construction site. If Jim is not paid, which of the following is E? a. Jim can le a builders lien against the owner's property for the amount unpaid, as long as the time limit for ling a lien has not expired. b. Jim can sue the contractor for breach of contract. c. Jim cannot le a builders lien against the owner's property but he can sue the owner directly for the amount owed him because his work and materials went into the owner's house. d. To provide for the possibility of builders liens being led, the owner is required to hold back 10% of the contract price from the contractor for a period of time. 4. If a hank, with a chattel mortgage under the Personal Property Security Act, fails to register the mortgage of a car bought by its customer, which of the following is false? a. The failure to register would not affect the rights of the hank against the customer if no third party is involved. b. If the customer sells the car to a third party who does not know of the mortgage, and does not pay the hank, the third party's claim would override that of the bank. c. If a trustee in hankmptcy who does not know of the mortgage seizes the car from the customer, the trustee's claim would override that of the hank. d. A potential purchaser of the car from the customer would not find the bank's interest recorded in the central registry in Victoria. e. The hank has lost its security and thus all its legal rights against anyone. 5. To which one of the following contracts would the Sale of Goods Act apply? a. A contract for the sale of a table where title to the table will not pass to the buyer until some future date. b. A contract for the assignment of a company's accounts receivable. c. A contract by which two computer programs were swapped for two others. d. A contract with a dentist to have teeth cleaned. e. A contract for the purchase of a farm.6. An agent owes a fiduciary duty to his principal; a director owes a fiduciary duty to the corporation; partners owe a fiduciary duty to the firm and to the other parties. Which of the following is not true with regard to one's fiduciary duty? a. A partner secretly competing with his own firm would be in breach of his fiduciary duty. b. A shareholder owning a business that secretly competes with the corporation is in breach of fiduciary duty. c. A fiduciary is in a position of trust and owes true loyalty to the person depending on him. d. An agent would be in breach of his fiduciary duty if he let his interest conflict with his duty. e. An agent failing to disclose to his principal all information relating to the principal's business transaction would be a breach of his fiduciary duty.7. With regard to the rights of creditors, which of the following is false? a. A secured creditor has priority to the assets covered by the security in priority to a trustee appointed under the Bankruptcy Act. b. A secured creditor with security properly registered in the registry in Victoria has priority to the asset over an unsecured creditor. c. If a bank chooses to enforce a security, the company may go into receivership without necessarily going into bankruptcy; d. If a debtor transfers all of her assets to her spouse to prevent a judgment creditor from recovering the assets to pay the debt, there is nothing the creditor can do e. A debenture under the Personal Property Security Act can create a "floating charge" that will not attach to anything specific until the debtor defaults or until the happening of another "crystallizing" event.8. Mary, a professional accountant, is concerned that if she is professionally negligent, a potential creditor could recover her house and car in execution proceedings. Although Mary has not been negligent and there are no creditors in existence, to be on the safe side Mary transfers her house and car into her husband's name. This is an example of: a. A Fraudulent Conveyance. b. A Fraudulent Preference. C. Estate or Tax Planning. d. Grounds to Petition Mary into Bankruptcy. e. Grounds for a creditor to take proceedings under the Execution Act.9. In which one of the following situations would it be legal for the parties to strike? a. The A.F.I.O., a union, was approached by a group of employees working for ACME Ltd. to see if they would organize the work force and unionize it. When the employer discovered this fact he fired that group of workers and the rest went out on strike. b. The A.F.I.O., the properly certified bargaining agent for the employees of Ace Manufacturing Ltd., were demanding an unreasonably high wage settlement from the employer, one which would bankrupt the firm if accepted. The employer refused to agree to this and the employees remained without an agreement and went out on strike. c. A collective agreement was in place between Ace Manufacturing Ltd. and its employees and that agreement was breached by the employer resulting in the employees going out on strike. d. Ace Manufacturing Ltd. made armaments and some were sold in the Middle East. When the employees found this out they went out on strike demanding that the practice stop.10. Your brother wants to borrow $8,000 from the Bank of Britannia and has asked if you would guarantee the loan. Which of the following statements is false? a. As guarantor you can use any defense against the bank that your brother could use. b. The defence of Non Est Factum (didn't know the nature of the document being signed) is not available in the case of guarantees. 3 C. You, as guarantor, may be relieved of your obligation if the bank does anything to weaken your position, e.g. by agreeing with your brother to increase the amount without your consent. d. If he defaulted on his payments and you had to pay the debt to the bank, you would be subrogationthe rights of the bank, i.e. you would get the bank's right to sue your brother. e. A guarantee not under seal must satisfy all the elements required to create a binding contract.11. Is an indemnity a primary or secondary obligation? 12. What is the responsibility of the prime contractor under legislation? 13. Jason had participated in the flower auction for the last 9 years as an agent for Holt with the authority to buy whatever he felt the store needed. Holt had often made known in the marketplace the extent of Jason's authority. However, this day he was given express instructions to buy only cut flowers. When flats of young camellia bushes with a rare gold flower were being sold, Jason bought them on behalf of the company contrary to his instructions. Which of the following is false? a. Holt is bound even if he doesn't ratify the contract. b. Holt is not bound by the contract, because Jason's authority was expressly restricted. c. Holt is bound by the contract, but Jason is in breach of his agency agreement. d. Holt is estopped from denying Jason's authority. e. The law respecting Apparent Authority applies.14. Which one of the following statements is true with respect to the relationship between an agent and a principal: a. An agent cannot bind the principal to contracts with a third party even though the principal may have no direct contact with the third party. b. An agency contract may not be inferred by necessity. C. An agent can delegate her duties under the agency agreement to another person. d. If the agent exceeds her authority she may liable for breach of warranty of authority. e. An agency contract must be in writing.15. As a general rule insurance agents act on behalf of the 16. A friend knows "someone" in financial difficulty and asks you to explain how bankruptcy process is initiated, what happens when in bankruptcy, the consequences to secured creditors, general creditors and governmental creditors, and the consequences to the debtor