Answered step by step

Verified Expert Solution

Question

1 Approved Answer

my professor helped out with solution but I still didn't get it. could you help me out how he calculated those number ? thanks! 1.

my professor helped out with solution but I still didn't get it. could you help me out how he calculated those number ? thanks!

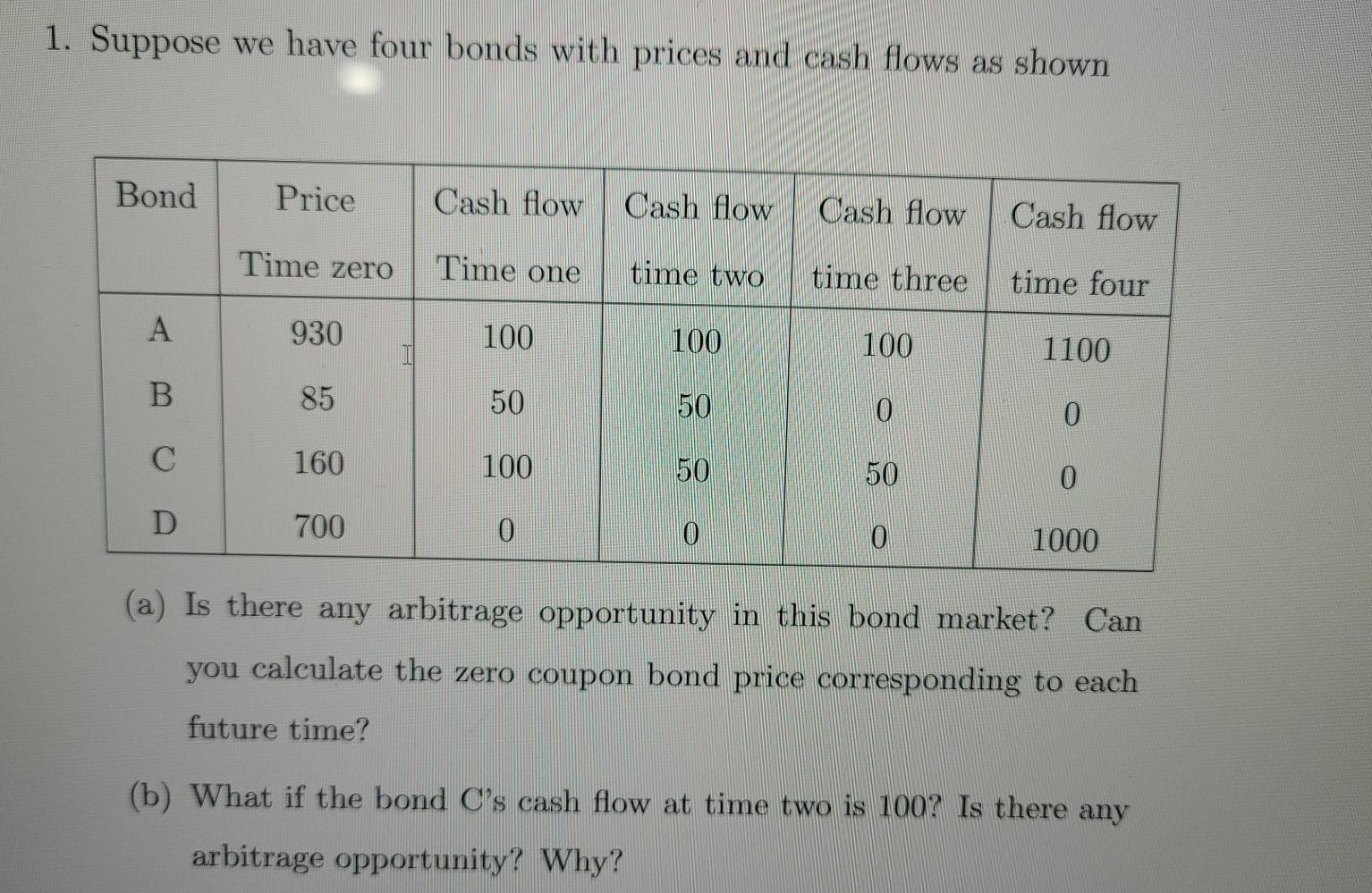

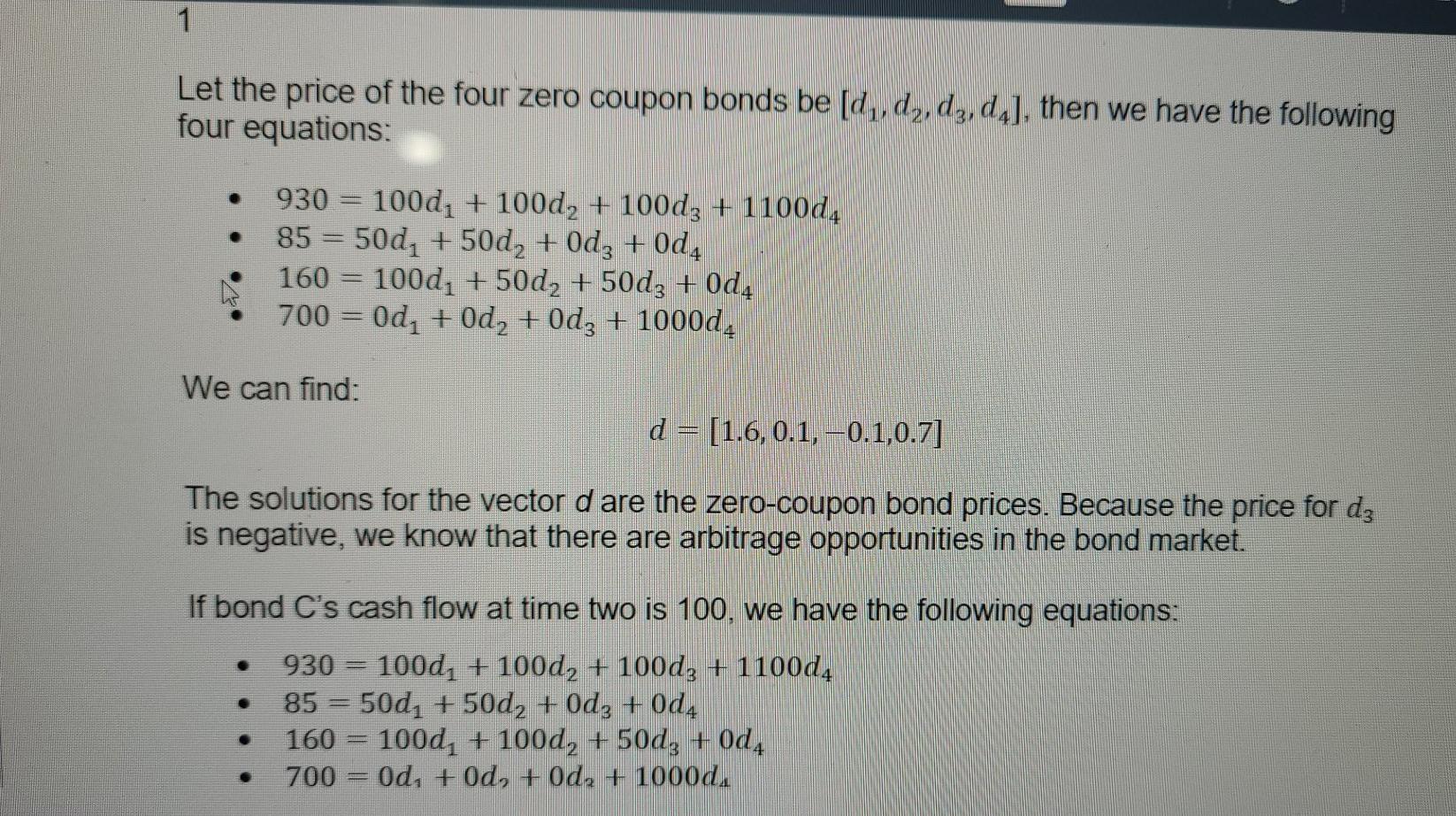

1. Suppose we have four bonds with prices and cash flows as shown Bond Price Cash flow Cash flow Cash flow Cash flow Time zero Time one time two time three time four A 930 100 100 100 1100 B 85 50 50 0 160 100 50 50 0 D 700 0 0 0 1000 (a) Is there any arbitrage opportunity in this bond market? Can you calculate the zero coupon bond price corresponding to each future time? (b) What if the bond C's cash flow at time two is 100? Is there any arbitrage opportunity? Why? 1 Let the price of the four zero coupon bonds be [d,, dy, dz, d4], then we have the following four equations: 930 = 100d1 + 100d2 + 100d3 + 110004 85 = 50d4 + 50d2 + 0d3 +0d4 160 = 1000, +50d2 + 50d3 +0d4 700 = 0d, +0d, +0dz + 1000d, We can find: d = (1.6, 0.1, -0.1,0.7] The solutions for the vector d are the zero-coupon bond prices. Because the price for dz is negative, we know that there are arbitrage opportunities in the bond market. If bond C's cash flow at time two is 100, we have the following equations: 930 = 100d+ 100d2 + 100d3 + 1100d4 85 = 500, +50d2 +0d3 +0d4 160 = 100d, + 100d, + 50d3 + 0d4 700 = Od, + Od, + Odz + 1000dStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started