Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MY PROJECT IS DUE TOMORROW I NEED HELP!! CAN SOMEONE PLEASE ANSWER THESE QUESTIONS AND FILL OUT THE FOLLOWING TABLE! IM CONFUSED ON HOW TO

MY PROJECT IS DUE TOMORROW I NEED HELP!! CAN SOMEONE PLEASE ANSWER THESE QUESTIONS AND FILL OUT THE FOLLOWING TABLE! IM CONFUSED ON HOW TO DO THIS. This will be done on excel which I will create, but if you could please answer all of the following questions on a piece of paper or word document would be better and upload it to me so I have the correct layout.

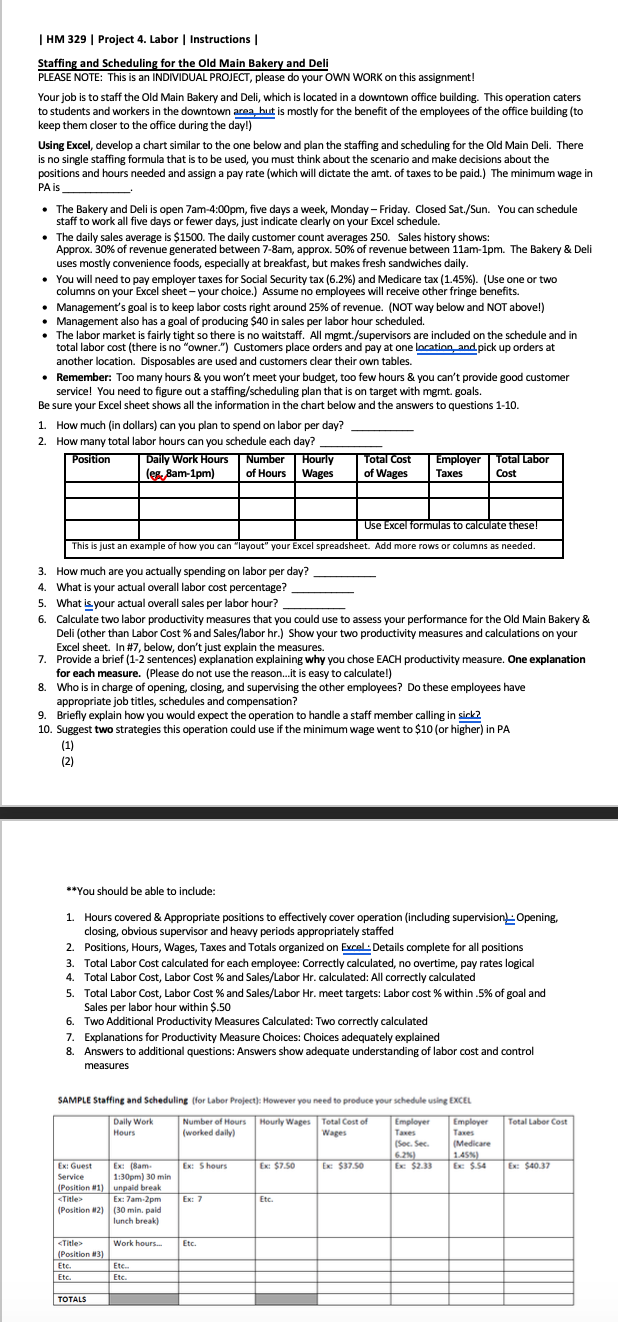

| HM 329 Project 4. Labor Instructions Staffing and Scheduling for the Old Main Bakery and Deli PLEASE NOTE: This is an INDIVIDUAL PROJECT, please do your OWN WORK on this assignment! Your job is to staff the Old Main Bakery and Deli, which is located in a downtown office building. This operation caters to students and workers in the downtown area but is mostly for the benefit of the employees of the office building to keep them closer to the office during the day!) Using Excel, develop a chart similar to the one below and plan the staffing and scheduling for the Old Main Deli. There is no single staffing formula that is to be used, you must think about the scenario and make decisions about the positions and hours needed and assign a pay rate (which will dictate the amt. of taxes to be paid.) The minimum wage in PA is The Bakery and Deli is open 7am-4:00pm, five days a week, Monday - Friday. Closed Sat./Sun. You can schedule staff to work all five days or fewer days, just indicate clearly on your Excel schedule. The daily sales average is $1500. The daily customer count averages 250. Sales history shows: Approx. 30% of revenue generated between 7-8am, approx. 50% of revenue between 11am-1pm. The Bakery & Deli uses mostly convenience foods, especially at breakfast, but makes fresh sandwiches daily. You will need to pay employer taxes for Social Security tax (6.2%) and Medicare tax (1.45%). (Use one or two columns on your Excel sheet-your choice.) Assume no employees will receive other fringe benefits. Management's goal is to keep labor costs right around 25% of revenue. (NOT way below and NOT abovel) Management also has a goal of producing $40 in sales per labor hour scheduled. The labor market is fairly tight so there is no waitstaff. All mgmt./supervisors are included on the schedule and in total labor cost (there is no "owner.") Customers place orders and pay at one location, and pick up orders at another location. Disposables are used and customers clear their own tables. Remember: Too many hours & you won't meet your budget, too few hours & you can't provide good customer service! You need to figure out a staffing/scheduling plan that is on target with mgmt.goals. Be sure your Excel sheet shows all the information in the chart below and the answers to questions 1-10 1. How much (in dollars) can you plan to spend on labor per day? 2. How many total labor hours can you schedule each day? Position Daily Work hours Number Hourly Total Cost Employer Total Labor leg, 8am-1pm) of Hours Wages of Wages Taxes Cost Use Excel formulas to calculate these! This is just an example of how you can "layout" your Excel spreadsheet. Add more rows or columns as needed. 3. How much are you actually spending on labor per day? 4. What is your actual overall labor cost percentage? 5. What is your actual overall sales per labor hour? 6. Calculate two labor productivity measures that you could use to assess your performance for the Old Main Bakery & Deli (other than Labor Cost % and Sales/labor hr.) Show your two productivity measures and calculations on your Excel sheet. In #7, below, don't just explain the measures. 7. Provide a brief (1-2 sentences) explanation explaining why you chose EACH productivity measure. One explanation for each measure. (Please do not use the reason...it is easy to calculate!) 8. Who is in charge of opening, closing, and supervising the other employees? Do these employees have appropriate job titles, schedules and compensation? 9. Briefly explain how you would expect the operation to handle a staff member calling in sick? 10. Suggest two strategies this operation could use if the minimum wage went to $10 (or higher) in PA (2) **You should be able to include: 1. Hours covered & Appropriate positions to effectively cover operation (including supervision Opening, closing, obvious supervisor and heavy periods appropriately staffed 2. Positions, Hours, Wages, Taxes and Totals organized on Excel. Details complete for all positions 3. Total Labor Cost calculated for each employee: Correctly calculated, no overtime, pay rates logical 4. Total Labor Cost, Labor Cost % and Sales/Labor Hr. calculated: All correctly calculated 5. Total Labor Cost, Labor Cost % and Sales/Labor Hr. meet targets: Labor cost % within.5% of goal and Sales per labor hour within $.50 6. Two Additional Productivity Measures Calculated: Two correctly calculated 7. Explanations for Productivity Measure Choices: Choices adequately explained 8. Answers to additional questions: Answers show adequate understanding of labor cost and control measures SAMPLE Staffing and Scheduling for Labor Project): However you need to produce your schedule using EXCEL Daily Work Hourly Wages Total Labor Cost Number of Hours (worked daily Hours Total Cost of Wages Employer Taxes (Soc. Sec. 6,2%) Ex $2.33 Employer Taxes (Medicare 1.45) Ex S.54 Ex: Shours Ex: $7.50 Ex $37.50 Ex: $40.37 Ex: Guest Service (Position #1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started